- Spot Ethereum ETFs have skilled 5 consecutive days of optimistic netflows.

- The short-term decline is partly pushed by by-product merchants taking brief place.

Over the previous week, Ethereum [ETH] has surged by 22.5%, reaching $3,444.25 — a degree not seen since July 24 of this yr. Nonetheless, it has since dropped by 6.37%.

In response to AMBCrypto’s evaluation, this urged that the continued decline is short-term and unlikely to influence Ethereum’s longer-term outlook.

5-day shopping for streak provides to ETH bullish outlook

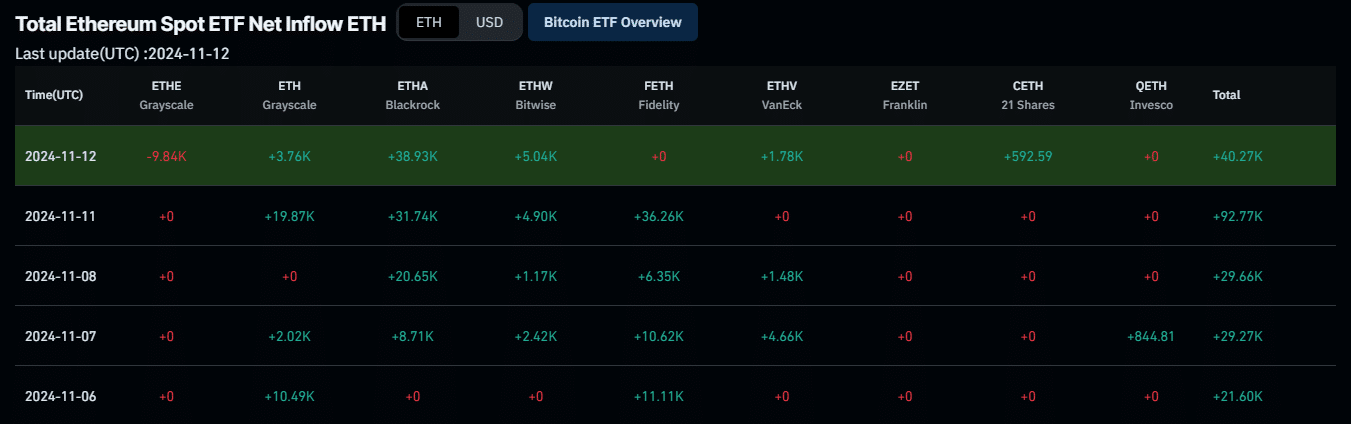

Ethereum’s bullish outlook was gaining momentum, supported by a five-day shopping for streak from conventional traders, who’re more and more committing to ETH.

These traders have been constantly buying spot ETH ETFs from a number of main platforms.

As of this writing, Coinglass reported a optimistic Netflow in spot ETH ETFs, with a complete of 213,570 ETH acquired throughout this era.

This sustained acquisition, regardless of latest value fluctuations, signaled that conventional traders had been sustaining sturdy long-term confidence in Ethereum, making ready for the following section of upward motion.

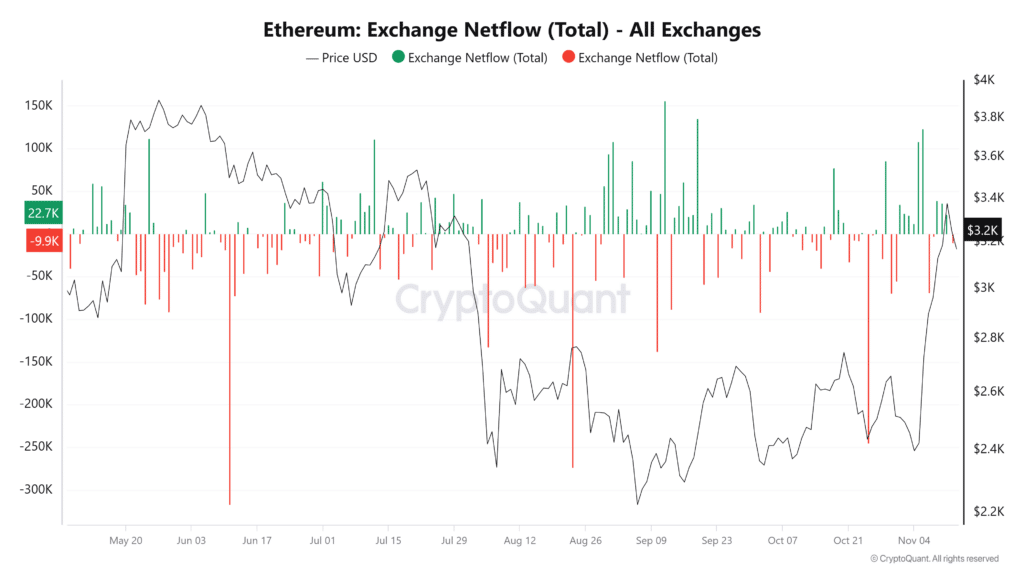

Alongside this transfer by institutional traders, AMBCrypto has noticed an identical development amongst some spot merchants.

Whereas conventional traders remained energetic, there was a shift amongst some merchants, with Trade Netflow exhibiting a unfavourable flip — a 9,957.59 ETH outflow previously 24 hours, based on Cryptoquant.

By-product merchants flip bearish on ETH

By-product merchants have turned bearish on ETH, with important lengthy liquidations recorded previously 24 hours.

An extended liquidation happens when the value strikes towards the place of lengthy merchants, who had guess on an upward development however can now not keep their positions.

