- ETH faces sell-off fears amidst elevated whale exercise.

- Ethereum dump continues as massive holders transfers $538.5 million price of ETH.

Ethereum [ETH], the second largest cryptocurrency by market cap has not too long ago skilled a average restoration in its value. In reality, as of this writing, ETH was buying and selling at $2366 after a 1.76% enhance previously 24 hours.

Previous to this, ETH was in a downward trajectory hitting a low of $2150 within the final week. Over the previous 40 days, the altcoin has declined by 11.09%.

Regardless of the good points on every day charts, ETH remained comparatively low from its current native excessive of $2820 and 51% from its ATH of $4878.

Though the altcoin has gained over the previous day, the market continues to be going through sell-off fears following unprecedented whale actions. As famous by Whale Alert, ETH has skilled huge transfers into exchanges.

Ethereum whales are on the transfer

In a sequence of transactions, Whale Alert has uncovered huge ETH transfers to numerous exchanges. These transfers whole a whopping $538 million which have been despatched to numerous exchanges together with Kraken, Binance, Arbitrum, and coinbase.

Based mostly on the report, Binance acquired $188.6 million price of ETH, Kraken acquired $127.2 million whereas Coinbase and Arbitrum recorded $34 million and $188.6 million, respectively.

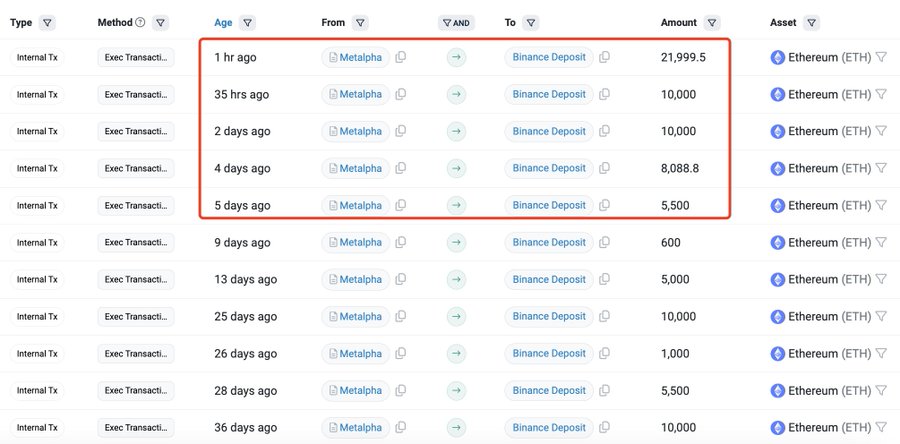

This transaction happens as Metalpha has additionally been on a depositing spree over the previous few days. In keeping with Lookonchain, the Hong Kong-based agency has deposited $51.16 million price of ETH previously hours.

Over the previous 5 days, Metalpha has deposited $128.7 million price of Ethereum to Binance.

These huge transactions have caught the eye of the ETH neighborhood as transfers into exchanges suggest preparation to promote.

If these holders promote, it’s going to end in promoting strain which can pressure costs to drop additional as provide on exchanges will increase.

What ETH charts recommend

Whereas good points on every day charts could give hope, current whale transactions go away markets at a crossroads. Such whale actions suggest a insecurity within the altcoin’s path a phenomenon that has been witnessed over the previous week.

