- Ethereum’s netflow sample may see hike in promoting strain within the coming days

- Knowledge from derivatives market revealed that taker quantity highlighted bearishness out there

Ethereum [ETH] noticed a ten% value bounce since Tuesday’s lows. Such a bounce forward of the U.S. Fed Meeting appeared ominous, however there have been no surprising revelations. The financial development has been slower than anticipated for the present yr, with the identical anticipated for subsequent yr. Additionally, the Federal Reserve signaled two fee cuts this yr, with a extra unsure outlook.

This isn’t horrible information for the crypto market, with Bitcoin [BTC] bouncing to $87.5k earlier than seeing a 1.86% retracement at press time. Ethereum was down 2.36% from its earlier day’s excessive at $2,069. In reality, a latest report famous that Ethereum’s network activity was at its lowest in 2025 – A warning signal for traders.

Piecing collectively the clues for Ethereum

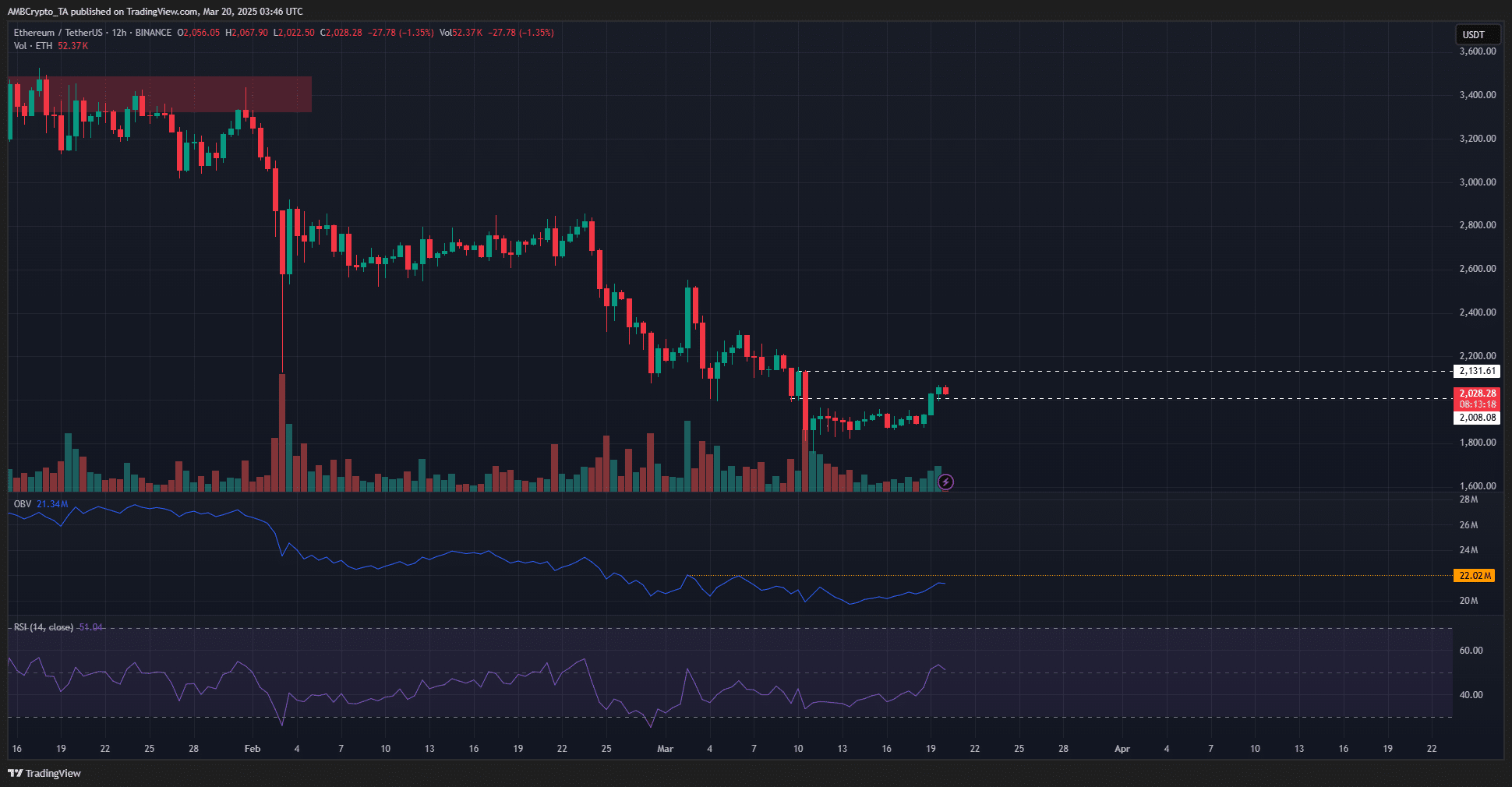

On the 1-day chart, ETH maintained a powerful bearish trajectory. The OBV was beneath native highs, though the RSI appeared to sign a bullish shift. The transfer past $2k gave the impression to be a press release, however it is also a liquidity hunt.

