- Ethereum surged 29% over the previous week, reaching a three-month excessive of $3,184.

- The altcoin might be approaching its YTD excessive, fueling hypothesis of a possible Ethereum ATH.

Ethereum [ETH] has skilled a exceptional surge over the previous week, climbing 29% to achieve a three-month excessive of $3,184. With this sturdy upward momentum, the cryptocurrency is on the point of hitting its year-to-date (YTD) excessive, drawing the eye of buyers and market watchers alike.

With Bitcoin’s [BTC] $89,000 surge, discussions about the potential for a brand new ATH for Ethereum are intensifying. May the main altcoin be poised for even larger beneficial properties, or is that this rally a short lived spike?

Ethereum rally pushed by merchants and holders

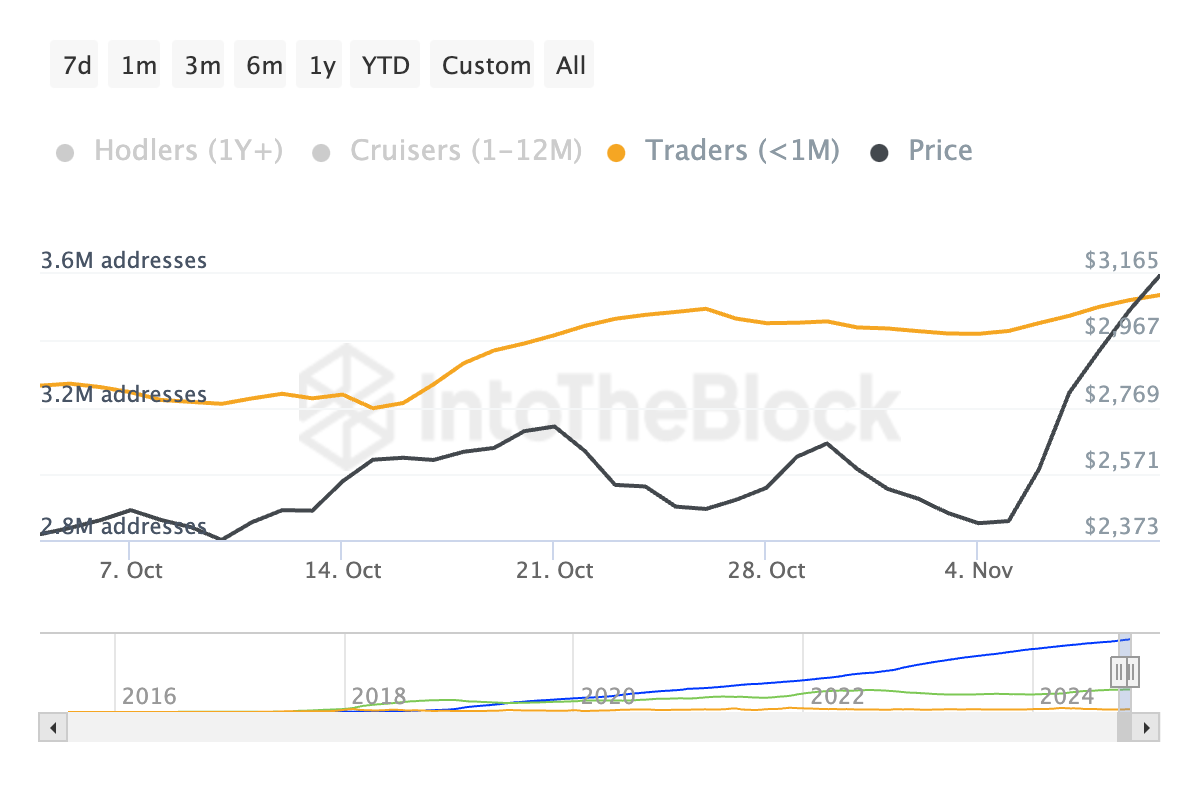

Ethereum’s current rally was supported by a rising common holding time, indicating elevated participation from long-term holders. This pattern suggests larger confidence within the ongoing worth surge and will sign a steady basis for additional beneficial properties.

The concurrent rise in each holding time and worth factors to a rally with endurance, fueled by stronger market sentiment and diminished promoting stress. Whether or not this momentum results in an ATH stays to be seen, however investor optimism is evident.

Furthermore, Ethereum’s worth surge was additionally fueled by a rise in short-term merchants, with round 3.6 million addresses holding for lower than a month.

This spike in speculative exercise suggests a possible short-term rally, however long-term holders and mid-term holders stay steady, offering a gentle base.

Is an Ethereum ATH doable?

