- ETH dangers additional correction as Futures quantity bubble sign an overheated state.

- Ethereum fundamentals recommend that the altcoin is extremely undervalued.

Since rallying to hit $2.7k per week in the past, Ethereum [ETH] has struggled to take care of its uptrend. After reaching these ranges, the altcoin retraced, hitting a low of $2.3k.

Over the previous three days, ETH has remained caught between $2.5 and $2.3k.

The failure to interrupt out of this vary has left strategists speculating over Ethereum’s future trajectory.

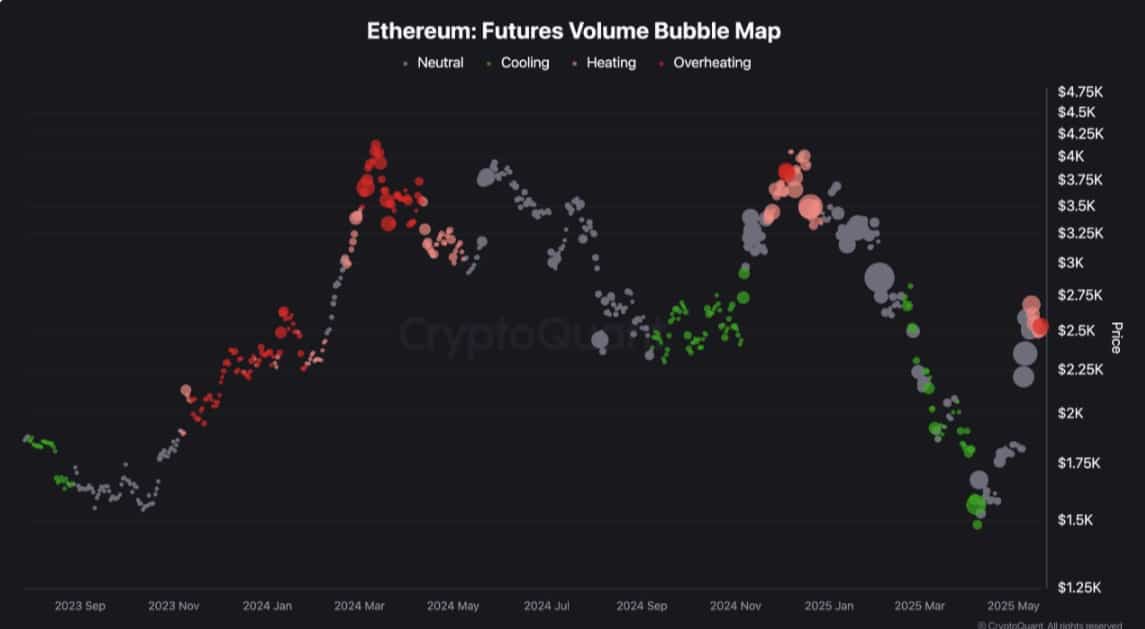

In keeping with CryptoQuant analyst Shayan, the Ethereum market has been overheating close to $2.5k, signaling a possible short-term correction.

In his evaluation, Shayan noticed that Ethereum’s method to the crucial $2.5K resistance stage has led to an overheating state, characterised by a major surge in buying and selling quantity.

The rise in buying and selling quantity is usually pushed by profit-taking exercise and the presence of resting provide at this important zone.

Such situations sign a possible market correction, though within the quick time period, because the market cools down. A quiet down is paving and constructing a basis for renewed accumulation.

This renewed accumulation is evidenced by a sustained interval of damaging change netflow. As such, Ethereum’s change netflow has remained inside damaging territory for 4 consecutive days.

This habits on the exchanges displays sturdy accumulation, as withdrawals outpace inflows.

Is ETH set for correction?

In keeping with AMBCrypto’s evaluation, though quantity has surged to sign overheated ranges, different metrics present a distinct story.

Actually, the altcoin overly undervalued, and the latest pullback is a wholesome retrace.

Quite the opposite, Ethereum is extremely undervalued. Ethereum’s MVRV Z rating, this metric has remained inside damaging territory for 4 consecutive days.

Over the previous week, ETH’s MVRV Z rating has solely hit a optimistic worth for 2 days.

Traditionally, a damaging MVRV Z rating for Ethereum has coincided with macro bottoms. For example, these occurred in December 2018, March 2020 and June to December 2022.

In earlier cycles, the altcoin held inside this territory for a short interval, providing a purchase alternative.

The identical may be mentioned after we take a look at Ethereum’s long-term holders and short-term holders’ MVRV distinction. Similar to the MVRV, the altcoin MVRV lengthy/quick distinction has held inside damaging territory.

Though it has signaled restoration, it’s but to maneuver exterior the damaging zone.

Over the previous week, Ethereum’s lengthy/quick MVRV distinction has moved from -41% to -31%. With the metric holding inside the damaging zone, it means that LTH are poorly performing relative to STH.

Thus, short-term holders at the moment are incomes greater than LTH. With long-term holders largely at a loss, they’re unlikely to promote. The present market situations should not incentivizing LTHs to shut their positions.

With out huge offloading from LTH, the market correction predicted above is unlikely.

What subsequent?

Merely put, though quantity has surged, the Ethereum market remains to be not overheated. Quite the opposite, the market is extremely undervalued, with traders taking this chance to build up.

At present situations, solely short-term holders are promoting.

Nevertheless, accumulating addresses are absorbing the promoting strain from STH.

Subsequently, Ethereum is anticipated to proceed its consolidation part till recent demand emerges to drive a breakout above the $1.5k resistance vary within the mid-term.

A breakout from the consolidation will strengthen the altcoin to leap in the direction of $1.8k.