- The ETH/BTC pair hovered close to cycle lows, however key assist round 0.05 BTC may present a launchpad.

- If BTC dominance declines, capital could rotate into ETH, driving a rebound within the pair.

The U.S. Greenback Index (DXY) has plunged to new lows, fueling speculation about capital rotating into danger belongings, significantly crypto. Traditionally, a weakening greenback has supported liquidity inflows into Bitcoin [BTC] and Ethereum [ETH].

Trump’s import tax hike intensified sell-side stress on the U.S. greenback, pushing it again to pre-election ranges. Nonetheless, AMBCrypto’s evaluation highlighted a vital shift – BTC and DXY have decoupled, decreasing the greenback’s reliability as a number one crypto market indicator.

But, macroeconomic catalysts stay in play. As quickly as U.S. President Donald Trump announced a tariff break, Bitcoin reclaimed $86k after buying and selling beneath this degree for seventeen days, whereas Ethereum surged previous $2k.

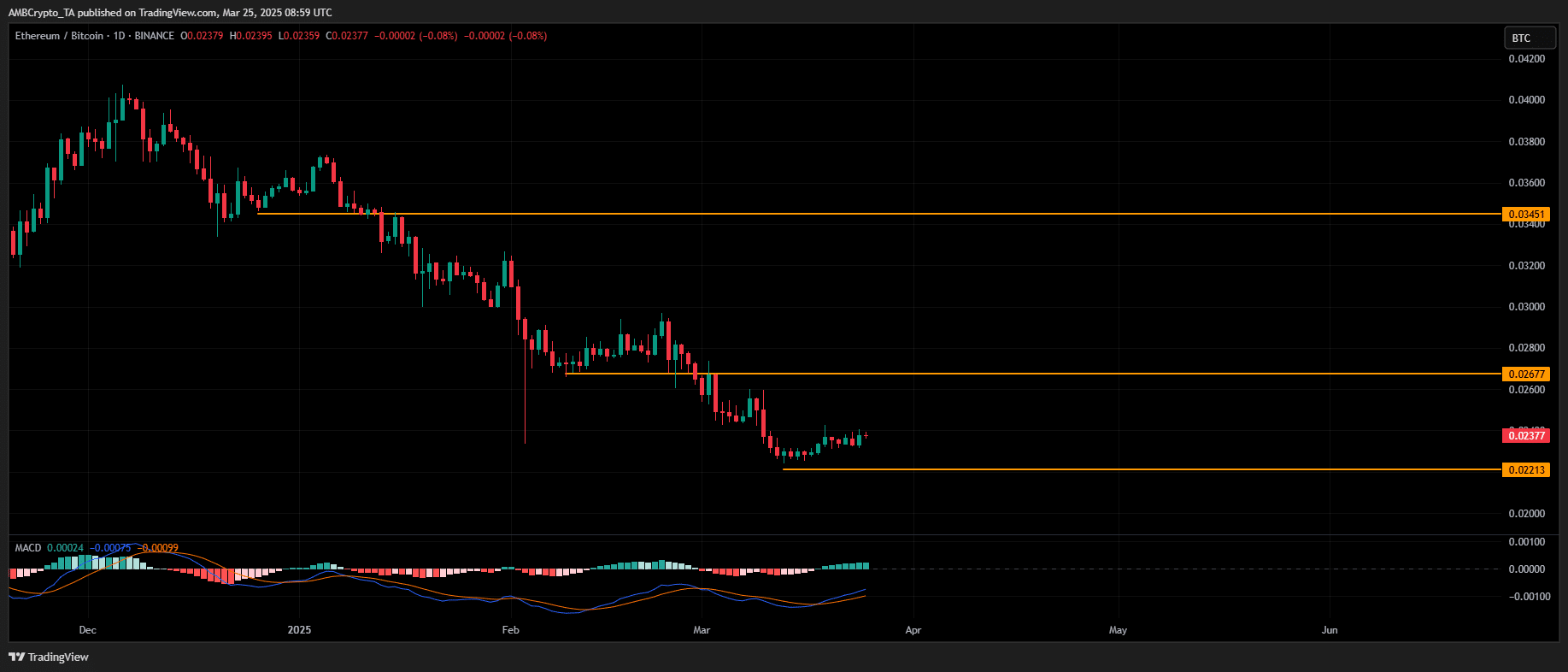

BTC’s present non-linear worth motion presents ETH with a window to draw capital. The ETH/BTC pair indicators rising momentum because the MACD flips bullish for the primary time in almost a month.

A well-defined assist cluster has fashioned, marking the third compression part in three months – a sign of a possible breakout and development reversal in ETH’s favor.

If the breakout construction is confirmed, analysts project a transfer towards 0.0019 BTC per ETH, with the pair at present hovering round 0.002 BTC.

Nonetheless, technicals alone gained’t do. In prior demand zones, patrons didn’t maintain accumulation, resulting in liquidity depletion and a breakdown to a five-year low.

If historical past repeats, the chance of additional liquidity sweeps stays elevated. In such a situation, ETH/BTC may prolong its draw back, additional weakening Ethereum’s relative energy in opposition to Bitcoin.

ETH/BTC: Breakdown continuation or development reversal?

For a confirmed ETH/BTC reversal, a BTC retracement stays a crucial set off.

Present market construction identifies $89k as a serious resistance zone for Bitcoin, the place a previous breakout try failed on the twenty fourth of March, reinforcing overhead provide.

If BTC faces sustained rejection at this degree, a corrective transfer may unlock ETH/BTC rotation, providing a possible bid for Ethereum dominance.

Nonetheless, bullish conviction seems weak. For the reason that post-election rally, ETH has proven an elevated correlation to BTC’s draw back, constantly forming decrease highs.

On the third of March, BTC’s 8.54% single-day drawdown led to a 14.66% ETH decline.

This structural shift suggests Ethereum is changing into more and more reactive to Bitcoin’s drawdowns relatively than benefiting from capital rotation.

If BTC retraces sharply, ETH dangers dropping the $2K liquidity zone, doubtlessly driving ETH/BTC to contemporary cycle lows.