- Ethereum appeared to have a bearish market construction on a number of timeframes

- Bears haven’t slowed down their promoting, and ETH might fall in the direction of $1.6k subsequent

Ethereum [ETH] has fallen by 11.8% over the previous week, with technical evaluation revealing that market bears haven’t weakened. In actual fact, ETH whale transfers to exchanges underlined the bearish market sentiment.

On the time of writing, ETH bulls have been swimming in opposition to the tide, and the prospect of additional losses was rising extra seemingly.

Ethereum sinks beneath early March help

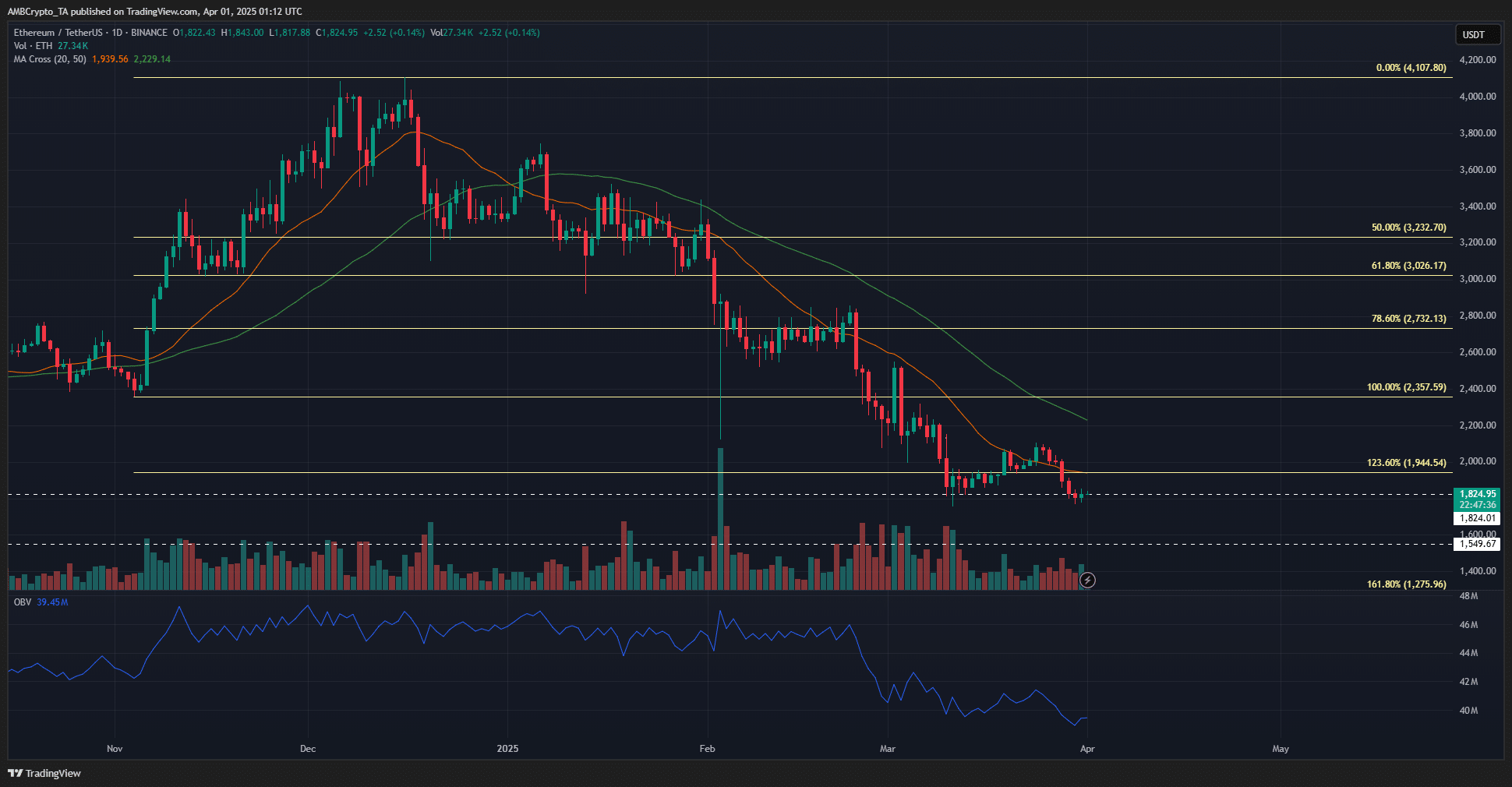

Ethereum had a strongly bearish outlook on the 1-day timeframe. It was once more beneath the 20-day transferring common and has been for many of 2025. The transferring averages confirmed the bearish momentum didn’t decelerate both.

