As Ethereum gained upward traction, the $4,500 value mark continuously proved to be a powerful resistance zone for the main altcoin to interrupt, inflicting it to show barely bearish. Although the altcoin is experiencing non permanent bearishness, the dip seems to have ignited the sentiment of key traders, triggering a pointy wave of accumulation in the previous few days.

Mega Ethereum Whales Accumulation Frenzy

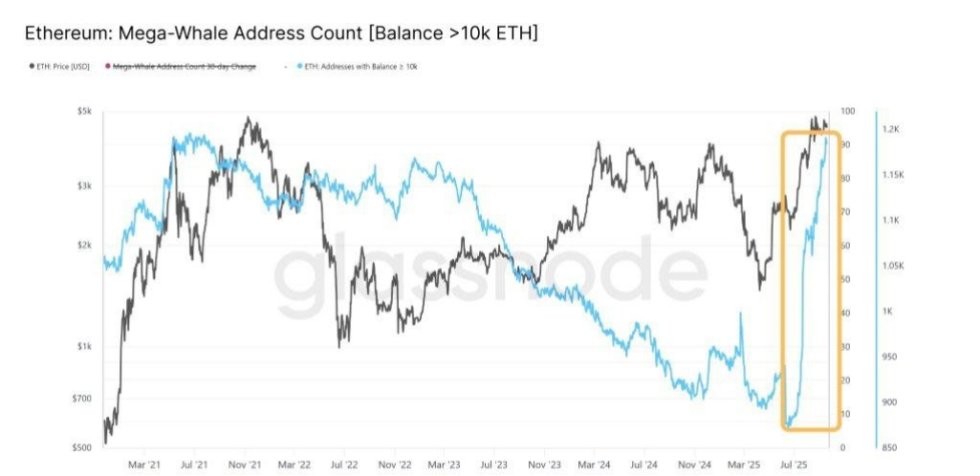

Ethereum’s upward motion in value might have slowed down, however its greatest gamers or traders are making daring strikes as soon as once more with their strong accumulation. Presently, there was a big uptick in shopping for stress amongst ETH mega whale wallets, because the variety of these addresses will increase sharply.

The sharp rise in ETH mega whale wallets reported by Niels, a crypto dealer and co-founder of Ted Labs, alerts renewed conviction amongst deep-pocketed traders. Although the temper of the broader crypto market stays combined, these key traders are stacking the altcoin at their quickest tempo in years.

In response to the knowledgeable, the present wave of buying spree by the ETH mega whales is much like that of the 2021 bull market cycle. As seen within the chart shared by Niels, a large accumulation by these cohorts was adopted by a powerful upward transfer in ETH’s value.

With the present shopping for stress mimicking that of 2021, the event might show to be a serious driver in Ethereum’s next major price cycle. After analyzing the chart, Niels highlighted that ETH mega whale wallets, significantly pockets addresses holding no less than 10,000 ETH, have risen again to 1,200.

This sizable variety of mega ETH whales was final seen on the peak of the bull run. Whereas accumulation by this cohort continues to be ongoing, the knowledgeable is assured that the event is past speculative babble.

His daring assertion is bolstered by the truth that such shopping for stress from these traders usually precedes rallies in value. It’s value noting that when whales collect this a lot, they’re planning for the following huge step up in value reasonably than inserting bets on short-term strikes.

In an X post by Rand, these giant traders at the moment are seeing unrealized income final noticed practically 4 years in the past. Information exhibits that their unrealized income this 12 months are drawing nearer to the $45 billion mark following the latest upswing in ETH’s price.

ETH Obtainable On Crypto Exchanges Is Declining Quick

Simply as accumulation is rising robust, the Ethereum stability on crypto exchanges is dropping at a considerable fee. According to the chart shared by CryptoGoos on X, the share of ETH balance on crypto exchanges has been steadily declining since August 2020.

Presently, the stability has now fallen beneath 14%, reflecting a rising development of traders shifting their holdings into staking and self-custody. On the similar time, the event reduces the quantity of liquid supply that’s accessible for buying and selling.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.