Ethereum has skilled a large drop, reaching its lowest stage since late November 2023. All the market has been hit by excessive volatility, uncertainty, and aggressive worth swings, with ETH dropping over 20% of its worth in simply hours. Traders concern that this correction might lengthen additional as Ethereum struggles to reclaim key demand ranges.

Associated Studying

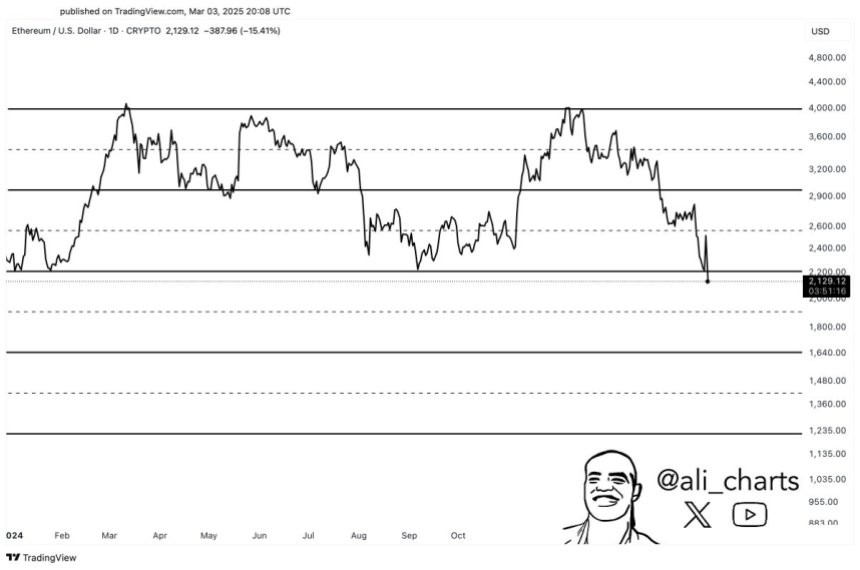

Analysts are carefully monitoring Ethereum’s worth motion, as the following few days might decide the short-term outlook for the second-largest cryptocurrency. High analyst Ali Martinez shared a technical evaluation on X, suggesting that Ethereum is on the verge of breaking out of a parallel channel to the draw back. If this push under the $2,000 mark occurs, ETH might be set for a deeper correction earlier than any restoration makes an attempt.

Ethereum’s weakness raises issues in regards to the broader crypto market, as altcoins have additionally been hit arduous throughout this newest sell-off. Sentiment stays bearish, and merchants are ready for affirmation of whether or not ETH will regain energy or proceed dropping towards decrease demand zones. The subsequent few buying and selling classes will likely be essential in figuring out whether or not Ethereum can maintain above crucial assist or if additional draw back is inevitable.

Ethereum Faces Extra Draw back Danger

Ethereum’s worth motion has been underwhelming because the broader crypto market struggles to seek out stability. Regardless of transient rallies and sharp declines, ETH has failed to determine a transparent pattern, leaving traders unsure about its future route. The asset has been caught in a protracted downtrend, persistently setting new lows and reinforcing the bearish sentiment throughout the market.

At the moment, Ethereum is buying and selling at bear market costs with little to no indicators of a sustainable restoration. Because the market construction weakens, many traders anticipate ETH to drop even additional. Analyst Martinez has highlighted a regarding growth, noting that Ethereum seems to be breaking down from a parallel channel that has contained worth for months. ETH might be on monitor for a pointy transfer towards $1,250, a stage that will sign a deeper market collapse.

A drop to $1,250 wouldn’t solely reinforce Ethereum’s bearish outlook but in addition function a key sign for a broader market breakdown. This state of affairs might result in panic promoting throughout the board, dragging different main property decrease and confirming an prolonged bear market. Regardless of occasional worth swings, Ethereum stays at a crucial juncture, with bulls struggling to reclaim key assist ranges. Until ETH can reclaim misplaced floor and set up a powerful assist base, the danger of additional draw back stays excessive.

Associated Studying

With Ethereum failing to indicate energy amid market volatility, traders stay cautious, anticipating cheaper price ranges earlier than any significant restoration can happen. The approaching days will likely be essential in figuring out whether or not ETH can stabilize or if Martinez’s $1,250 goal will turn out to be a actuality, confirming the bearish outlook for the complete crypto market.

ETH Testing Vital Demand Degree

Ethereum is buying and selling at $2,090 after a interval of weak worth motion, marking a 30% decline since February 24. This important drop has left traders questioning whether or not ETH can keep its long-term bullish construction or if a deeper correction is imminent.

At the moment, Ethereum is at a crucial assist stage that should maintain to maintain any hope of a bullish continuation. A breakdown under this stage would probably verify a bear market state of affairs, pushing ETH towards cheaper price ranges as promoting strain intensifies. The uncertainty surrounding Ethereum’s worth motion has left merchants cautious, as any additional weak point might speed up the decline.

Nonetheless, a restoration stays doable if ETH can reclaim the $2,500 resistance stage. Such a transfer would sign renewed shopping for momentum and will spark a powerful restoration, probably reversing the current bearish pattern. If Ethereum manages to flip $2,500 into assist, it could point out renewed confidence within the asset and set the stage for greater worth targets.

Associated Studying

For now, all eyes are on Ethereum’s capability to defend $2,090. The approaching days will likely be essential in figuring out whether or not ETH can stabilize or if the market is heading towards a extra extended bearish part.

Featured picture from Dall-E, chart from TradingView