Neither did the promoting strain ease as ETH fell beneath the $2,000-psychological stage. The OBV made decrease highs and decrease lows and made a brand new decrease low on 30 March. This signified a downtrend in progress on the OBV, and regular promoting strain on Ethereum.

The $1,824 and $1,550 help ranges from October-November 2023 can be the following value targets for ETH. Because it closed a 1-day buying and selling session beneath $1,824, the bears would seemingly have management of the area.

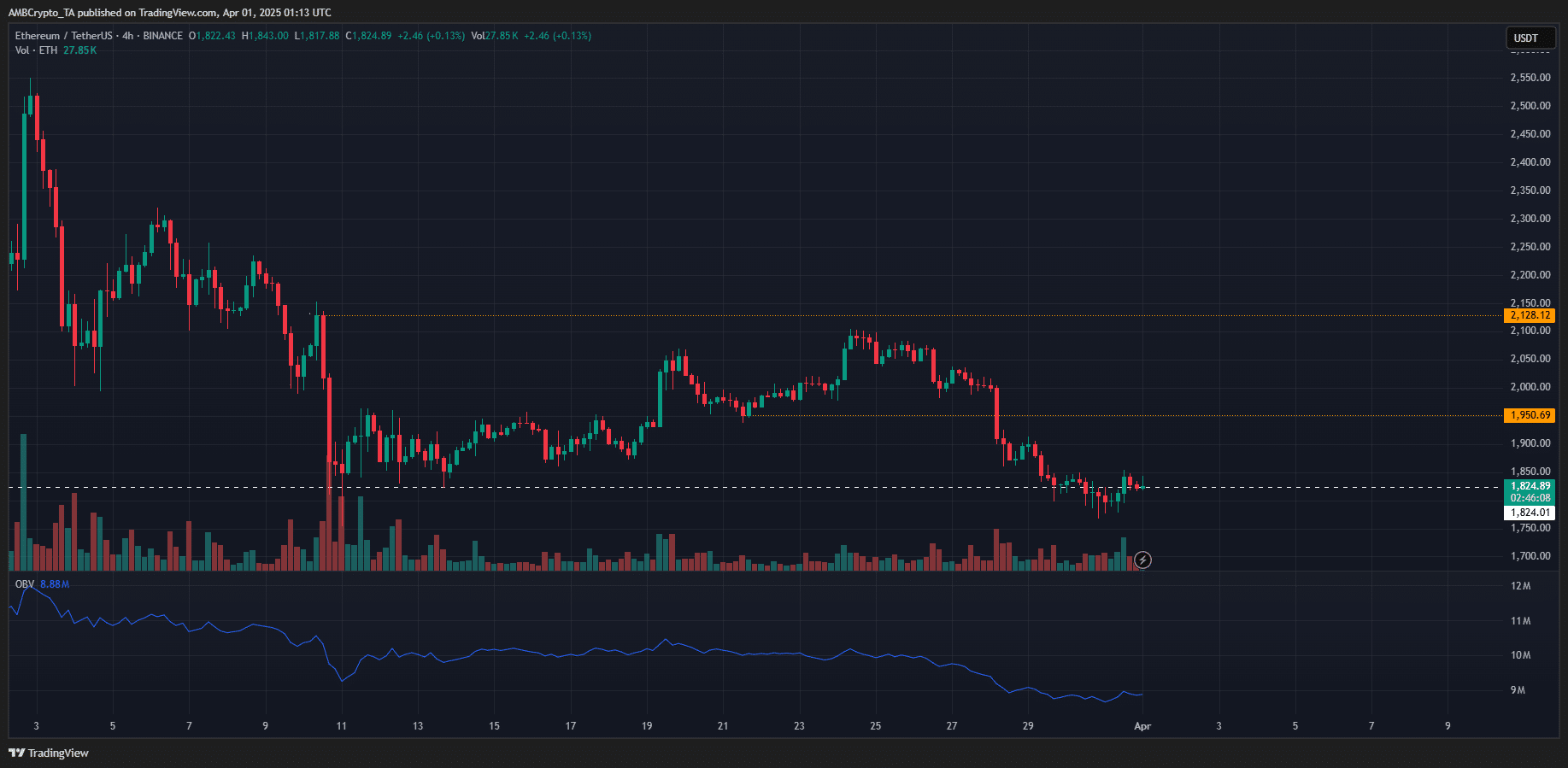

The 4-hour chart confirmed that the $1,850 zone, which served as help in mid-March, is now performing as resistance. The market construction appeared to be bearish too. The rally in the direction of $2,128 didn’t meet its goal, however reversed at $2,100. The $1,950 larger low was not defended both.

