Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

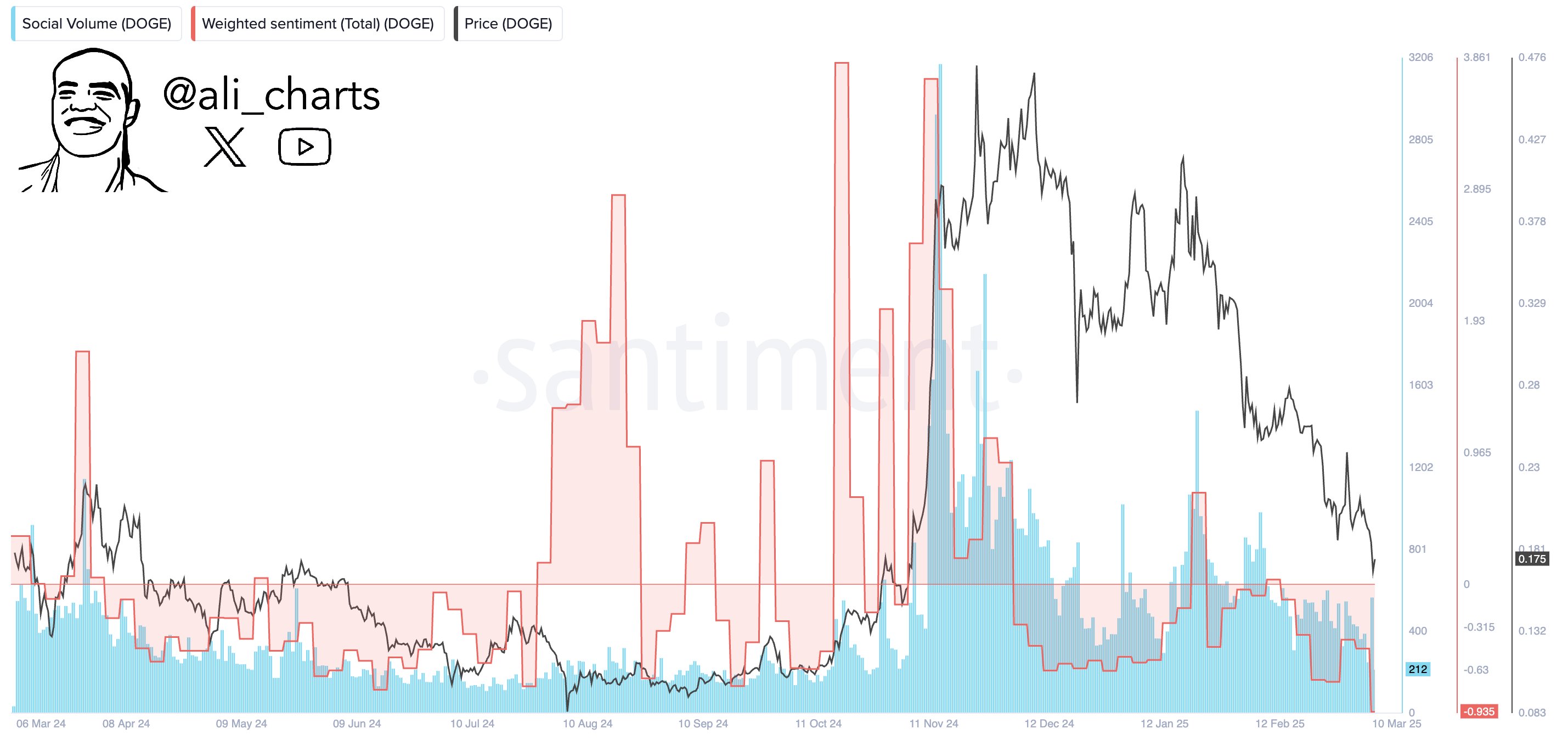

Dogecoin’s sentiment has reportedly reached its most destructive stage in over a yr. Crypto analyst Ali Martinez (@ali_charts) shared the beneath chart illustrating the present panorama of Dogecoin’s social sentiment and noted: “Investor sentiment round Dogecoin is at its most destructive in over a yr. Traditionally, excessive worry has set the stage for main reversals. This may very well be a chief alternative to be a contrarian.”

What This Means For Dogecoin

Inside the chart, the purple line—the Weighted Sentiment—now sits at roughly -0.93, marking the steepest destructive studying in additional than 12 months. Weighted Sentiment considers each the amount of social media mentions (Social Quantity) and the general polarity of discussions (constructive vs. destructive). Spikes above zero usually point out widespread bullish sentiment (and might coincide with surging costs), whereas sharp dips recommend that market members are overwhelmingly bearish.

Associated Studying

Alongside this destructive flip in Weighted Sentiment, the chart’s blue bars—Social Quantity—present reasonable ranges in comparison with the dramatic spikes seen mid-November by December. In that interval, Social Quantity soared above 3,000 mentions, correlating with extraordinarily constructive Weighted Sentiment (above +3 on the chart) and a considerable worth rally.

Now, Social Quantity hovers round simply over 200 mentions, which underscores that whereas destructive sentiment dominates, the general dialog frequency about DOGE is comparatively low.

