- Shopping for quantity within the derivatives market has surged to its highest level of the 12 months.

- The technical chart indicated that Ethereum has the potential to achieve the $3,440 degree if shopping for momentum persists.

Ethereum’s [ETH] present worth degree of $2,732 follows a month-long decline of 16.15%, steering the market within the bears’ favor.

Nonetheless, early indicators of a possible reversal are rising, as ETH closed the previous week with a 2.08% acquire.

The surge in shopping for quantity within the derivatives market and the technical sample on the chart may play a significant function in ETH establishing a brand new market excessive.

Shopping for quantity reaches a brand new excessive

On the time of writing, the Taker Purchase Promote Ratio—a metric used to find out market sentiment by indicating whether or not shopping for stress (above 1) or promoting stress (under 1) is dominant—exhibits that patrons are in management.

At the moment, this ratio has reached its highest level of the 12 months, with a studying of 1.13, that means patrons out there are extra aggressive as they purchase extra of the asset.

The Funding Fee, one other key metric for gauging sentiment within the derivatives market, confirms this pattern. It at the moment reads 0.0050%, indicating that purchasing exercise is predominant.

The Funding Fee measures which facet of the market is paying the premium. When optimistic, as is the case with ETH for the time being, it means that longs are paying the premium to take care of their positions, reflecting rising confidence within the asset.

This confidence, as noticed by AMBCrypto, may translate into a significant worth swing for ETH, doubtlessly pushing it to the $3,440 degree as a bullish sample types on the chart.

Is a significant rally in sight for ETH?

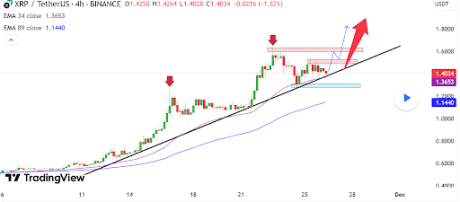

On the chart, ETH was approaching the higher resistance degree of the symmetrical channel it’s buying and selling in. This sample types when assist and resistance ranges converge, signaling a interval of market accumulation.

When the value breaches this degree, it sometimes marks the start of a collection of successive rallies. Nonetheless, if ETH breaks via this resistance degree, it’ll encounter one other key resistance at $2,798.34, which may quickly gradual the rally.

If shopping for momentum stays robust, ETH may surpass this resistance degree and commerce considerably larger, reaching $3,442—a 23.06% rally.

In any other case, ETH might proceed consolidating inside the symmetrical triangle, doubtlessly making one other breakout try later.

Liquidity move surges

In accordance with Artemis, Chain Netflow—a metric used to evaluate liquidity inflows and outflows inside the ecosystem—signifies a large surge in Ethereum liquidity.

Over the previous seven days, whole Netflow stands at $100.7 million, that means extra inflows than outflows throughout this era.

A key takeaway from this pattern is that market sentiment stays decidedly bullish, making a significant rally solely a matter of time.