- Regular decline of Ethereum was partly resulting from lowered transaction charges

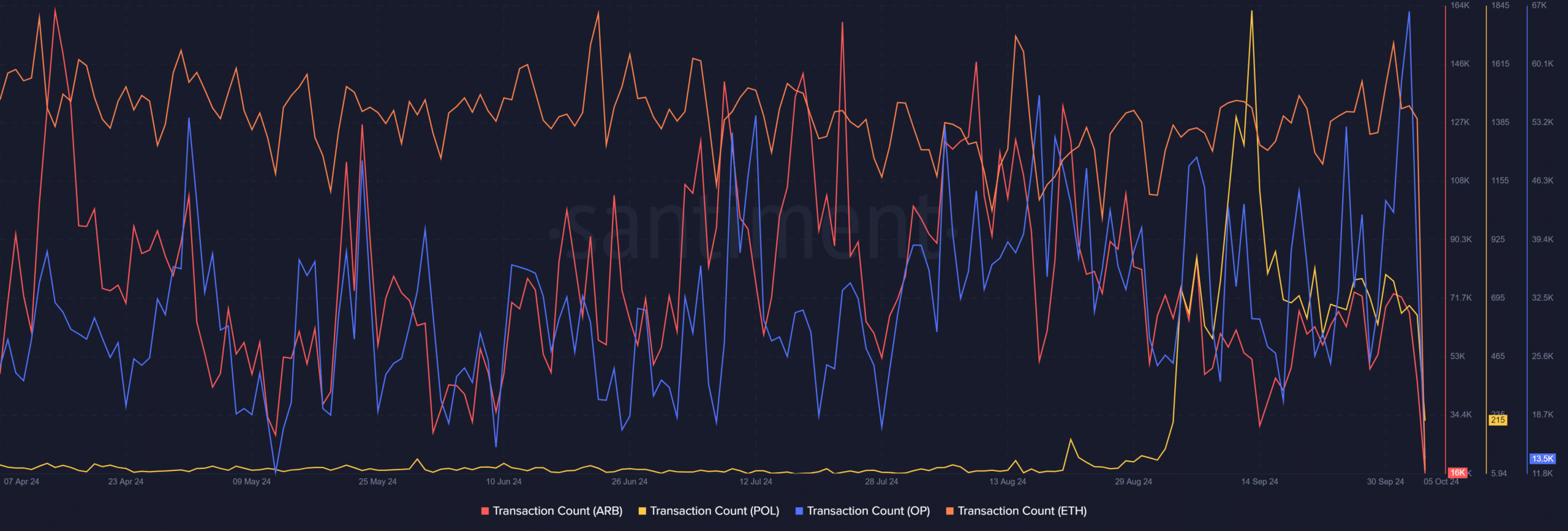

- Different main L2s noticed rising transaction counts whereas ETH misplaced out barely

