- ETH’s change outflows totaled $4 billion in Q1 of 2024

- MVRV ratio prompt the coin was buying and selling barely under its realized worth

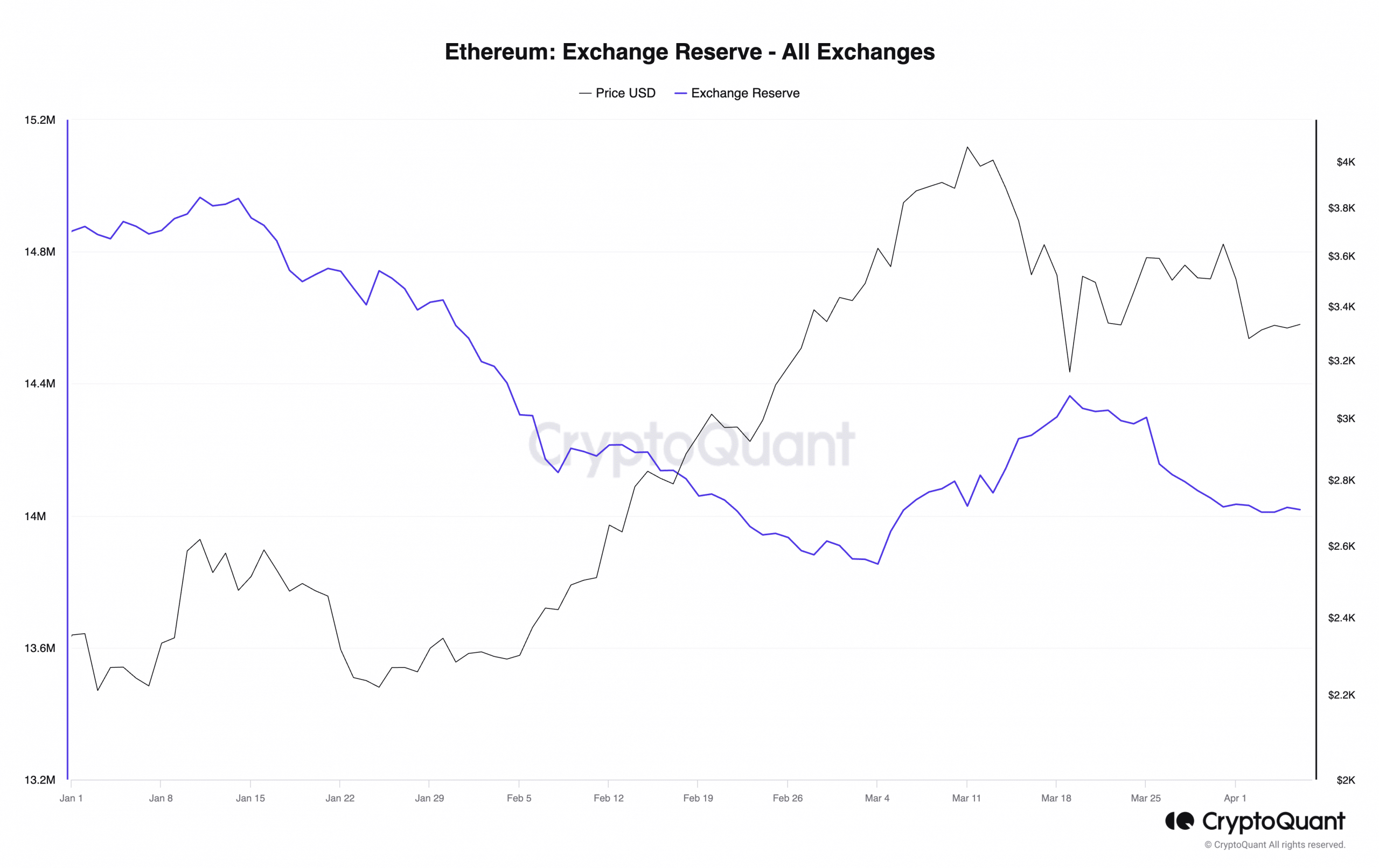

Based on data launched by IntoTheBlock, Ethereum [ETH] outflows from cryptocurrency exchanges totaled $4 billion within the first quarter of the yr. This alerts a surge in coin accumulation by market members over the 90-day interval, regardless of the ten% decline in ETH’s worth after it peaked at $4065 on 11 March.

The altcoin’s rally above $3500 in direction of $4000 between 4 and 19 March triggered a wave of sell-offs. This contributed to a hike in its change reserves, with a year-to-date (YTD) evaluation of the coin’s reserves revealing a 5% decline.