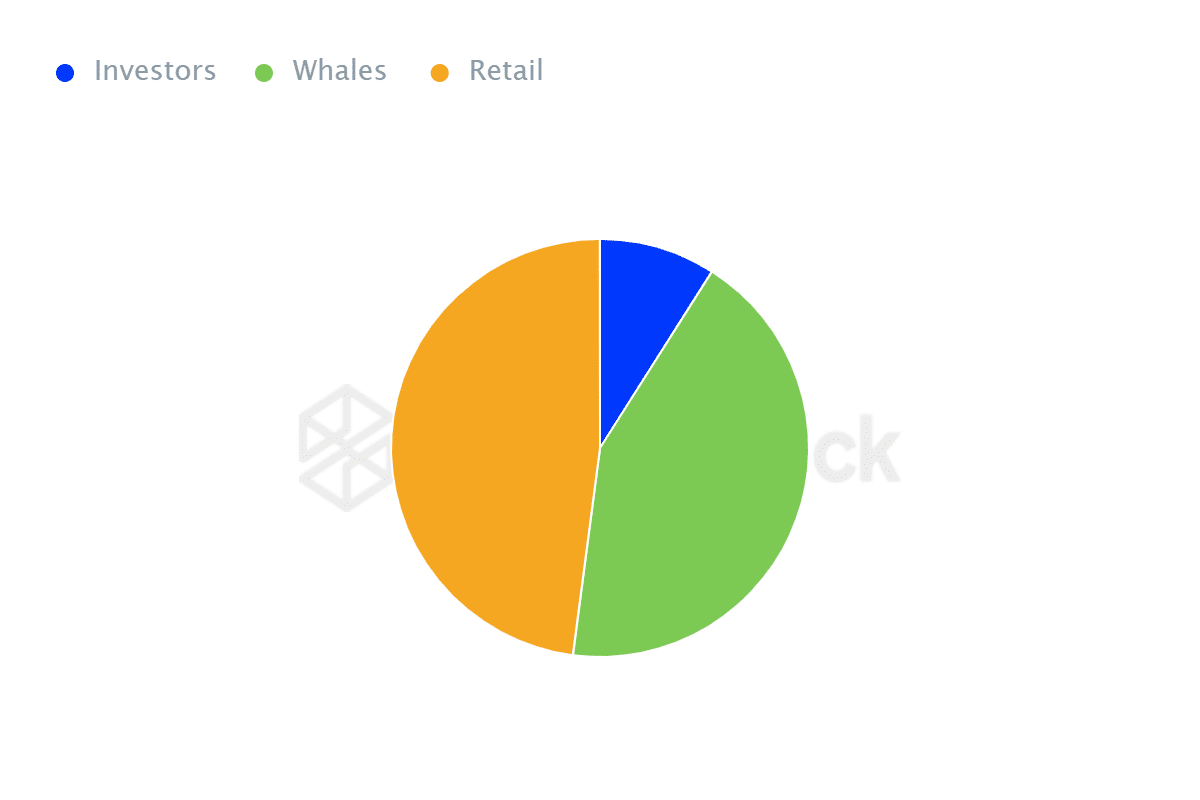

For starters, Ethereum’s possession by focus has modified drastically leaving retail merchants dominating the market.

In keeping with IntoTheBlock, retail merchants management 47.93% of the ETH market whereas whales management 43.07%. This units the altcoin for an additional decline when whales cut back their holdings as retail merchants are emotional sellers.

Equally, a decline in whale holding suggests massive holders lack confidence within the altcoin’s path.

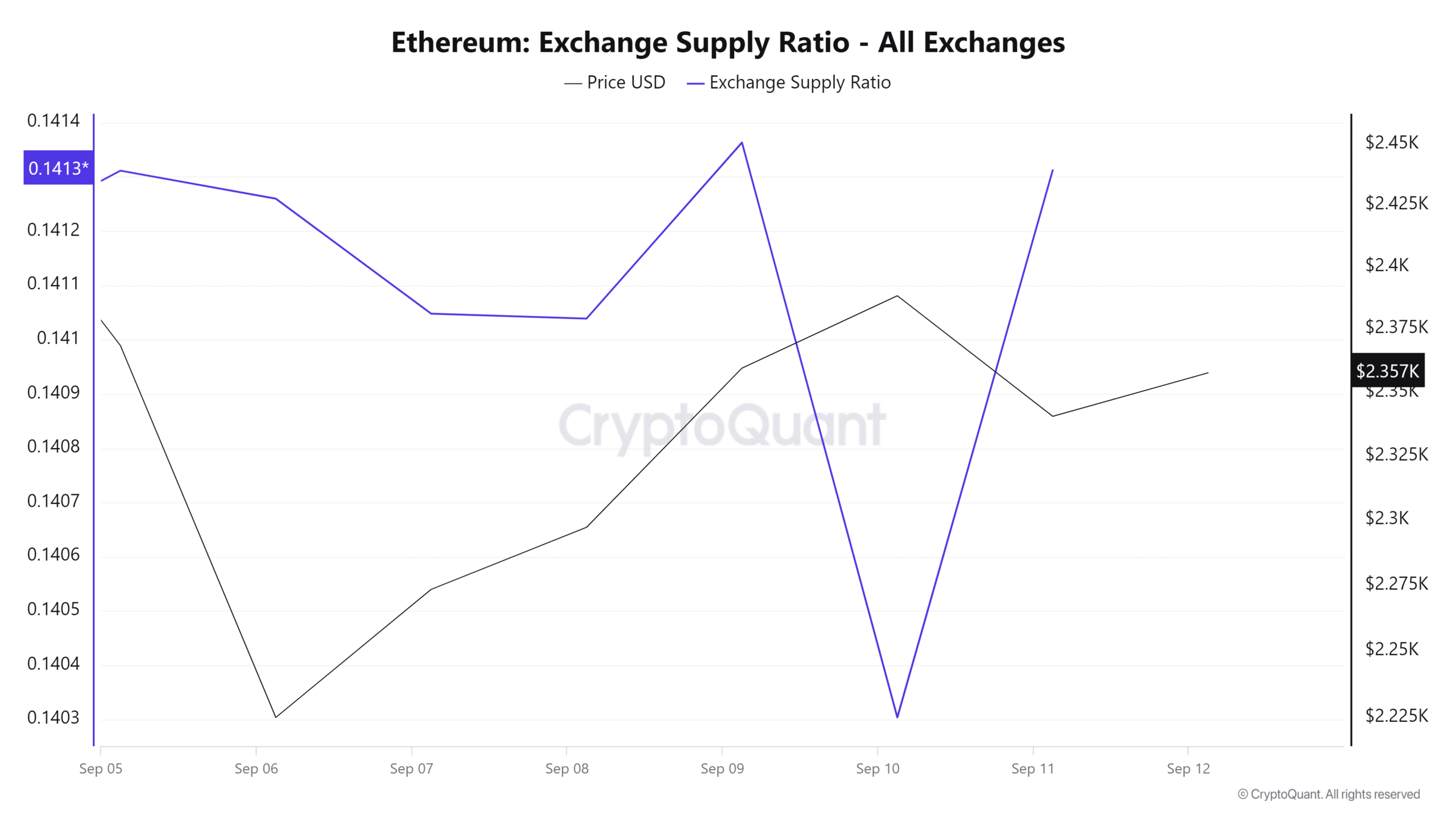

Moreover, the change provide ratio has spiked over the previous day suggesting elevated provide on exchanges.

When the availability ratio will increase as extra belongings are transferred into exchanges, it suggests holders are getting ready to promote due to an anticipated value drop.

Due to this fact, these whale transactions recommend massive holders are getting ready to promote which alerts a insecurity in ETH’s future value actions.

If these whales promote, ETH will face huge promoting strain which can drive costs right down to an eight-month low of $2114.