- ETH weekly recap reveals the sharpest decline since FTX days.

- Leveraged liquidations might have had a powerful hand in ETH’s efficiency.

Ethereum [ETH] has skilled fairly the roller-coaster of risky worth motion within the final 7 days. The end result has crashed the little bullish optimism that had began to manifest on the finish of July, so let’s check out how ETH fared.

ETH was bullish total in July, regardless of the slight pullback noticed within the final week. This was adopted by a short-lived restoration try thwarted by a strong wave of promote stress that prevailed final week.

ETH tanked consecutively for the final 7 days, for an total 36.59% drop.

The final time that ETH skilled such a speedy decline in a brief interval was in June in the course of the FTX collapse in 2022. ETH traded at $2,277 at press time.

The latest wave of promote stress triggered issues that we would witness extra draw back within the subsequent few weeks. Whereas a extra bearish consequence is possible, it’s also potential that the bulls might regain management.

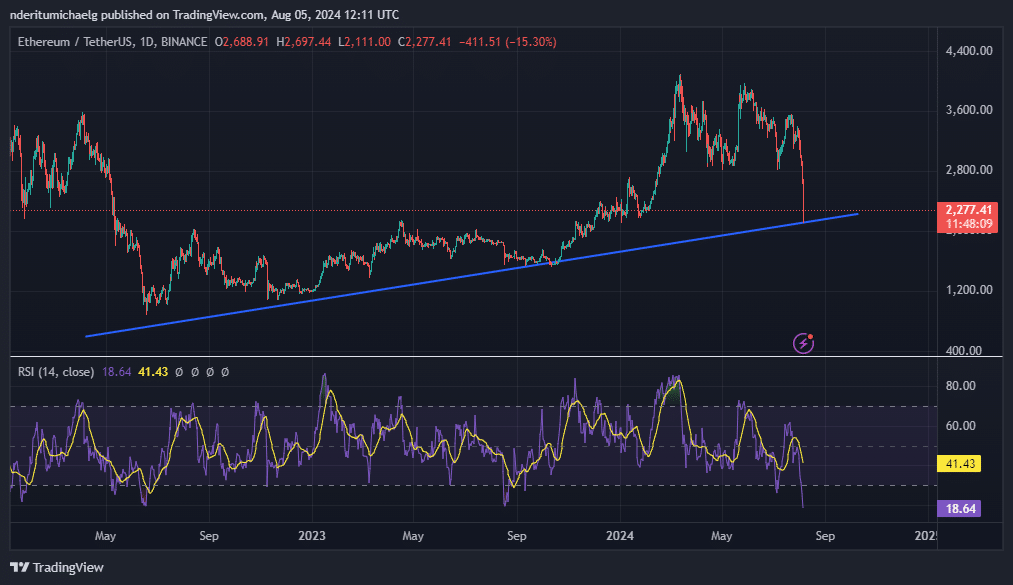

In ETH’s case there have been a number of indicators pointing in direction of a possible restoration. For instance, the worth received extraordinarily oversold in response to the RSI.

Second, the latest huge pullback retested a significant ascending assist degree, triggering some accumulation. ETH had already bounced again by 5% from this assist degree.