In response to Coinglass, $98.73 million price of lengthy trades have been forcefully closed because the market tendencies downward.

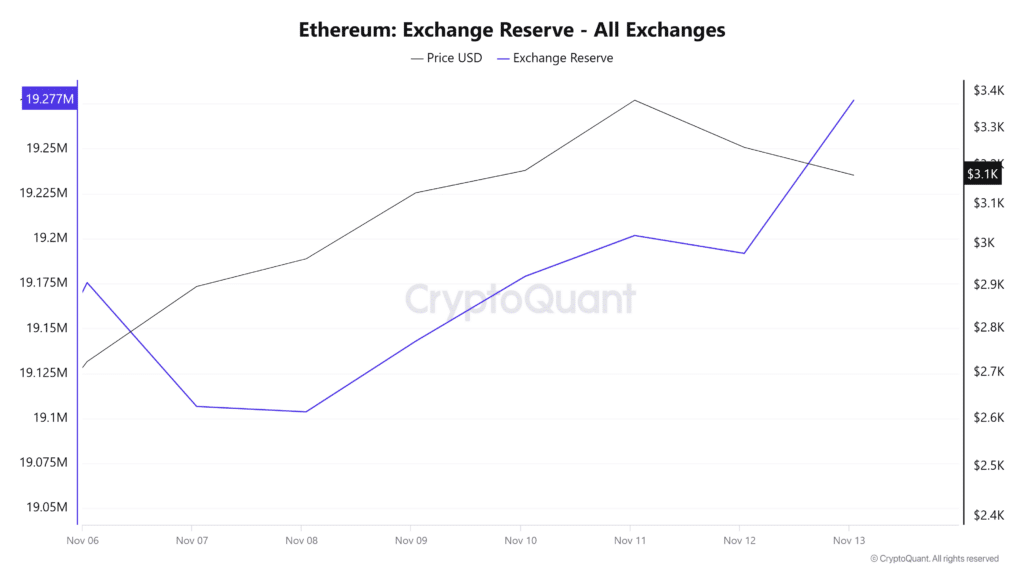

In parallel, Ethereum’s rising Trade Reserve urged an inflow of ETH into change wallets, indicating that some merchants are making ready to promote.

Given these elements, ETH’s value is prone to expertise additional declines. Nonetheless, the important thing query stays: how low will it go?

AMBCrypto has carried out additional evaluation to undertaking potential value ranges for ETH’s downturn.

A minor dip earlier than resuming bullish rally

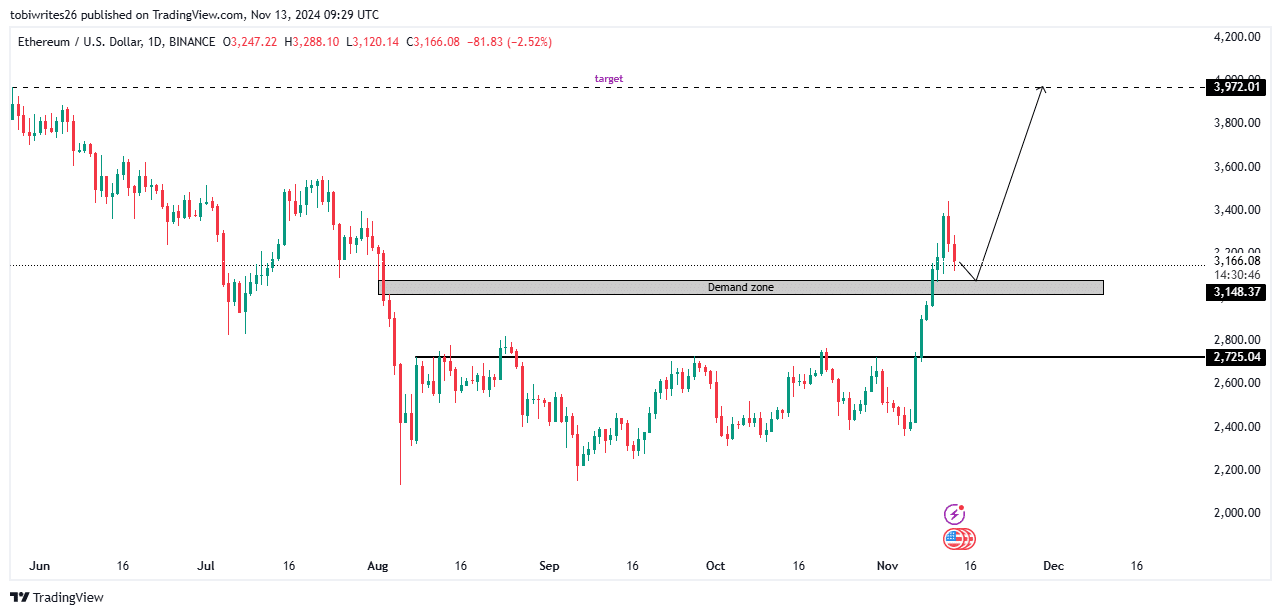

ETH continued to keep up a robust general bullish construction, although a slight decline is anticipated earlier than its rally resumes.

In response to the day by day ETH chart, the important thing demand zone the place it should fall lies between $3,079.89 and $3,015.91.

This zone is anticipated to offer the shopping for strain essential to get ETH again on monitor for its bullish motion.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

As soon as ETH reaches this degree, it’s anticipated to make a big upward transfer towards $3,972.01.

Nonetheless, if bearish sentiment persists, ETH may see an extra drop, doubtlessly falling to $2,725.04 — a degree that might function a catalyst for a renewed bullish surge.