- Ethereum exhibits potential for a bullish reversal, with a uncommon every day bullish divergence and narrowing Bollinger Bands.

- Macroeconomic shifts and on-chain information might propel Ethereum’s value upward, regardless of current bearish momentum.

Ethereum [ETH] was exhibiting indicators of a value reversal at press time, with a bullish divergence rising on the every day timeframe. This marks the primary bullish divergence for ETH in over two years.

Michaël van de Poppe, a crypto analyst, lately noted,

“These are nice indicators on the markets, as $ETH has made its first bullish divergence within the every day timeframe in additional than two years.”

Nevertheless, he additionally posed the vital query:

“Will this be the precise reversal sign?”

Technical indicators sign doable value motion

Ethereum traded at $2,514.53 at press time, reflecting a 0.89% decline previously 24 hours and a 4.94% drop over the past week. Regardless of this current downturn, technical indicators are hinting at a possible shift.

The Bollinger Bands are narrowing, which frequently signifies {that a} important value motion might be on the horizon.

ETH was buying and selling under the center Bollinger Band at press time, suggesting that the asset was nonetheless beneath bearish momentum.

The Transferring Common Convergence Divergence (MACD) indicator confirmed that the MACD line remained under the sign line, with each trending in damaging territory.

Whereas this advised ongoing bearish strain, the histogram revealed a slight weakening, which might point out the early phases of a doable reversal or consolidation.

At press time, the Relative Energy Index (RSI) was at 39.7, inserting it within the oversold territory.

Thus, whereas promoting strain stays, there could also be a chance for consumers to re-enter the market, probably resulting in a short-term bounce.

Macroeconomic influences

Macroeconomic components might additionally play a vital position in Ethereum’s potential value surge.

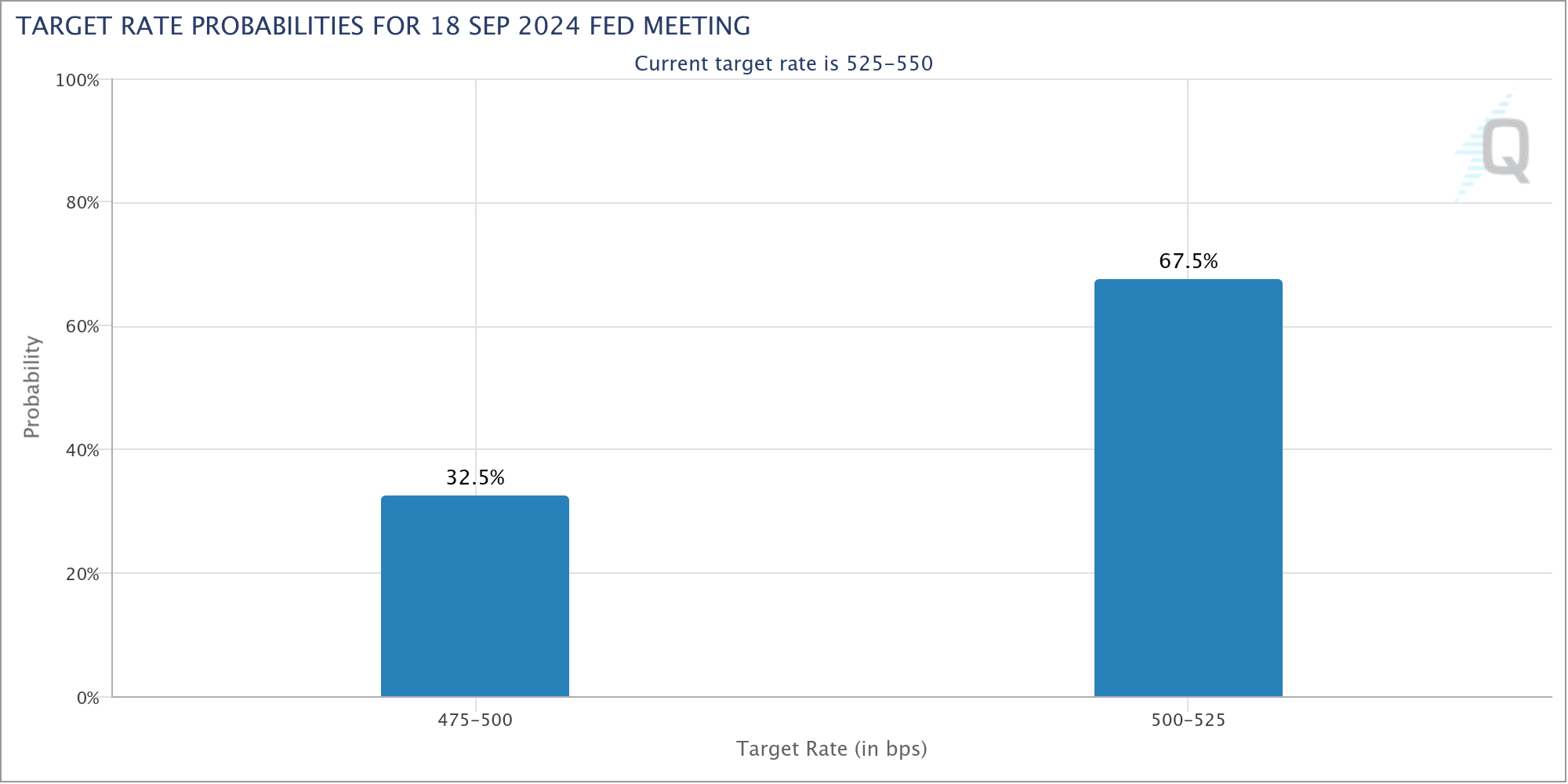

The Federal Reserve is predicted to chop rates of interest in September and probably proceed with additional reductions, pushed by slowing inflation and financial uncertainty.

A discount in rates of interest sometimes makes riskier belongings like cryptocurrencies extra enticing, because the enchantment of safe-haven belongings such because the U.S. greenback diminishes.

Traditionally, fee cuts have led to elevated capital inflows into the crypto market, as buyers search larger returns in different belongings.

Given Ethereum’s established ecosystem and its rising adoption, the crypto might be a major beneficiary of this shift in investor sentiment.

A dovish stance from the Federal Reserve might weaken the U.S. greenback, offering additional upward strain on ETH’s value.

Ethereum’s progress prospects

On-chain information additionally supported a constructive outlook for Ethereum. Based on DefiLlama, the Complete Worth Locked (TVL) in Ethereum-based decentralized finance (DeFi) protocols was $46.966 billion at press time.

Moreover, the community noticed a 24-hour transaction quantity of $1.13 billion, with inflows of $2.44 million.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

The variety of lively addresses within the final 24 hours was 390,291, alongside 64,793 new addresses, highlighting continued person engagement and community exercise.

So, there’s sustained curiosity within the Ethereum community, which might assist the asset’s value within the coming months.