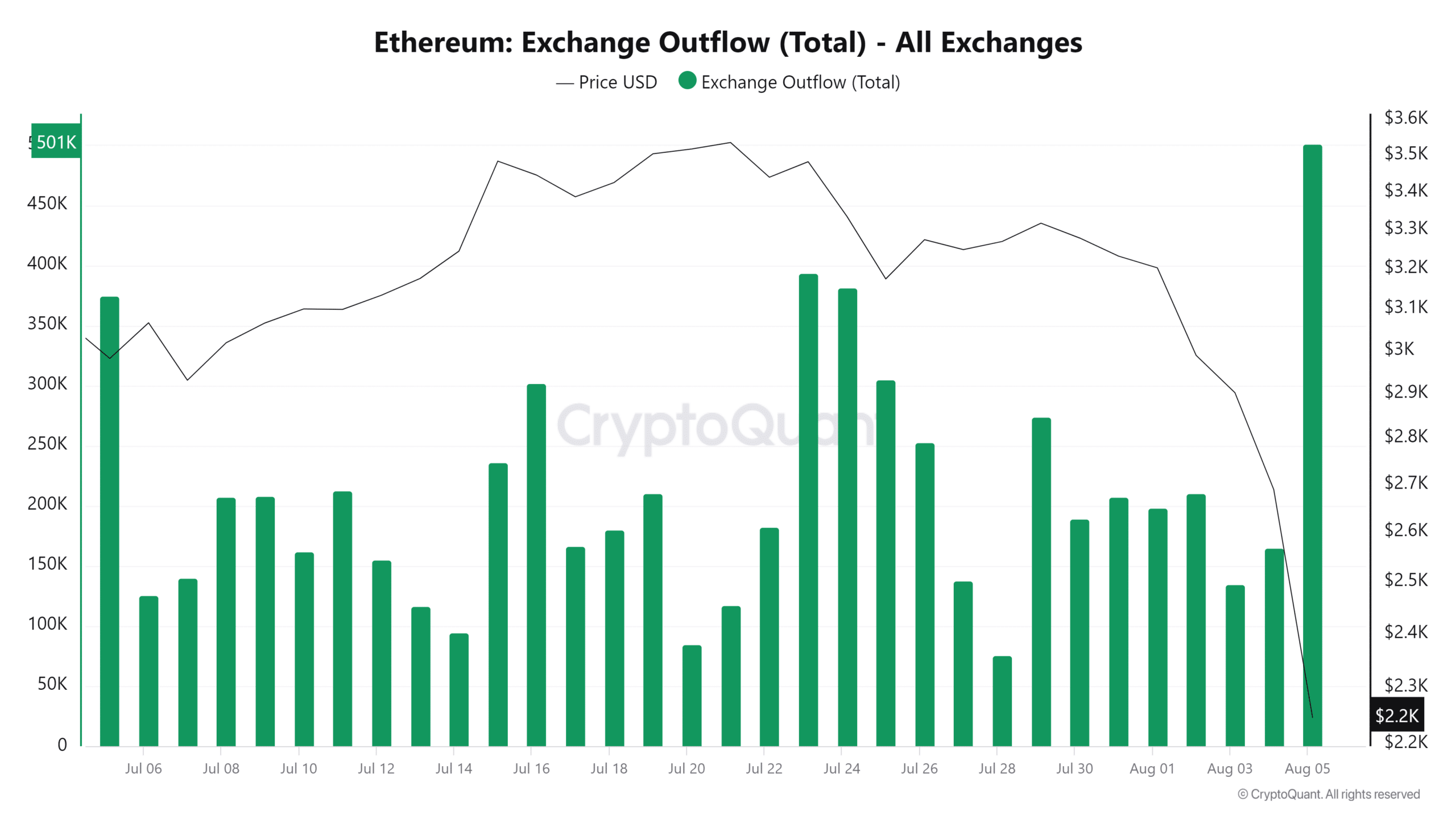

Ethereum change flows additionally revealed some fascinating findings. Over 501,000 ETH was moved out of exchanges within the final 24 hours. This was the very best quantity of ETH that flowed out of exchanges in a single day throughout the final 30 days.

For distinction, there was a complete 446,877 ETH in change inflows that befell throughout the identical interval. This was additionally the very best inflows recorded within the final 30 days.

This implies ETH had greater outflows than inflows by roughly $119 million in greenback worth.

The change flows knowledge might point out a requirement restoration at discounted costs. ETH might obtain a big bounce again if the promote stress will get hosed down.