Given the construction, it could be seemingly that the value would head decrease as soon as once more. The shopping for quantity essential to drive a bullish construction shift was not but right here, in response to the OBV. Market sentiment was additionally broadly fearful at press time.

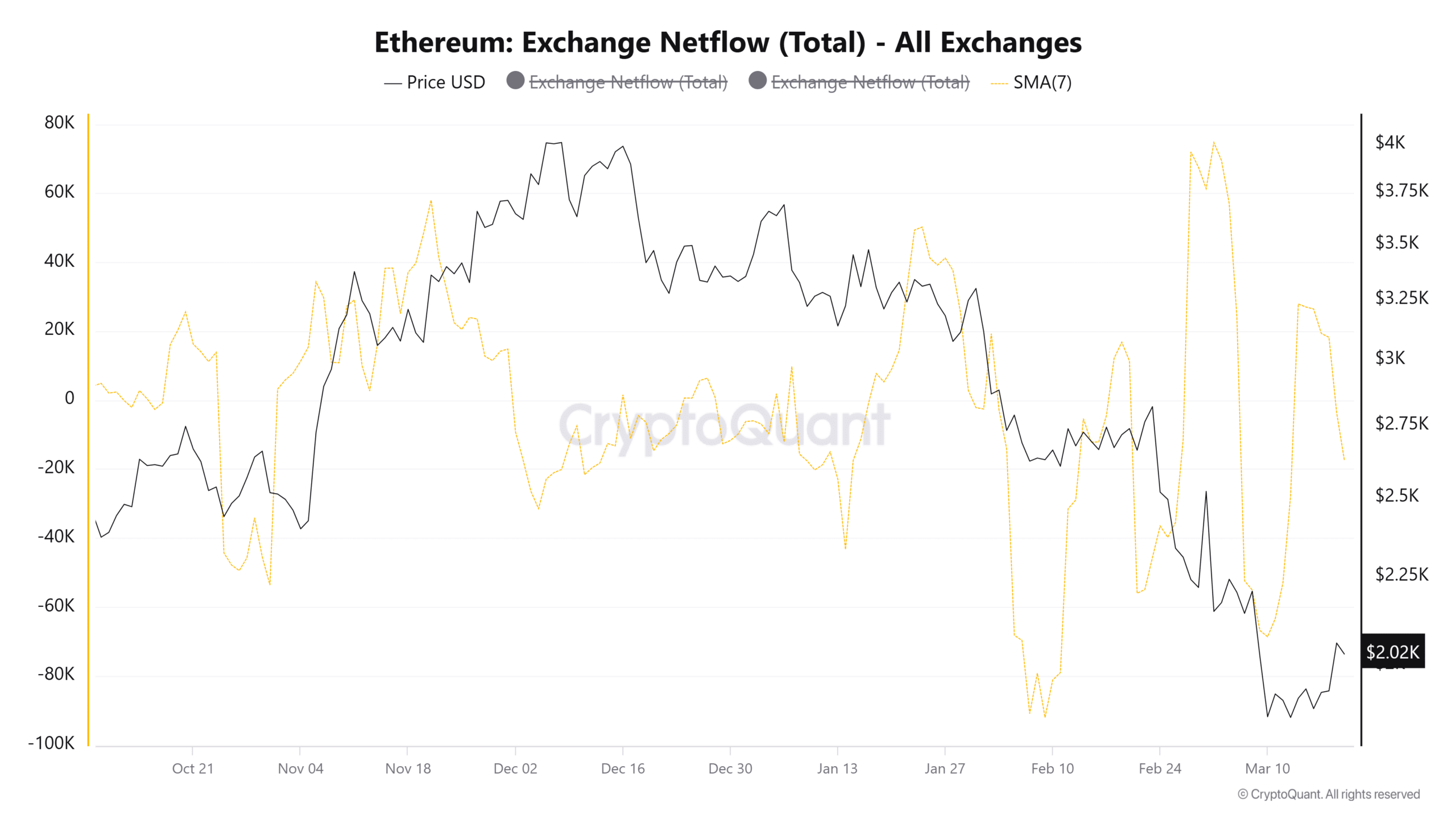

Supply: CryptoQuant

Trade netflows observe the circulate of ETH into and out of all exchanges. It’s the distinction between inflows and outflows, and the 7-day shifting common to clean out variance. Larger inflows suggest extra promoting strain, whereas hike in outflows suggest accumulation amongst market members.

