Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Maelius (@MaeliusCrypto) has published a contemporary weekly chart of DOGE/USDT from Binance and—regardless of the meme-coin’s current pull-back—sees the groundwork for a textbook Elliott-wave extension that would catapult costs towards the psychological $1.00 mark.

Can Dogecoin Hit $1?

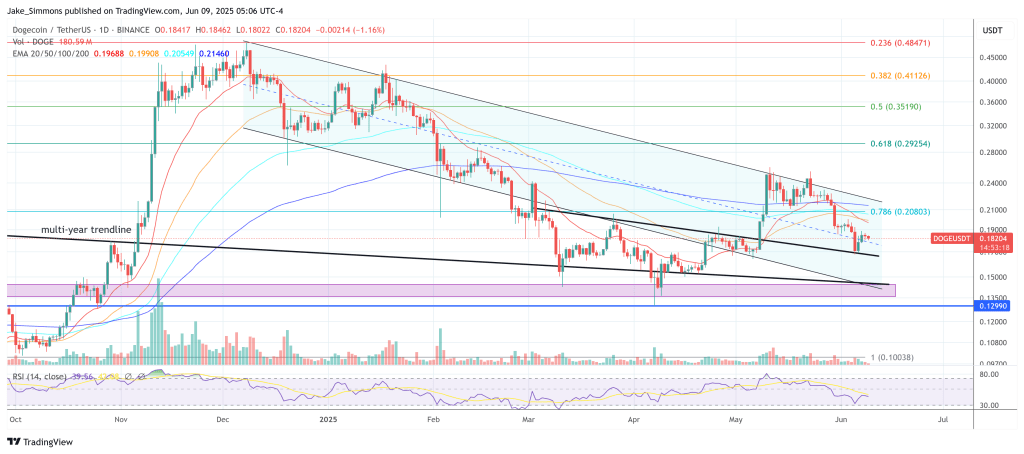

The chart tracks each weekly candle since early-2021 and places the present market at $0.1843 after a four-week slide from the March excessive close to $0.26. That decline has carried worth straight again right into a broad inexperienced “demand” band that now stretches roughly from $0.12 as much as $0.17. The zone as soon as acted as heavy overhead resistance throughout 2022-23; Maelius notes that, after final 12 months’s breakout, it has switched polarity and is behaving as a base of demand.

Two shifting averages body the construction. The 50-week exponential common (EMA 50, blue) is curling larger and sits at about $0.205, whereas the 200-week EMA (crimson) is printed at $0.1415. Value is presently wedged between the 2, a configuration that always precedes a decisive growth in volatility. Notably, a rising crimson trend-line—drawn beneath successive larger lows since late-2023—now coincides nearly precisely with the 200-week EMA, reinforcing the $0.15 space as technical assist.

Associated Studying

Maelius’ rely assigns the March 2024 spike to $0.23 as the first wave 1, and the next retreat to the October 2024 low close to $0.12 as the first wave 2. From that inflection level the analyst sees the opening levels of a 3rd wave unfolding, however—crucially—he marks a smaller-degree wave 1 of that bigger wave 1 peaking simply above $0.48 in early December final 12 months, adopted by the current pull-back that he labels the smaller-degree wave 2.

In different phrases, the chart exhibits a basic “1-2, 1-2” nesting: an enormous 1-2 at main diploma, instantly adopted by a smaller 1-2 that kicks off the presumed third-of-third advance. Such a configuration is usually regarded by Elliott technicians as essentially the most explosive setup in the whole impulse hierarchy as a result of the subsequent leg is the wave 3 of wave 3, a phase that may lengthen with the steepest slope and infrequently delivers the majority of a pattern’s worth appreciation.

Associated Studying

A dashed projection ray extrapolates that third wave to the $1.10 area, earlier than wave 4 is pencilled in as a shallow retrace to roughly $0.65 and wave 5 completes someplace within the $1.50–$1.80 vary. Maelius tempers the roadmap in his accompanying submit, stating he’s “not a fan of onerous targets” however believes “this one goes in direction of $1 within the subsequent impulse.”

Below the worth pane Maelius plots the weekly WaveTrend Oscillator (WTO). Each the quick (black) and gradual (crimson) curves bottomed contained in the highlighted oversold band in April and have since hooked sharply larger. That flip has been accompanied by a gentle contraction within the crimson histogram bars; during the last two candles the histogram has in actual fact flipped again to light-grey on the constructive facet of the midline, signalling that bearish momentum is losing its grip and {that a} contemporary bullish impulse could also be brewing.

DOGE is now hovering precisely on the higher rim of the demand field. A weekly shut above the EMA 50 at $0.205 would sign renewed bullish dominance and open the way in which to $0.26—the Might swing excessive—and the mid-$0.40s cluster that halted worth in the course of the December 2024 rally. Conversely, a decisive break beneath $0.14 would violate the two-year ascending trend-line and postpone the Elliott rely.

At press time, DOGE traded at $0.18.

Featured picture created with DALL.E, chart from TradingView.com