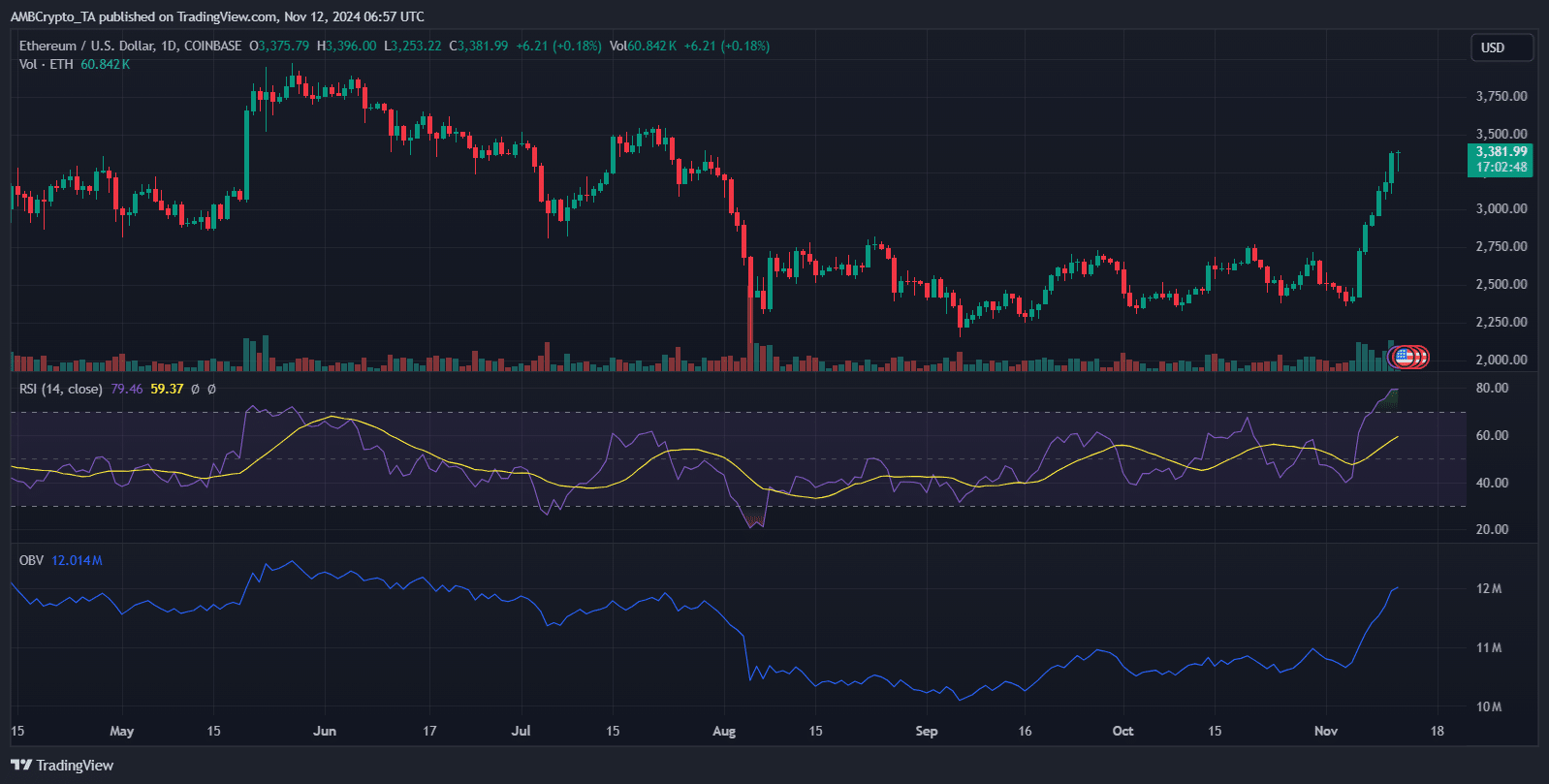

Ethereum’s worth surge pushed the RSI to 77.45, indicating overbought situations, which can immediate a short-term correction. The value momentum is supported by a rising OBV, reflecting sturdy shopping for curiosity.

If Ethereum breaks above its present stage of $3,348, it may most actually transfer towards the YTD excessive.

Nonetheless, given the overbought RSI, a pullback to $3,000 might happen earlier than additional upside. Merchants needs to be cautious and look ahead to consolidation round present ranges or potential retests earlier than any try to achieve a brand new ATH.

Market sentiment and institutional involvement

Ethereum’s rally is pushed by sturdy market sentiment and rising institutional curiosity, with large gamers drawn to its increasing function in DeFi and Web3.

Establishments add liquidity and stability, bolstering Ethereum’s long-term outlook and decreasing volatility.

Learn Ethereum Price Prediction 2024-25

Nonetheless, with RSI at overbought ranges, any shift in sentiment – maybe because of macroeconomic or regulatory adjustments – may set off a pullback.

If institutional confidence stays excessive, Ethereum might maintain its beneficial properties and strategy a brand new ATH. This ongoing institutional assist might be pivotal in sustaining the present rally, offering a basis for potential future highs.