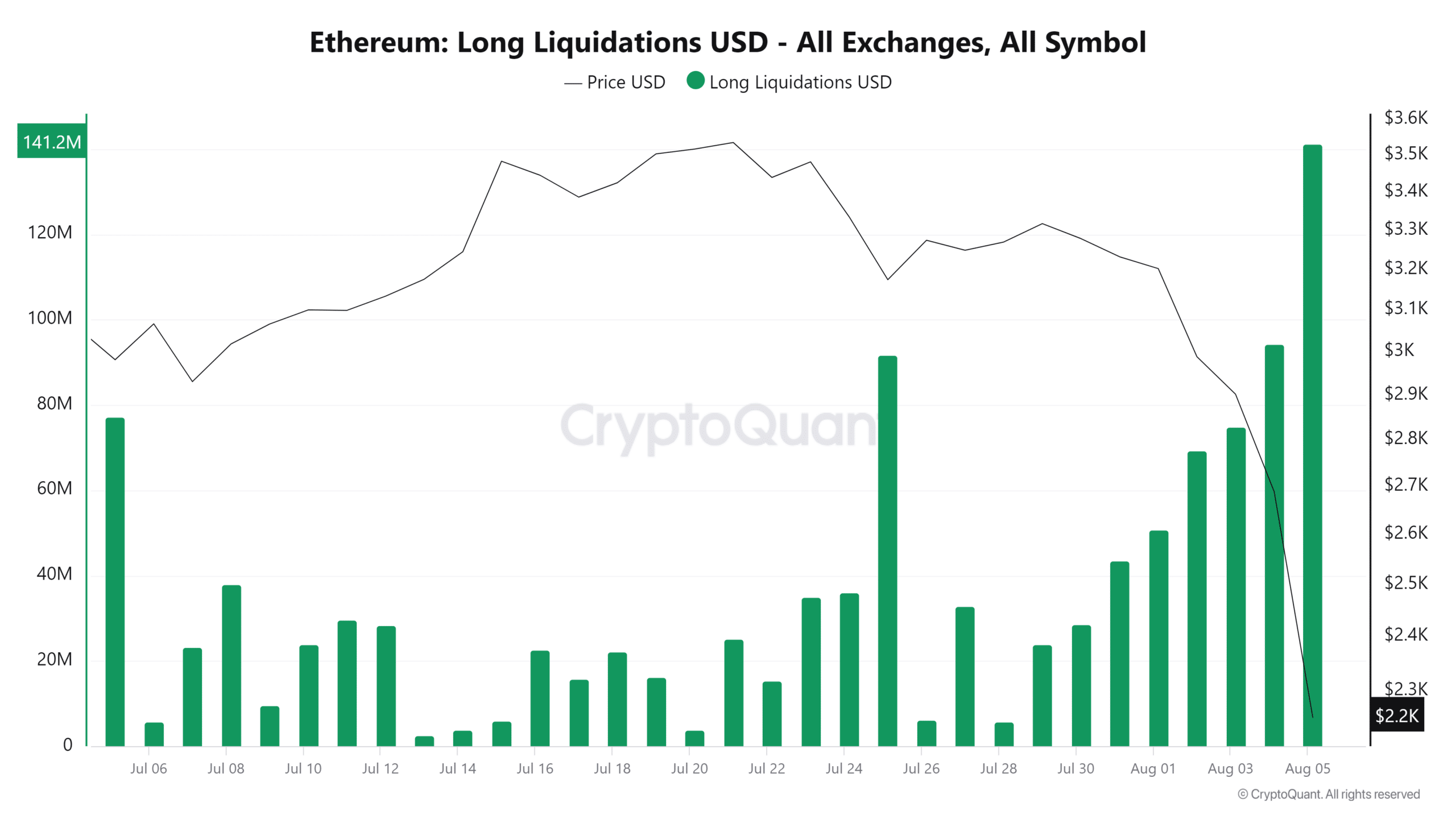

Derivatives knowledge revealed that lengthy liquidations additionally peaked within the final 24 hours. The overall lengthy liquidations amounted to $141.2 million within the final 24 hours. The best single-day liquidations recorded within the final 30 days.

The overall shorts liquidations within the final 24 hours have been a fraction at $35.5 million. Margin calls of leveraged longs might have contributed to the extra draw back noticed within the final 24 hours.