This decline confirmed that ETH accumulation considerably outpaced distribution through the quarter.

ETH on-chain in Q1

Between January and March, the variety of ETH pockets addresses holding between 100 and 100,000 cash fell by 2%, in line with Santiment. This underlined a decline in ETH holding by its investor cohort, identified to be market movers.

At press time, 45,623 pockets addresses held between 100 and 100,000 ETH. These addresses at the moment maintain 36% of ETH’s circulating provide.

Conversely, through the interval below assessment, the variety of shrimp addresses holding between zero and 100 ETH cash climbed. As of 31 March, their quantity was 118.25 million, up 6% through the yr’s first quarter. On the time of writing, this class of ETH holders managed 10% of the coin’s provide.

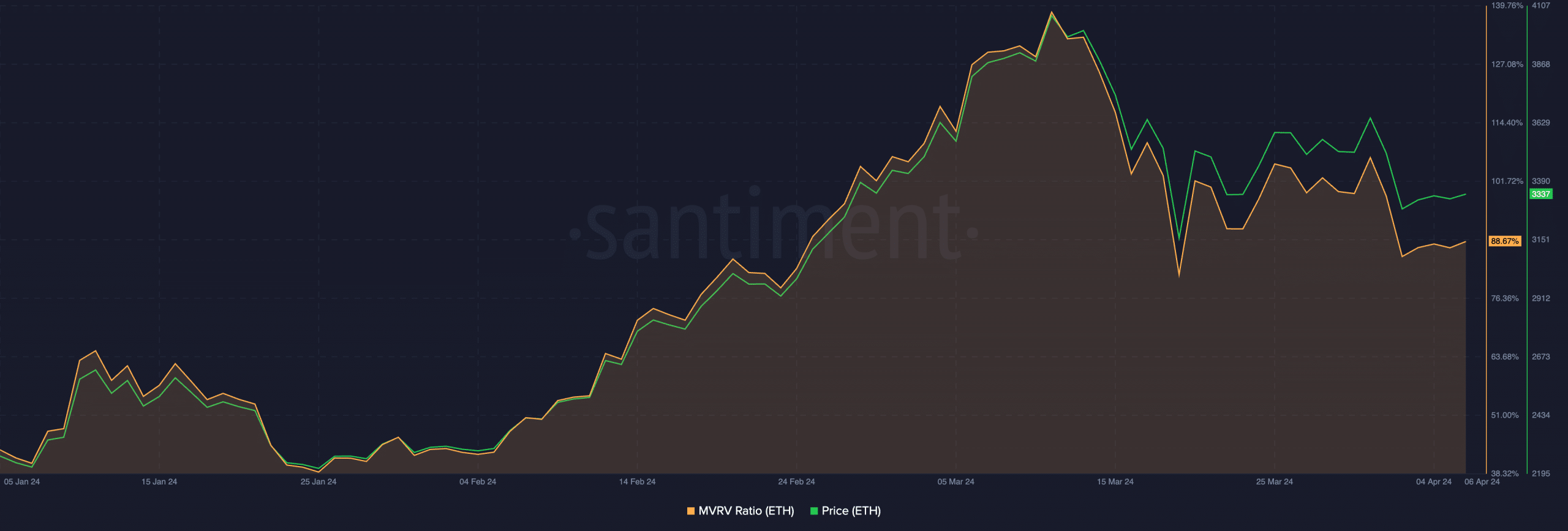

Additionally, the surge in ETH’s worth above $3500 in Q1 led to a spike in its Market Worth to Realised Worth (MVRV) ratio.

Learn Ethereum’s [ETH] Price Prediction 2024-25

This metric measures when an asset is overvalued or undervalued. When its ratio is excessive and on an uptrend, it means that an asset’s market worth has exceeded its realized worth. When this occurs, most asset holders will likely be in revenue.

Conversely, when an asset’s MVRV ratio declines, it’s deemed to be undervalued relative to its realized worth. Traders who select to promote their holdings at this level through the market cycle usually accomplish that at a loss.

ETH’s worth rally to $4000 on 11 March pushed its MVRV ratio to a YTD excessive of 138.38%.

Though ETH’s MVRV ratio additionally declined after its worth fell from its peak, it closed the quarter with a worth of 107%. Under 100% at press time, ETH’s MVRV ratio confirmed its worth was barely under the typical worth at which all cash had been final moved on-chain