- Ethereum spot ETFs noticed $104M inflows, pushing complete property to $6.14 billion.

- Bitcoin ETFs led by BlackRock’s IBIT gained $422.5M, displaying stronger institutional curiosity.

Ethereum [ETH] ETFs noticed modest exercise on the first of Could, with complete web inflows reaching $6.5 million, in response to data from Farside Buyers.

Ethereum ETF replace

Constancy’s Ethereum Fund (FETH) was solely liable for the constructive momentum, recording $6.5 million in recent inflows.

In distinction, Grayscale’s Ethereum Belief (ETHE) skilled $12 million in outflows, offsetting the $12 million that entered Grayscale’s newly launched spot Ethereum ETF (ETH).

Different Ethereum ETFs remained flat, displaying no fund actions for the day.

What about Bitcoin ETF?

On the identical day, spot Bitcoin [BTC] ETFs witnessed a outstanding surge in investor curiosity, drawing in a combined $422.5 million in inflows.

Main the pack was BlackRock’s IBIT, which alone attracted $351.4 million, underscoring its dominance within the house.

Grayscale’s newly launched Bitcoin ETF adopted with $41.9 million, whereas Bitwise’s BITB secured $38.4 million in recent capital.

Constancy’s FBTC added $29.5 million, and VanEck’s providing drew $21.9 million. Even Grayscale’s legacy GBTC, regardless of earlier outflows, managed to tug in $16 million.

Franklin’s EZBC and Invesco’s BTCO additionally contributed with $10.6 million and $8.72 million, respectively, whereas different funds remained stagnant.

This sharp distinction to Ethereum ETF flows alerts continued robust institutional confidence in Bitcoin-backed merchandise.

Ethereum vs. Bitcoin worth replace

The ETF inflows got here as Bitcoin traded at $96,850.00, marking a 0.72% achieve over the earlier 24 hours. Ethereum additionally noticed modest upward momentum, rising 0.18% to commerce at $1,834.35.

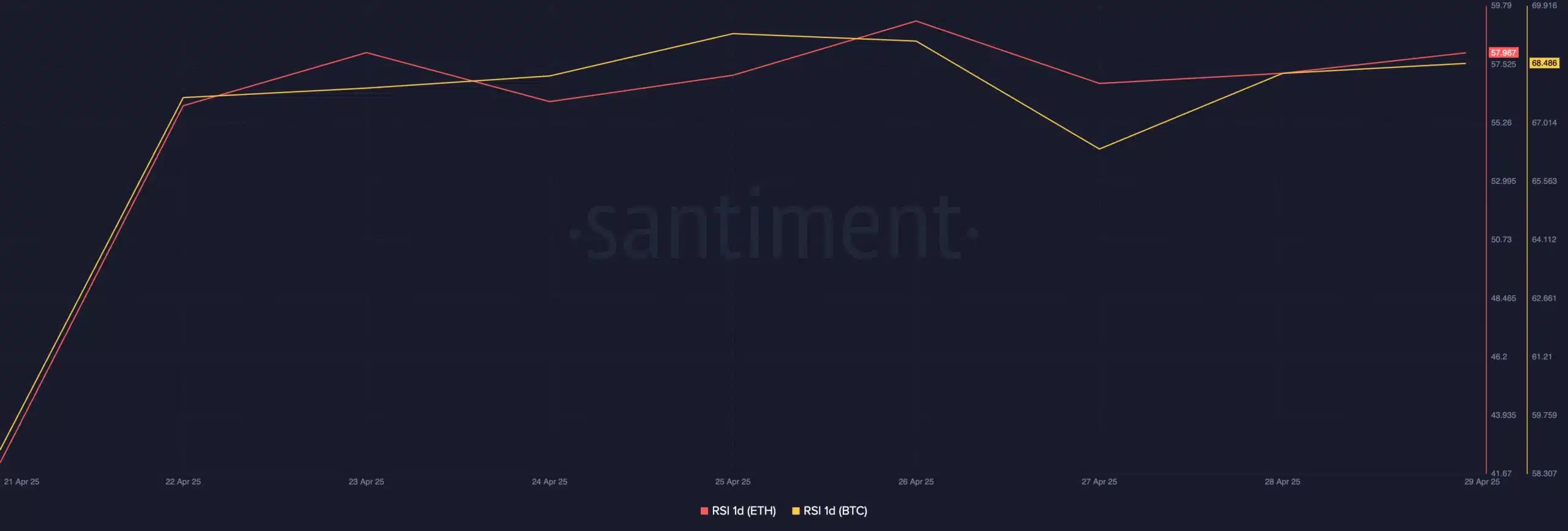

Technical indicators mirrored this bullish sentiment, with the Relative Power Index (RSI) for each property hovering across the 57 mark, usually an indication of accelerating shopping for strain.

The present positioning of the RSI means that bullish momentum is gaining floor, signaling rising investor confidence within the short-term trajectory of each Bitcoin and Ethereum.

What’s extra?

In reality, just lately, Ethereum spot ETFs witnessed a big uptick in demand, drawing in a notable $104 million in web inflows over the previous 24 hours, in response to SoSoValue knowledge.

This pushed the entire web asset worth of ETH ETFs to a powerful $6.14 billion, with a web asset ratio of two.83%.

The cumulative historic inflows have now climbed to $2.4 billion, signaling robust institutional curiosity. If this momentum continues, Ethereum could possibly be on monitor to retest the $2,000 stage.

Nonetheless, any strategic profit-taking by sellers may set off a draw back transfer, doubtlessly pulling ETH again towards the $1,730 assist vary.