Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

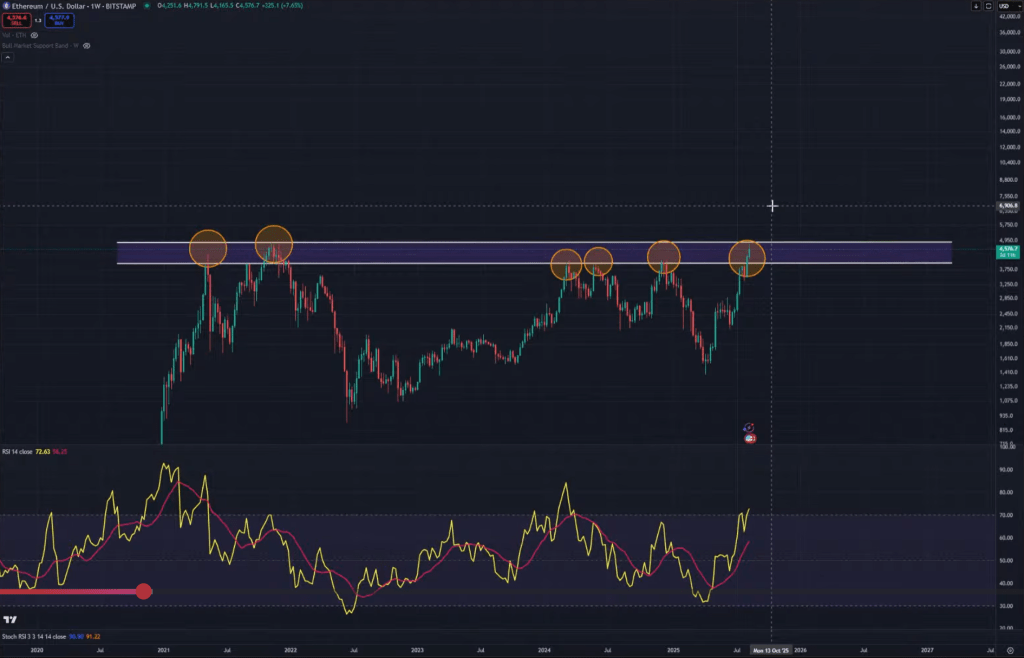

Ethereum has run straight into its four-year ceiling, with value motion urgent the $4,700 band that Kevin (@Kev_Capital_TA) repeatedly calls “the extent that decides all the things.” His newest broadcast frames ETH’s setup as binary: both a decisive break by means of this resistance — confirmed by a clear weekly shut and a break of the down-trending weekly RSI line — or one other rejection that extends a months-long sample of weakening rallies.

Ethereum Teeters at $4,700 — Breakout Oor Massacre?

“The catch-up is over,” Kevin said, noting ETH has “lastly caught as much as mainly the place Bitcoin is at… it’s at its main resistance.” In his learn, the $4,700 space shouldn’t be a single tick however a provide zone outlined by the prior cycle’s peak and bolstered by a “weekly downtrend on the RSI” that has capped each advance since early 2024. “Break resistance and the actual bull will start,” he added. Till that occurs, he characterizes this band because the “line within the sand.”

Momentum into the check was actual. Kevin described cash movement enhancing and “good patterns forming on some altcoins” — together with “textbook inverse head and shoulders” — earlier than the follow-through failed and ETH stalled right at resistance. He pointed to the Asia session’s lack of continuation and, extra forcefully, to a macro shock that hit because the market was leaning lengthy.

Associated Studying

That shock was the US Producer Value Index. “The PPI got here in considerably hotter than anticipated,” Kevin mentioned, emphasizing each the magnitude and the place the strain confirmed up: month-over-month +0.9% versus +0.2% anticipated, year-over-year 3.3% versus 2.5%, with core PPI +0.9% m/m versus +0.2% and three.7% y/y versus 3.0%.

In his view, this displays tariff-driven prices being “brunted by the producer,” which is why the spike surfaced in PPI slightly than CPI. The open query — and the danger to ETH at resistance — is whether or not these prices “trickle into the CPI” and, by extension, PCE. He underscored how shortly rate-cut possibilities whipsawed on the FedWatch software intraday: September nonetheless closely favored, October largely intact, and December “pricing out a 3rd price minimize” earlier than flipping again towards it because the day progressed. “This has been risky this morning… let it settle out,” he cautioned, including that next week’s Jackson Hole remarks from Chair Powell are the subsequent main macro catalyst.

Technically, Kevin’s guidelines for Ethereum doesn’t change with one information print. He stresses two confirmations: take out the horizontal provide round $4,700 with authority and “break the weekly downtrend on the RSI” to nullify the bearish divergence that has endured since Q1 2024. “Resistance is resistance till it’s not,” he mentioned. Fail there, and ETH dangers one other corrective leg as late longs are pressured out on the worst attainable spot. Succeed, and “the complete dialog modifications,” opening a path to what he calls a “actual bull” in ETH and, by knock-on impact, within the broader alt market.

Associated Studying

He ties ETH’s destiny to broader market construction with out diluting the main focus. Total2 — his ETH-plus-alts proxy — “got here as much as 1.69 trillion” in opposition to a well-telegraphed breakout set off at “1.72 trillion,” whereas tapping its personal weekly RSI downtrend. The shortcoming to push that previous few dozen billions alongside the PPI shock explains the abrupt reversal throughout ETH and alts. Kevin additionally flagged stablecoin dynamics and seasonal liquidity as background variables, noting USDT dominance stays elevated and that September “often” isn’t a fantastic month as conventional funds return from summer season, handle taxes, and put together for This autumn threat.

Operationally, he argues that the correct commerce location was behind us, not at resistance. “There’s no cause to be shopping for up in these loopy ranges,” he mentioned, advising persistence for anybody positioned from decrease. His framework is straightforward and strict: watch the weekly ETH chart, the $4,700 band, and the RSI trendline. If macro “stays regular,” he expects the break; if it deteriorates, he’ll reassess. Both means, the pivot received’t come from lower-timeframe noise however from ETH lastly resolving its four-year wall.

“Deal with these charts and nothing else,” Kevin concluded. For Ethereum, which means one check, one stage, and one sign: clear $4,700 and retire the divergence — or wait.

At press time, ETH traded at $4,619.

Featured picture created with DALL.E, chart from TradingView.com