An analyst has defined how a Dogecoin month-to-month shut above this stage might pave the best way for the memecoin to retest its all-time excessive (ATH).

Dogecoin Is Buying and selling Round The Decrease Finish Of An Ascending Channel

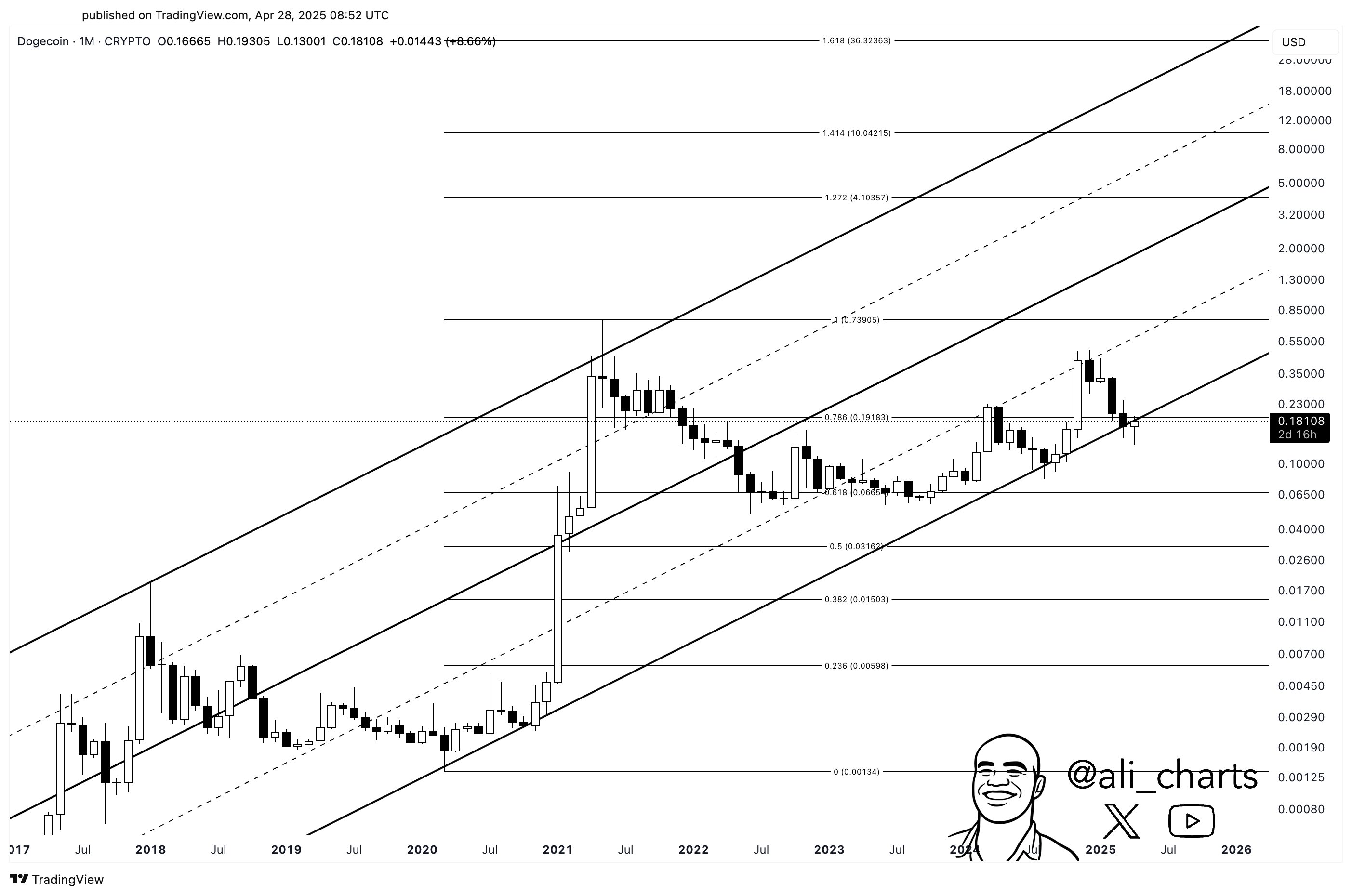

In a brand new post on X, analyst Ali Martinez has shared a technical evaluation (TA) sample that the month-to-month worth of Dogecoin has been exhibiting just lately. The sample in query is an “Ascending Channel,” which is a kind of Parallel Channel.

Parallel Channels type when an asset’s worth consolidates between two parallel trendlines. The higher line is probably going to offer resistance sooner or later, whereas the decrease one help. A get away of both of those ranges can suggest a continuation of pattern in that route.

Parallel Channels will be of three varieties. Essentially the most primary one entails trendlines which can be parallel to the time-axis. This case emerges when consolidation occurs in a sideways method.

The opposite two varieties type when the asset consolidates at an angle. When this occurs within the up route, the channel forming is called an Ascending Channel. Equally, a downward consolidation leads to a Descending Channel. Within the context of the present matter, the previous of the 2 is of curiosity.

Since an Ascending Channel represents a section of web upward consolidation within the worth, its higher line connects collectively increased highs and the decrease one increased lows.

Beneath is the chart shared by the analyst that reveals the Ascending Channel that the 1-month worth of Dogecoin has been caught inside for the final a number of years.

As is seen within the above graph, the 1-month Dogecoin worth has just lately fallen to the decrease stage of this long-term Ascending Channel and seems to be slipping beneath it. If the memecoin now sees a sustained transfer down, a breakout towards the draw back could possibly be confirmed.

Within the state of affairs that it could actually recuperate above the decrease stage of the channel once more, nonetheless, its path could as soon as once more develop into that charted out by the sample. The underside stage of the Ascending Channel isn’t the one one which the asset could be very near breaking above; there may be additionally the 0.786 Fibonacci Retracement stage.

Fibonacci Retracement ranges are based mostly on ratios from the well-known Fibonacci collection. The 0.786 Fibonacci Retracement line from the chart is located across the $0.20 worth stage. The following main stage, the 1.000 Retracement, corresponds to DOGE’s ATH of round $0.74.

As Martinez explains,

If Dogecoin $DOGE can safe a month-to-month shut above $0.20, it might pave the best way for a rally towards its all-time excessive of $0.74. Such a breakout would sign robust bullish momentum and probably appeal to elevated investor curiosity.

DOGE Worth

On the time of writing, Dogecoin is buying and selling round $0.17, up over 9% within the final week.