Ethereum is rising because the vanguard for a revolutionary monetary system. Advocates of the second most dear blockchain extol the virtues of good contracts, envisioning a future marked by market transparency, tokenized funds, and expeditious settlement occasions.

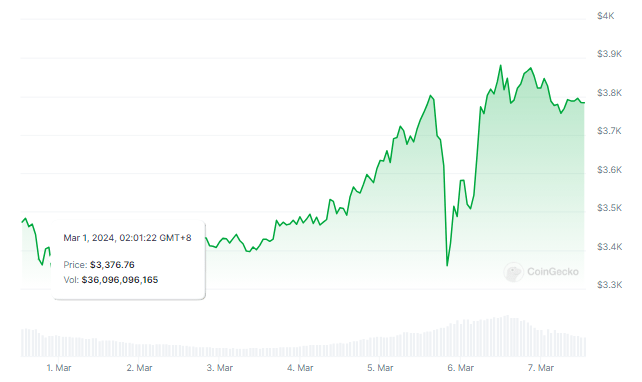

On the time of writing, Ether was trading at $3,780, up 2% and eight% within the day by day and weekly timeframes, information from Coingecko reveals.

Ethereum’s Untapped Institutional Potential

Consultants argue that Ethereum is but to endure its institutionalized hype cycle, lagging behind the fervor witnessed by Bitcoin.

Robby Greenfield, the visionary co-founder and CEO of Umoja Labs, foresees a big uptick in institutional curiosity in Ethereum, notably fueled by the upcoming Bitcoin halving and the cascading inflows from Bitcoin ETFs.

Greenfield’s daring prediction locations Ethereum on a trajectory to slender the hole with Bitcoin’s positive factors, asserting that the cryptocurrency may surpass the $10,000 milestone this yr.

Institutional buyers, he believes, will play a pivotal function in propelling Ethereum to new heights, bringing a few surge in shopping for strain.

ETH worth motion within the final week. Supply: Coingecko

Regulatory Crossroads: The SEC’s Stance On Ethereum ETFs

Whereas optimism runs excessive, the trail to Ethereum’s ascendancy isn’t with out regulatory hurdles.

The US Securities and Alternate Fee, led by Chair Gary Gensler, might undertake a cautious strategy towards approving an Ethereum ETF, not like the comparatively smoother approval course of witnessed with Bitcoin ETFs.

Gensler’s hesitance stems from a historical past the place the SEC reluctantly gave the nod to Bitcoin ETFs after a authorized battle with Grayscale.

Whole crypto market cap is at present at $2.456 trillion. Chart: TradingView.com

The SEC is about to scrutinize Ethereum ETF purposes, together with these from monetary giants BlackRock and Constancy, in Could.

Regardless of business expectations, the approval odds range, with Polymarket estimating a 43% chance and JPMorgan providing a extra optimistic 50% probability.

Ethereum’s Catalyst: The Dencun Improve

JPMorgan highlights a possible catalyst for Ethereum’s development—the Dencun upgrade. Crafted to boost scalability by lowering prices for numerous rollup options, this improve facilitates the batching of crypto transactions into smaller information chunks settled on the Ethereum community.

Not like Bitcoin’s programmed shortage with a capped token provide of 21 million, Ethereum’s provide stays infinite, presenting a novel dynamic within the crypto panorama.

Eugene Cheung, Bybit’s head of establishments, underscores the optimistic implications of the Dencun improve for Ethereum supporters.

With layer 2 options constructed on prime of Ethereum, the blockchain is evolving right into a settlement layer for a novel digital infrastructure spanning gaming, buying and selling, and investing.

Within the eyes of some, the looming resolution on Ethereum ETFs is simply the opening act.

Bloomberg ETF analyst Eric Balchunas dismisses an Ethereum ETF as “small potatoes,” characterizing it as an underwhelming prelude to extra substantial developments throughout the crypto sphere.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal danger.

ETH worth motion within the final week. Supply: Coingecko

ETH worth motion within the final week. Supply: Coingecko