- Ethereum noticed a surge in deposits over withdrawals.

- ETH’s worth patterns confirmed a possible breakout.

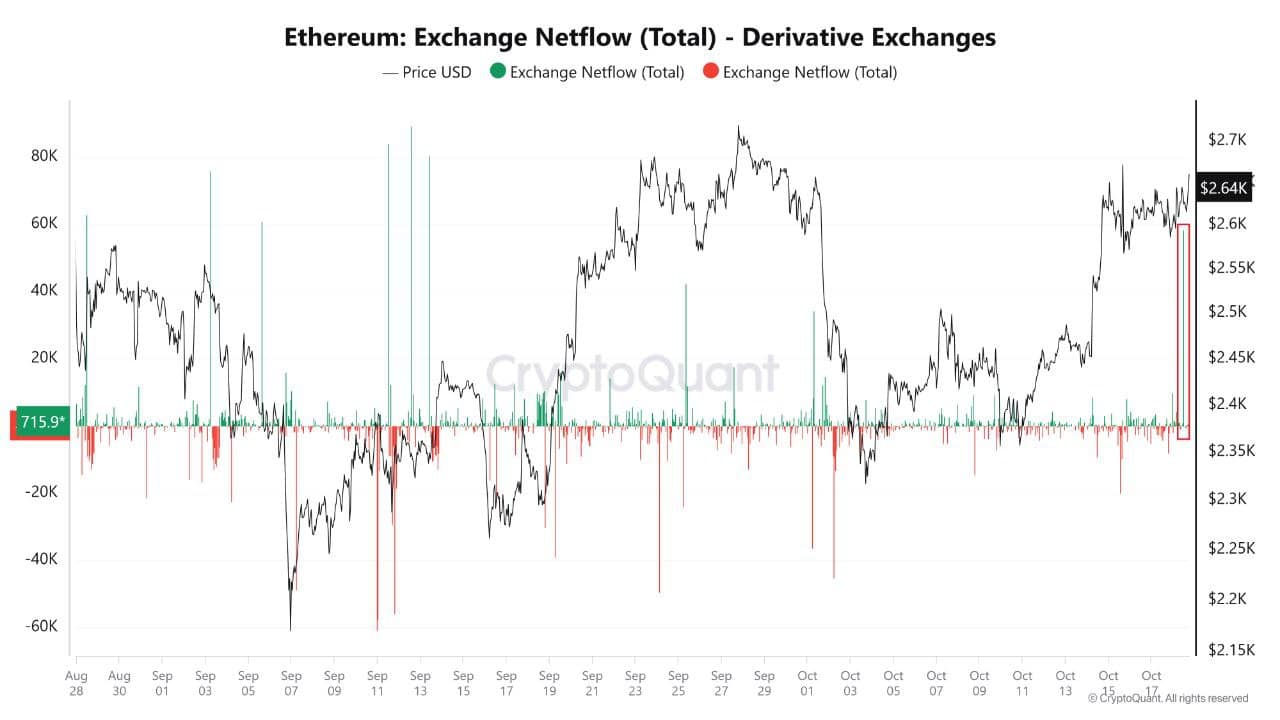

Ethereum’s [ETH] netflows on by-product exchanges lately surpassed 50,000 ETH per day, indicating a big surge in deposits over withdrawals.

This pattern has merchants speculating in regards to the potential influence on ETH worth actions.

A spike in deposits might sign both impending promoting strain or elevated borrowing to gasoline lengthy positions, suggesting volatility is on the horizon.

With market contributors anticipating main worth swings, Ethereum’s outlook for the approaching months could possibly be a key focus for buyers.

ETH worth and inflation charge

Ethereum’s worth motion has remained within the highlight. Over the previous week, ETH has risen by 8.53%, and as of press time worth stood at $2605.63.

ETH/USDT is presently positioned inside an ascending triangle, and a breakout from this sample may push the worth increased. The following key goal for ETH is $2800, which could possibly be surpassed if the bullish momentum continues.

On the ETH/BTC pair, it’s buying and selling close to a crucial assist degree at $0.039 on the weekly chart. Regardless of bearish sentiment available in the market, this assist degree has held agency, indicating the potential for a bounce.

Such a rebound couldn’t solely profit ETH but in addition spark a broader rally within the high 100 altcoins.

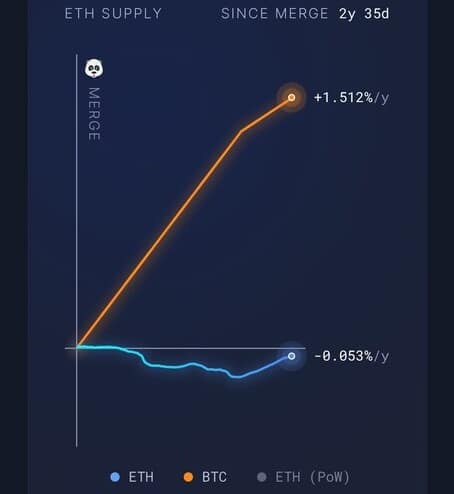

Inflation stays a vital consider Ethereum’s total market efficiency. Presently, Ethereum’s inflation charge stands at +0.31% per yr, a determine decrease than each Bitcoin and gold.

Because the Merge, which transitioned Ethereum to Proof-of-Stake, over 135,000 ETH have been burned, lowering provide. This burn mechanism has continued to reinforce its deflationary facet.

Regardless of the subdued worth motion in latest months, the community’s rising demand and deflationary traits are setting the stage for potential long-term worth will increase.

The mix of Ethereum’s provide discount and growing community utilization is more likely to drive ETH costs increased sooner or later.

Main sensible contract platform

Ethereum’s dominance because the main sensible contract platform stays unchallenged. Since its inception in 2015, Ethereum has been the muse for innovation within the DeFi and NFT sectors.

With ETH 2.0 now dwell, the community is extra scalable, safe, and energy-efficient than ever earlier than. These developments are contributing to Ethereum’s continued progress within the blockchain area.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

The continued growth and use of Ethereum’s blockchain, coupled with its diminished inflation and deflationary mechanisms, are key drivers behind the expectation of upper costs.

Ethereum is well-positioned for robust efficiency within the close to time period. Maintaining a detailed eye on Ethereum’s subsequent strikes is required, particularly with the potential for positive aspects as 2025 approaches.