Associated Studying

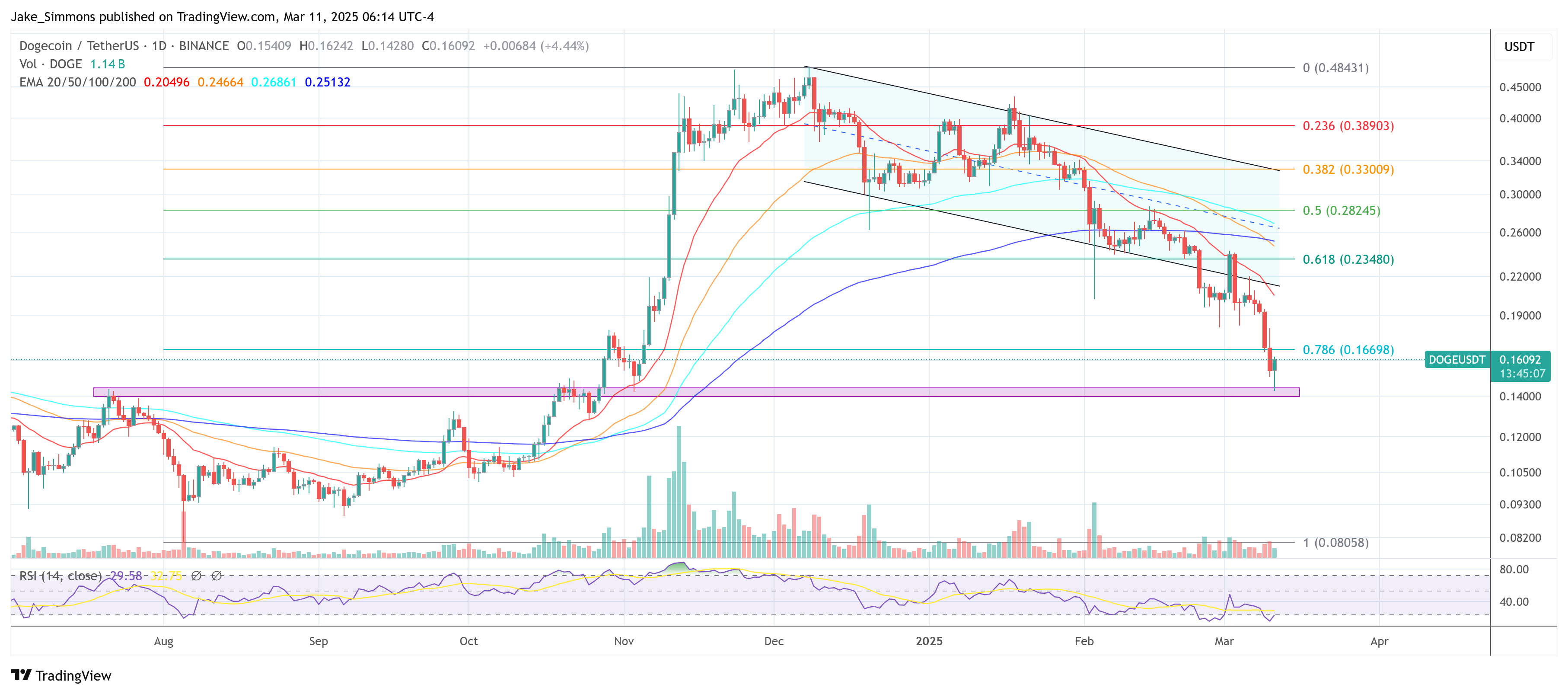

One other common analyst, Lumen (@Lumen0x), points out that Dogecoin has dropped 20% in per week—sliding from $0.22 to $0.17. Regardless of the pullback, whale addresses reportedly scooped up 1.7 billion DOGE (roughly $298 million) up to now 72 hours, suggesting that larger gamers is likely to be positioning for an eventual rebound.

Lumen additionally speculates {that a} potential Dogecoin ETF approval might act as a bullish catalyst. In accordance with him, if Dogecoin’s worth reclaims $0.20 forward of any ETF-related announcement, it might pave the way in which for a surge towards $0.50, citing the liquidity these funding automobiles might carry and the opportunity of renewed social media pleasure.

In accordance with Lumen, the instant assist sits round $0.17–$0.18, reflecting current lows on the chart. The psychological pivot level is at $0.20, a stage ceaselessly talked about by analysts as a key threshold for bullish continuation. A mid-term potential upside goal is at $0.50, per Lumen’s outlook if important market catalysts (e.g., an ETF) materialize.

General, Dogecoin’s plunge in social sentiment underscores the volatility intrinsic to meme-based cryptocurrencies. The Sentiment Weighted metric’s deep dive means that the majority of social media commentary has taken a distinctly pessimistic flip. But, some analysts like Martinez and Lumen consider this excessive destructive sentiment might mark the beginning of a rebound, particularly in gentle of notable whale accumulation and potential ETF catalysts on the horizon

At press time, DOGE traded at $0.16.

Featured picture created with DALL.E, chart from TradingView.com