- Musk helps Trump’s push for presidential management over the Federal Reserve’s insurance policies.

- Bitcoin features momentum as a hedge in opposition to inflation amid rising U.S. nationwide debt.

Elon Musk, the influential CEO of Tesla and SpaceX, has lengthy been a vocal supporter of the now-President Donald Trump, significantly throughout his 2024 election marketing campaign.

After Trump’s victory in turning into the forty seventh President of the US, Musk brazenly endorsed the concept of permitting the president to play a extra direct function in shaping Federal Reserve insurance policies.

Senator Mike Lee on ending Federal Reserve’s energy

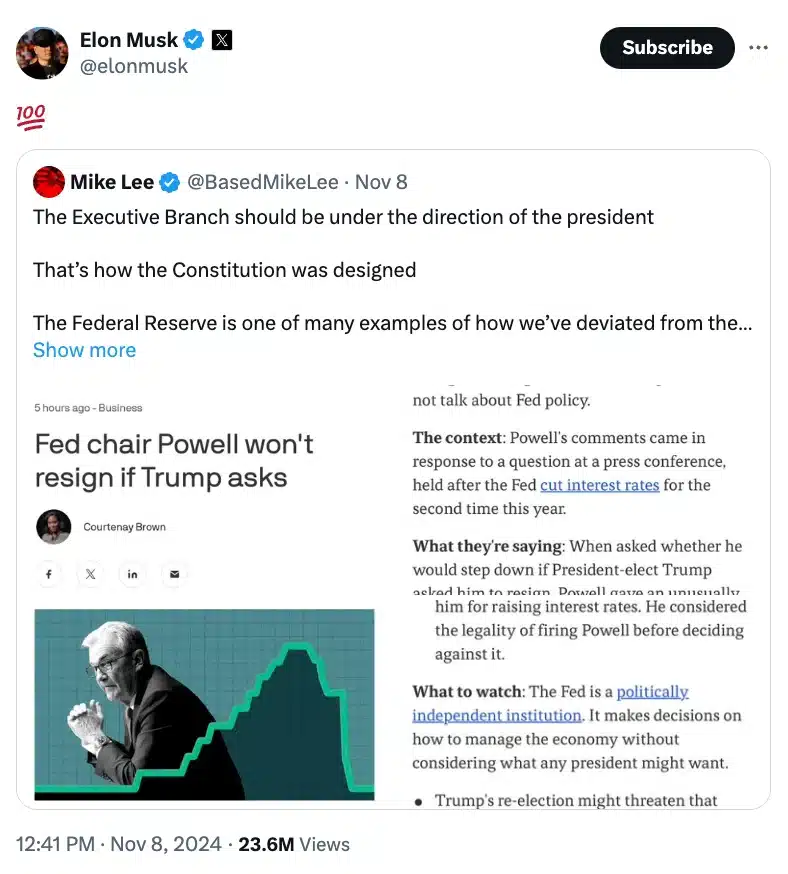

This emerged from a response to a current publish by Senator Mike Lee, R-Utah, advocating for the Federal Reserve to function beneath the direct management of the president.

Including on to this, Musk signaled his help the next day with a easy “100” emoji, generally used to specific full settlement.

For these unaware, Senator Lee had wrapped up his tweet with the hashtag #EndtheFed, calling for a radical shift in U.S. financial coverage.

He stated,

“The Govt Department ought to be beneath the route of the president. That’s how the Structure was designed. The Federal Reserve is one among many examples of how we’ve deviated from the Structure, in that regard. But another excuse why we should always finish the Fed.”

How did this begin?

For context, Lee’s publish was sparked by Federal Reserve Chair Jerome Powell’s refusal to step down even when requested by incoming President Trump, a transfer Lee considered as emblematic of an out-of-control system. As anticipated, Musk’s endorsement of Lee’s place on social media stirred additional debate in regards to the function of the Federal Reserve in U.S. financial governance.

Reacting to the scenario the neighborhood reacted as highlighted by an X consumer – Truth Justice who stated,

“The top of presidency corruption.”

The problem flared up when Fed Chair Jerome Powell reaffirmed that he wouldn’t step down if requested by President-elect Trump. This prompt a renewed friction between the central financial institution and the White Home.

What’s extra?

Traditionally, the Federal Reserve has operated independently to make choices based mostly solely on financial circumstances, however throughout his first time period, Trump ceaselessly criticized Powell’s insurance policies.

Thus, in the course of the 2024 election marketing campaign, Trump expressed curiosity in exerting extra affect over the Fed’s actions ought to he return to workplace. Remarking on the identical, in August at a press convention at his Mar-a-Lago membership in Florida Trump asserted,

“I really feel the president ought to have a minimum of [a] say in there.”

As anticipated, Musk additionally shared an analogous sentiment in a current tweet when he argued,

“The unelected and unconstitutional Federal paperwork at present has extra energy than the presidency, legislature or judiciary! This wants to alter.”

How is Bitcoin the savior?

With the U.S. nationwide debt exceeding $35 trillion, Bitcoin [BTC] is rising as a possible hedge in opposition to inflation pushed by years of cash printing. Figures like Florida CFO Jimmy Patronis and Senator Cynthia Lummis are pushing for BTC investments to guard buying energy.

Moreover, Trump has additionally suggested utilizing Bitcoin to handle the nationwide debt, highlighting its rising function in U.S. financial technique. Subsequently, as the talk on Bitcoin’s monetary impression intensifies, its potential as an inflation hedge features growing consideration.

In truth, an X consumer put it greatest when he stated,