Learn Ethereum (ETH) Price Prediction 2024-25

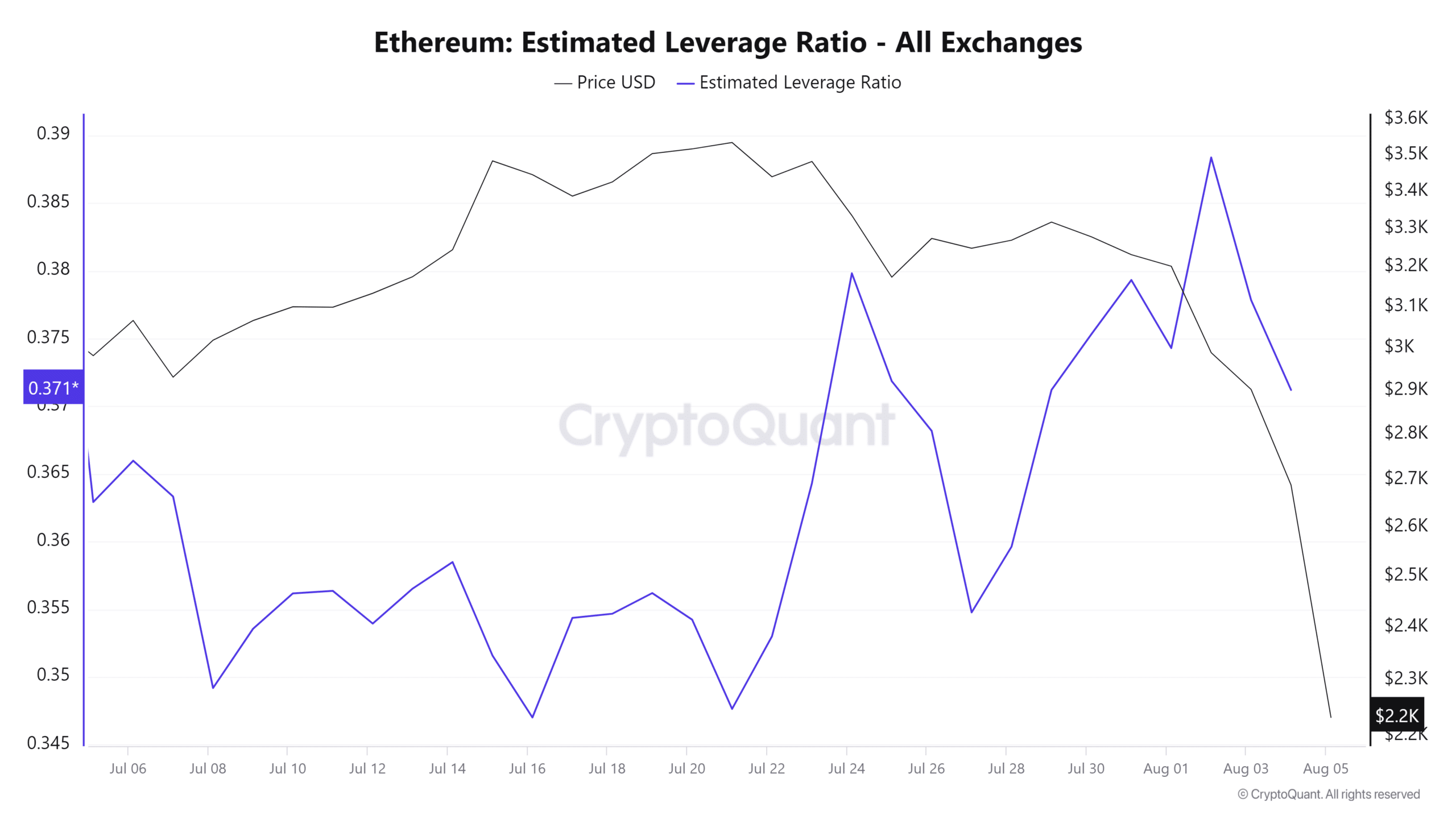

This will have additionally contributed to the extra volatility contemplating that urge for food for leverage went up within the final week, therefore many leveraged positions.

It’s possible that volatility will cut back now that the markets have been deleveraged by latest margin calls. Nonetheless, the potential for robust demand or continued promote stress might hinge on exterior market elements.