- Ethereum dropped 22% regardless of Eric Trump’s endorsement and rising whale exercise.

- Whale shopping for spiked as giant traders positioned themselves within the face of a downtrend.

On the 4th of February 2025, Eric Trump made waves by endorsing Ethereum’s [ETH] on his X (previously Twitter) account, urging followers to purchase Ethereum.

Nevertheless, since then, Ethereum’s worth has dropped massively, by 22%. Regardless of this decline, a surge in whale exercise has been recorded, with 110,000 ETH being accrued in simply 72 hours.

Amid blended alerts, one does marvel: Are giant traders positioning themselves for a rebound, or is the market nonetheless on a downward trajectory?

Eric Trump’s endorsement and subsequent decline

The preliminary response to Trump’s endorsement was adopted by a short worth surge, however the rally rapidly fizzled out. Since then, Ethereum’s worth has dropped 22%, resulting in questions in regards to the lasting impression of his endorsement.

A number of components have contributed to the value decline. A major $1.5 billion hack of the Bybit change on the twenty fifth of February undermined investor confidence, triggering a broader market selloff.

Moreover, fading euphoria following President Donald Trump’s election, coupled with unmet expectations for a pro-crypto regulatory framework, has dampened market sentiment.

International financial uncertainties have additionally pressured Ethereum’s worth downward.

Whale accumulation: A vote of confidence or a tactical play?

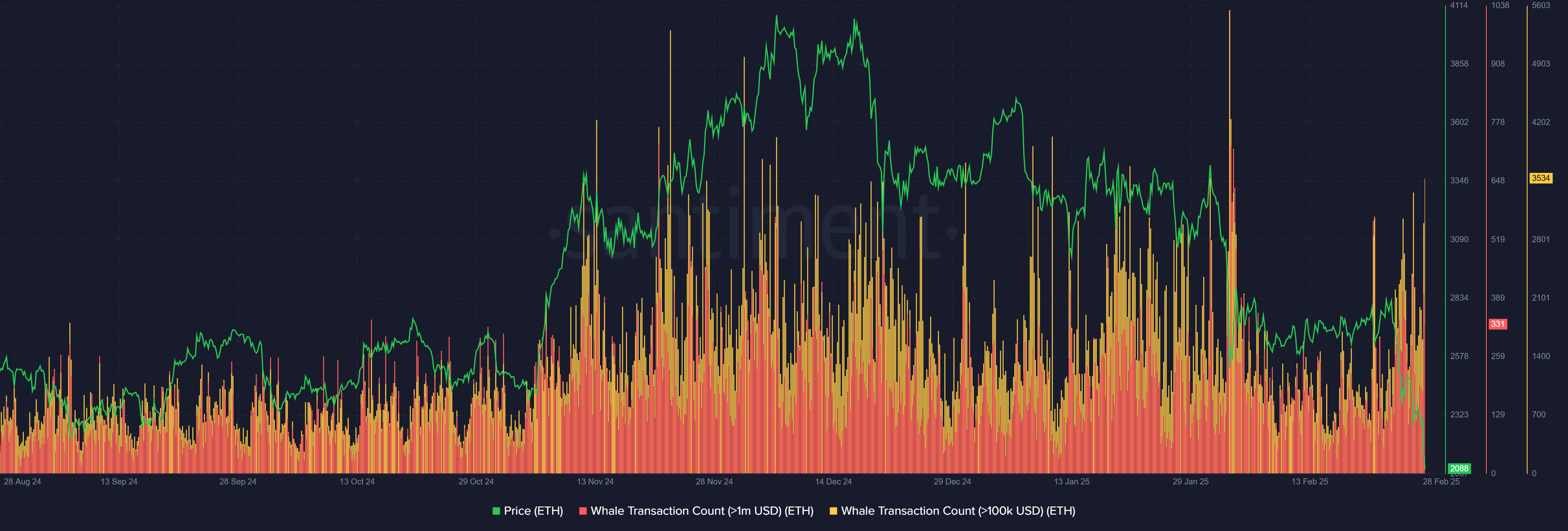

Regardless of Ethereum’s 22% drop, whale exercise has surged, with 110,000 ETH accrued in simply 72 hours. Santiment knowledge highlights a pointy improve in whale transactions.

This implies giant traders could also be positioning themselves for a rebound or capitalizing on discounted costs.

Traditionally, related accumulation phases have been adopted by robust recoveries, however not all the time.

As an illustration, heavy whale exercise in late December 2024 coincided with ETH’s peak, and mid-January noticed the same accumulation, which aligned with a short bounce.

If ETH holds the $2,100–$2,135 vary, this might reinforce bullish sentiment. Nevertheless, a sustained break under this degree may recommend that whales are securing liquidity earlier than a deeper correction.

Ethereum: Whale confidence vs. bearish momentum

Ethereum’s oversold RSI at 38.90 and a deepening MACD bearish crossover point out a protracted downtrend. The 50-day SMA at $2,929 stays considerably above Ethereum’s present worth of $2,109, reinforcing bearish strain.

If whales are shopping for to front-run a restoration, reclaiming the $2,200–$2,300 vary may validate a short-term bounce.

Retail traders ought to stay cautious. If ETH fails to carry key help, the following main demand zone lies round $1,900–$2,000.

Whale shopping for isn’t all the time a definitive bullish sign, particularly in a market-wide downturn. Retail traders ought to look ahead to affirmation of a development reversal earlier than following whale sentiment.