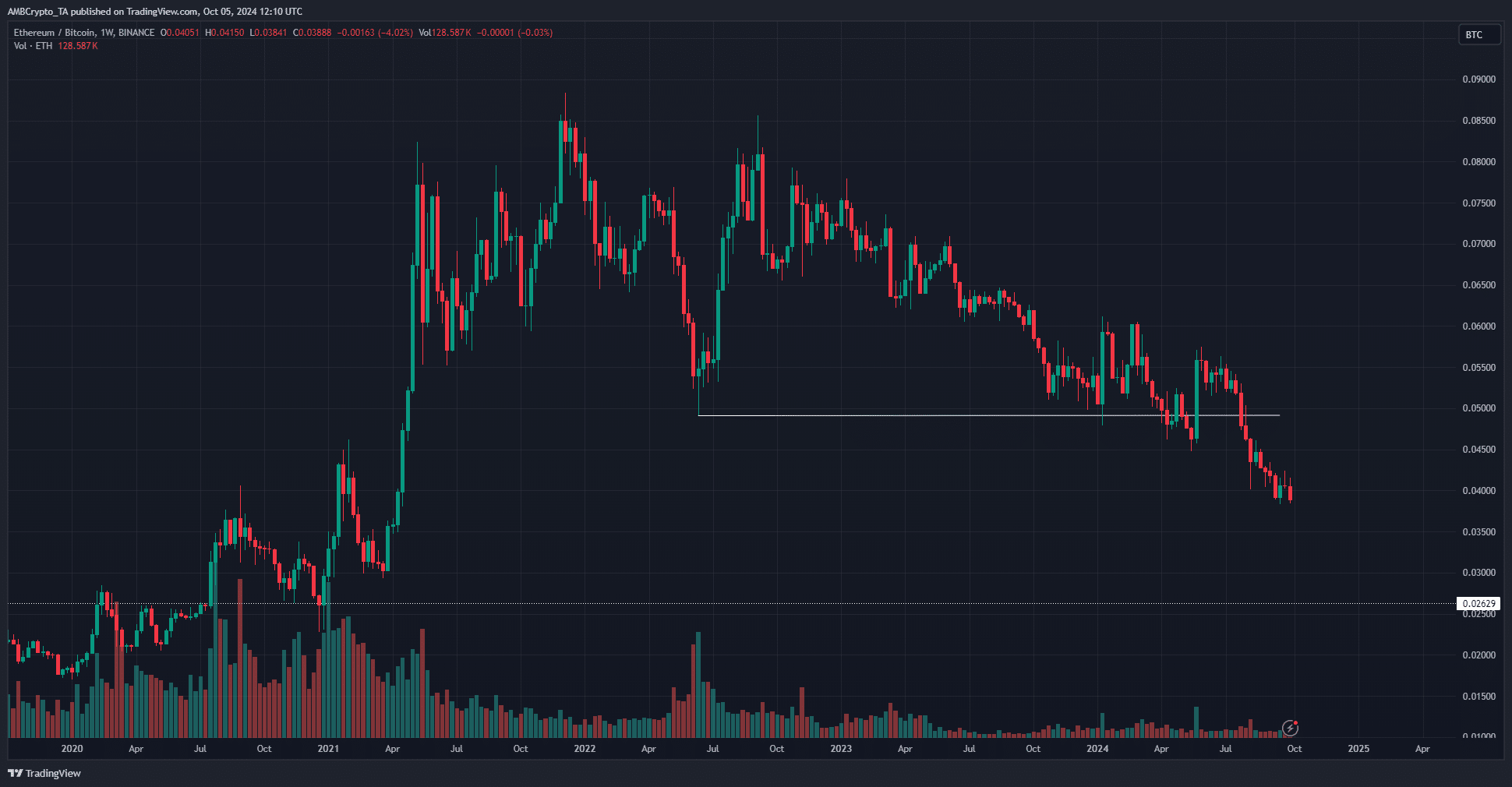

Ethereum [ETH] has carried out poorly since April, particularly in comparison with Bitcoin [BTC]. Because the chief of the altcoin market, some members anticipate ETH to guide the altcoins’ bullish cost. As issues stand, nevertheless, the altcoin is struggling to maintain up with the market.

The ETH/BTC chart has been on a marked downtrend since April 2023. Till April 2024, the lows from June 2022 at 0.049 had been defended, however the persistent downtrend of the previous six months took ETH/BTC to lows not seen since April 2021.

Causes for Ethereum dropping worth

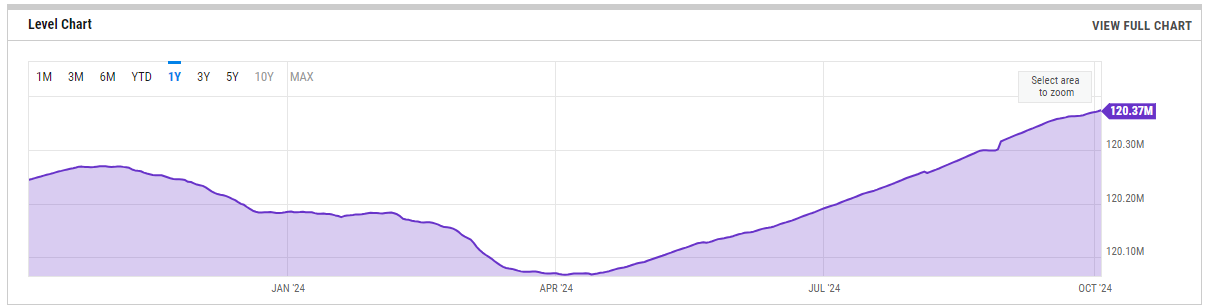

Lengthy-term Ethereum buyers could be frightened about Ethereum dropping floor to Bitcoin at such a speedy price. One of many causes the token is dropping out is the inflation current within the community because the Dencun improve in March 2024.