Since mid-January, there have been 4 notable spikes in ETH inflows to exchanges. Native peaks in netflows have been seen on 24 January, 19 February, 3 March, and 14 March.

The primary three spikes have been adopted by a pointy value drop inside just a few days. The early March inflows occurred throughout Ethereum’s drop from $2.8k to $1.8k.

If this sample repeats itself, the troubles from the value motion entrance are much more prone to be appropriate. Bears may provoke one other value drop within the coming days.

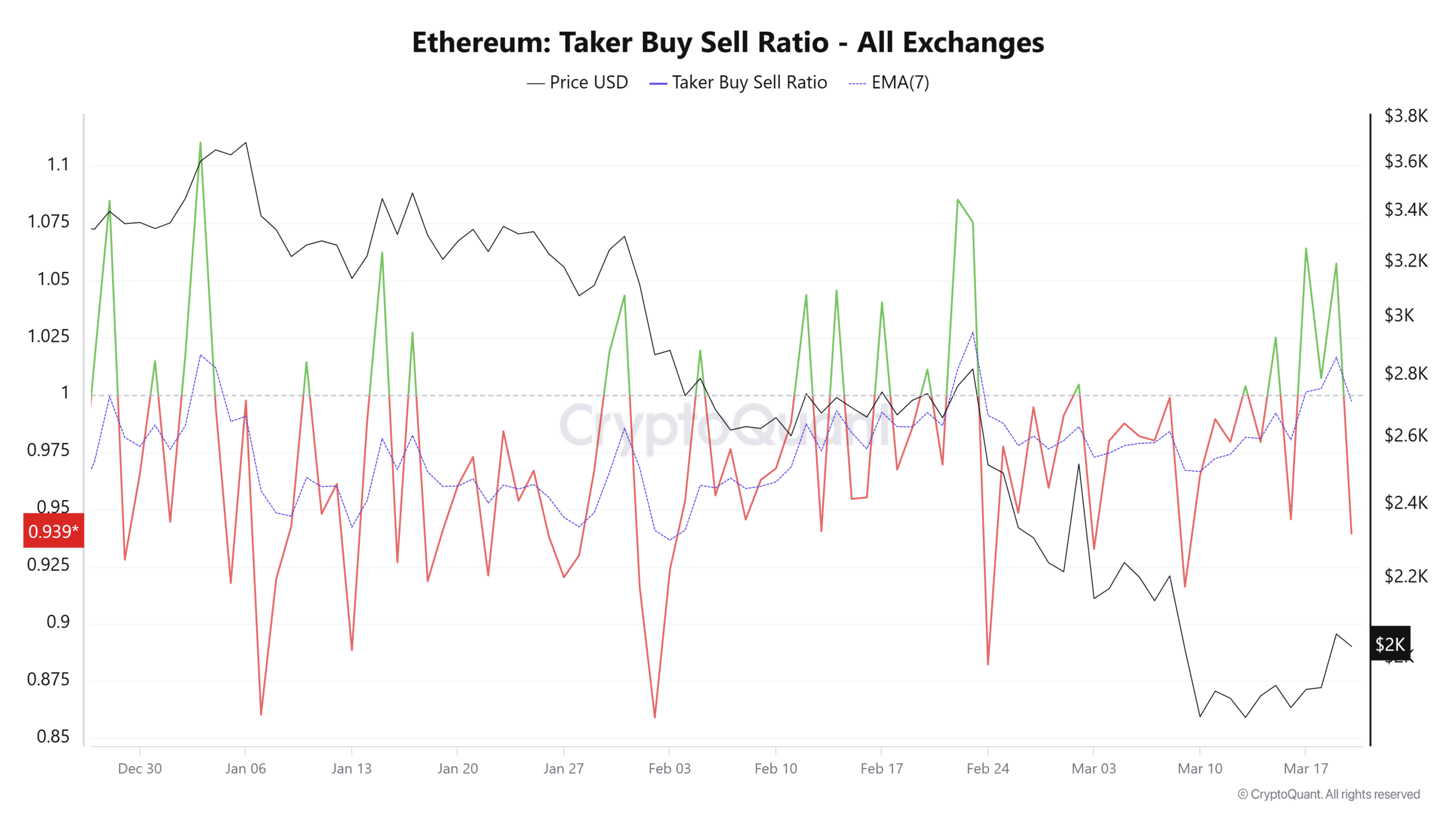

Supply: CryptoQuant

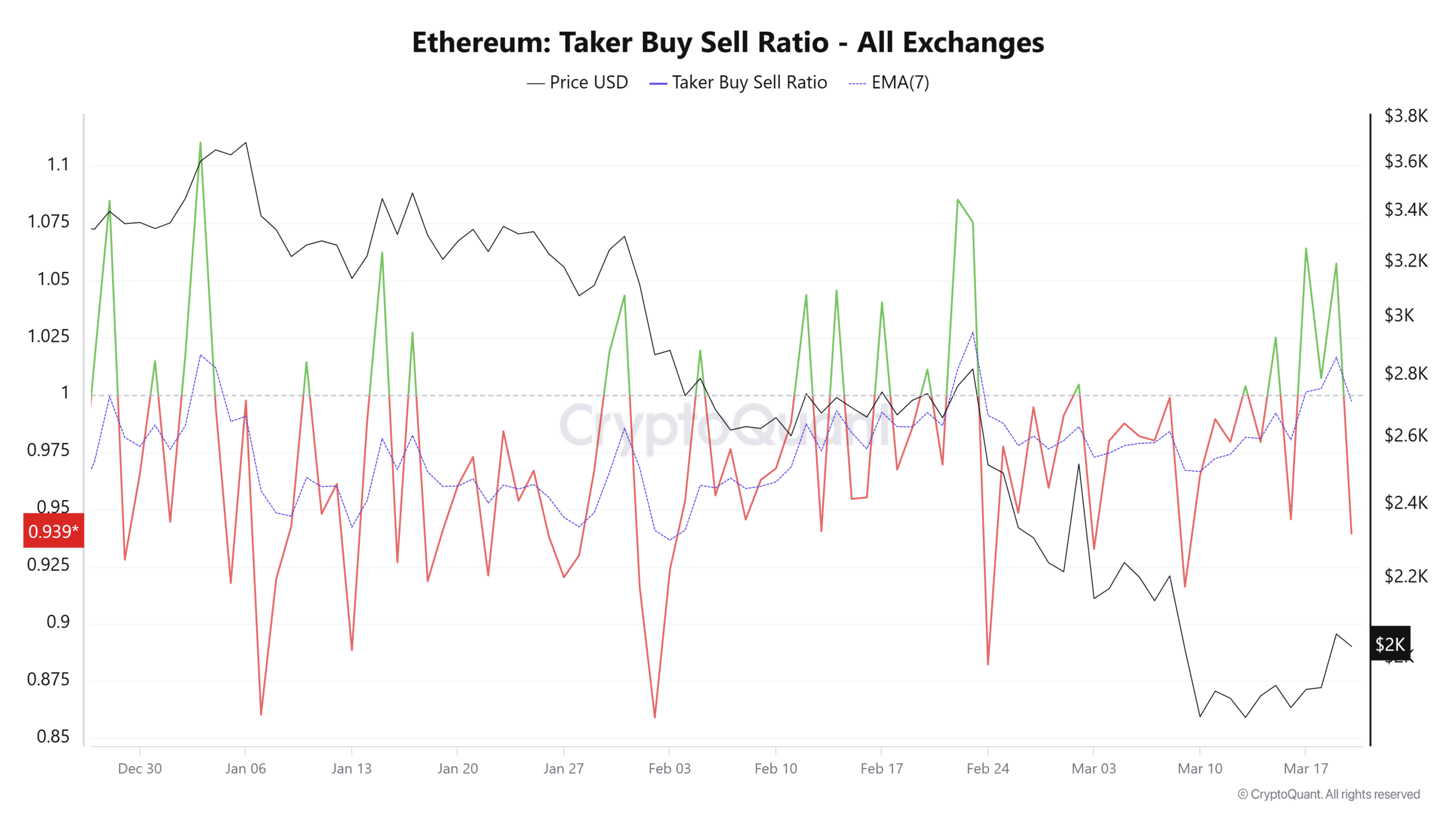

The taker purchase/promote ratio measured the taker (market order) purchase quantity to promote quantity in perpetual trades. A ratio over 1 meant taker purchase orders have been dominant – Indicating bullish sentiment.

Over the previous three weeks, bearishness has been prevalent. The taker ratio confirmed promoting strain was stronger. It started to vary over the previous two days, which in flip noticed the 7-EMA (purple) climb above 1.

This ascent was short-lived although. At press time, the 7-EMA of the taker ratio was destructive as soon as once more, outlining the potential of a value drop. Mixed with the clues from the value motion and the trade netflows, it could be seemingly that Ethereum would fall to $1,750 or decrease.