Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

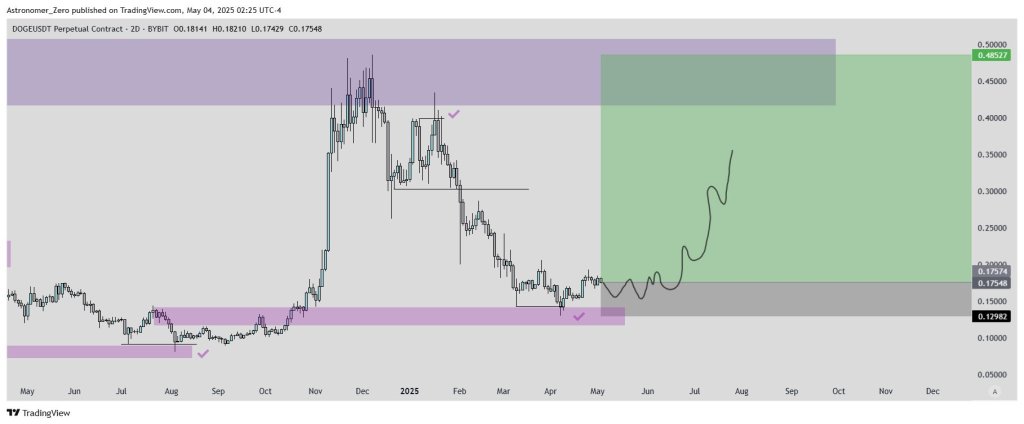

The Dogecoin two-day candlestick chart has returned to the identical accumulation shelf that preceded its five-fold burst final autumn, and unbiased market technician Astronomer (@astronomer_zero) argues the sample “seems bottomed—early name, and I’m lengthy.” The strategist, who flagged Bitcoin’s April higher-low earlier than it erupted by means of $69 000, told followers on X that DOGE now presents a “6R+ commerce” again into December’s provide wall.

The Dogecoin Backside Is In

The up to date chart exhibits worth printing successive wicks right into a lavender demand band that begins at $0.12and tops out just under $0.15000. To date each check of that ground has been absorbed, leaving a collection of upper two-day closes. “Alright, DOGE solely moved barely off the low,” Astronomer wrote, “so there nonetheless is a 6R+ commerce to be scored if it had been to go to the highs.”

The black horizontal at $0.18210 marks the primary decisive reclaim. Sunday’s session opened at $0.18141, punched to $0.18210, and settled at $0.17548—fractionally underneath the set off however nicely away from the gray worth space that defines the analyst’s danger field. For merchants operating tight stops, the invalidation sits just below $0.12982, limiting downside to roughly twelve-and-a-half cents whereas conserving the total upside open to a $0.40000–0.48527 liquidity void shaded in emerald inexperienced. “In order for you an outlined danger for an outlined reward,” Astronomer added, “an extended as introduced additionally is sensible.”

Associated Studying

Technically the construction mimics October 2024, when DOGE carved a rounded base at $0.10, ignited on rising quantity, and topped out at $0.48527 eight weeks later. “Final time we left the vary mindset was October ‘24 and we purchased DOGE at 10 c,” the analyst reminded readers. “It pulled a 5x earlier than retracing for what IMO now has change into a better low.”

The projection sketched on the chart anticipates a one to 2 months sideways chop contained in the gray band that caps at roughly $0.175, adopted by a staircase advance into the low-$0.30s and an autumn check of the December pivot.

Associated Studying

Not one of the hand-drawn arrows pierce the outdated excessive, underscoring that the thesis just isn’t predicated on price discovery—solely on a mean-reversion to the final heavy provide node. “Given that is an altcoin and expectations are doubtless past $0.5, having heavy spot baggage already pays for little danger,” he wrote. “They nonetheless might take time and take off slower than BTC, however the RR IMO will probably be greater.”

As ever, affirmation will come—or fail—on the tape. A two-day shut above $0.20000 would set up a higher-time-frame reversal and expose $0.30 liquidity, whereas a settlement beneath $0.12982 would invalidate the setup and reopen the 10-cent deal with. Till then, Astronomer’s name rests on the premise that Bitcoin bottoms first, Ethereum follows, and “one after the other, alts backside out by means of cyclical timing, sentiment, and their respective POIs.” Dogecoin, he contends, simply ticked each field.

At press time, DOGE traded at $0.173.

Featured picture created with DALL.E, chart from TradingView.com