Supply: YCharts

The Dencun improve launched EIP 4844 which drastically lowered the transaction prices of L2 transactions. Whereas it’s excellent news for customers, the falling community charges meant a decrease quantity of ETH was being burnt, making the token barely inflationary prior to now six months.

This was seen within the rising ETH provide chart.

Optimism exercise developments firmly increased

Supply: Santiment

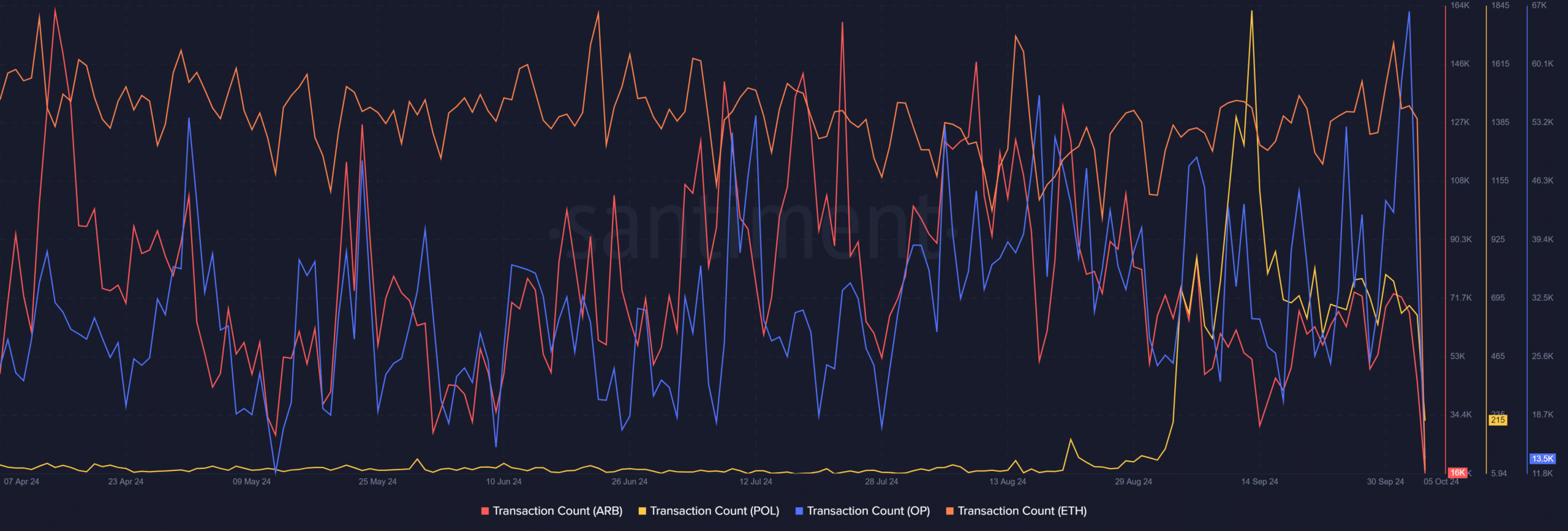

Arbitrum [ARB] and Polygon Ecosystem Token [POL] noticed the next transaction depend, however Optimism [OP] was the clear chief. This confirmed that the L2s had been rising in reputation.

Specifically, Optimism outperforming the remainder can possible be attributed to the rise in Coinbase’s Base L2 on prime of the Optimism Superchain.

Learn Ethereum’s [ETH] Price Prediction 2024-25

An inflationary ETH and its efficiency towards Bitcoin problem the concept Ethereum is cash. An uptick in exercise may alleviate this drawback, however the lack of market conviction in ETH could be exemplified by the ETH/BTC chart.