The OBV, prefer it did on the 1-day chart, continued its regular downtrend. Therefore, the worth motion on the every day and the 4-hour charts pointed to additional losses for the main altcoin.

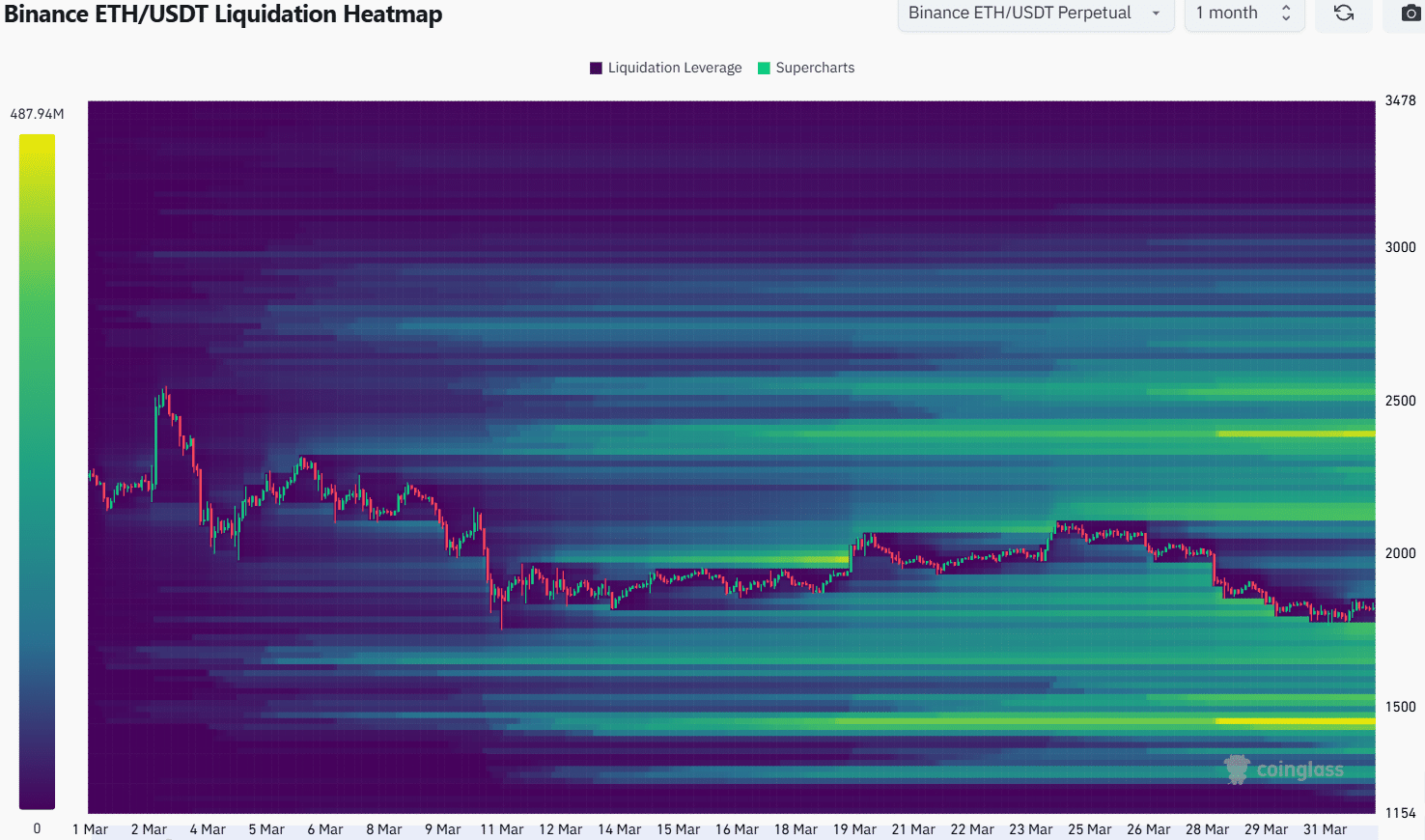

Supply: Coinglass

The liquidation heatmap outlined $2,150 as a magnetic zone that might pull costs larger. On the identical time, the $1,760-$1,640 space emerged as a liquidity pocket a lot nearer to the worth. This meant Ethereum is more likely to fall decrease in the direction of $1.6k within the coming days.

Given the worth motion and the market sentiment, extra losses could also be seemingly within the short-term. The long-term downtrend has not been halted both.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion