- Whale exits and a 63.8% drop in massive transactions weaken Ethereum’s bullish construction.

- On-chain metrics and rising alternate reserves level to growing promoting strain and fading demand.

Ethereum [ETH] has seen a major 63.8% decline in massive transactions since February 25, highlighting a steep drop in whale participation. Over the previous two weeks, whales have offered over 760,000 ETH, contributing to rising promoting strain throughout the market.

Moreover, a long-term Ethereum holder lately offered the remaining 2,001 ETH of their portfolio for $3.82 million, after initially accumulating 5,001 ETH at $277 again in 2017.

These gross sales point out that giant holders are lowering their publicity, presumably in anticipation of additional value declines or as a part of a strategic shift away from Ethereum.

This decline in whale-driven accumulation weakens Ethereum’s upward momentum. When whales exit, retail traders typically wrestle to soak up the promoting strain, making the asset extra vulnerable to volatility.

Because of this, except demand returns swiftly, Ethereum could face short-term downward strain. The approaching days will likely be essential in figuring out whether or not the market finds new help ranges or experiences an extra decline.

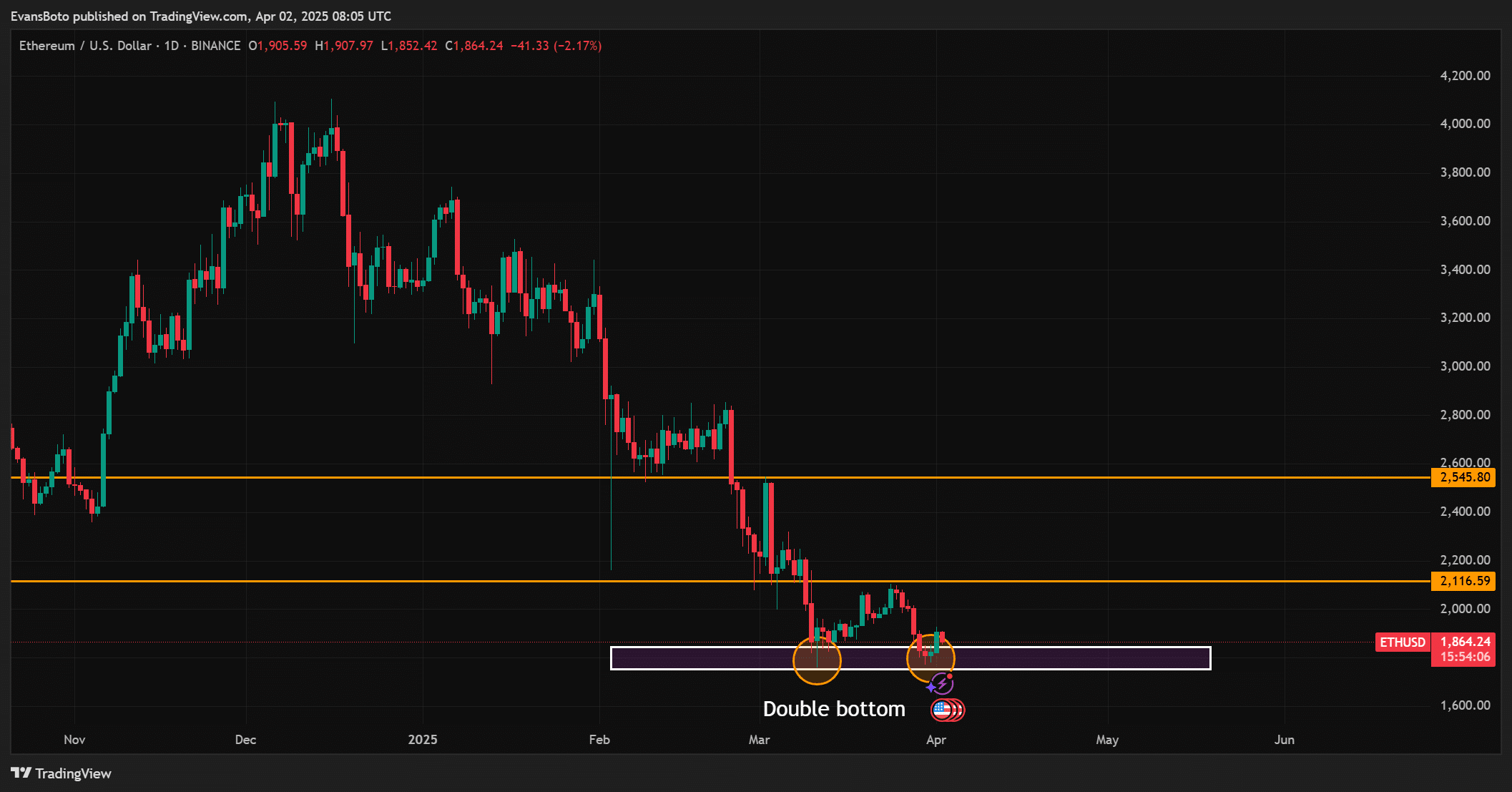

Ethereum varieties a double backside – Can bulls take management?

On the time of writing, Ethereum was buying and selling at $1,863.12, reflecting a 0.53% every day enhance.

The worth motion suggests a possible double backside close to the $1,800 help zone, signaling that bulls could also be making a restoration try.

Nonetheless, Ethereum’s value stays under essential resistance ranges at $2,116.59 and $2,545.80, that are important to reclaim for confirming a bullish reversal. With out breaking above these ranges, the present rebound could show short-lived.

Whereas the construction of this bounce exhibits some optimism, the general development stays cautious.

Current whale exits and low market participation considerably dampen the probability of a sustained breakout. Because of this, the $1,800 help stage turns into a crucial threshold; if breached, it may result in accelerated promoting.

To stop additional declines, bulls should act decisively and with power.

Liquidation information exhibits resistance forward for ETH bulls

The 24-hour liquidation heatmap on Binance confirmed important liquidation exercise between the $1,900 and $1,950 vary. This means a excessive focus of leveraged merchants being compelled out of their positions, creating short-term resistance.

Ethereum has struggled to keep up ranges above this vary, highlighting an absence of purchaser confidence. To regain upward momentum, ETH must construct stronger bullish help and break by this zone.

If the worth continues to stall under these ranges, bears may seize management. Sturdy liquidation partitions typically act as boundaries, trapping value motion inside a sideways buying and selling vary.

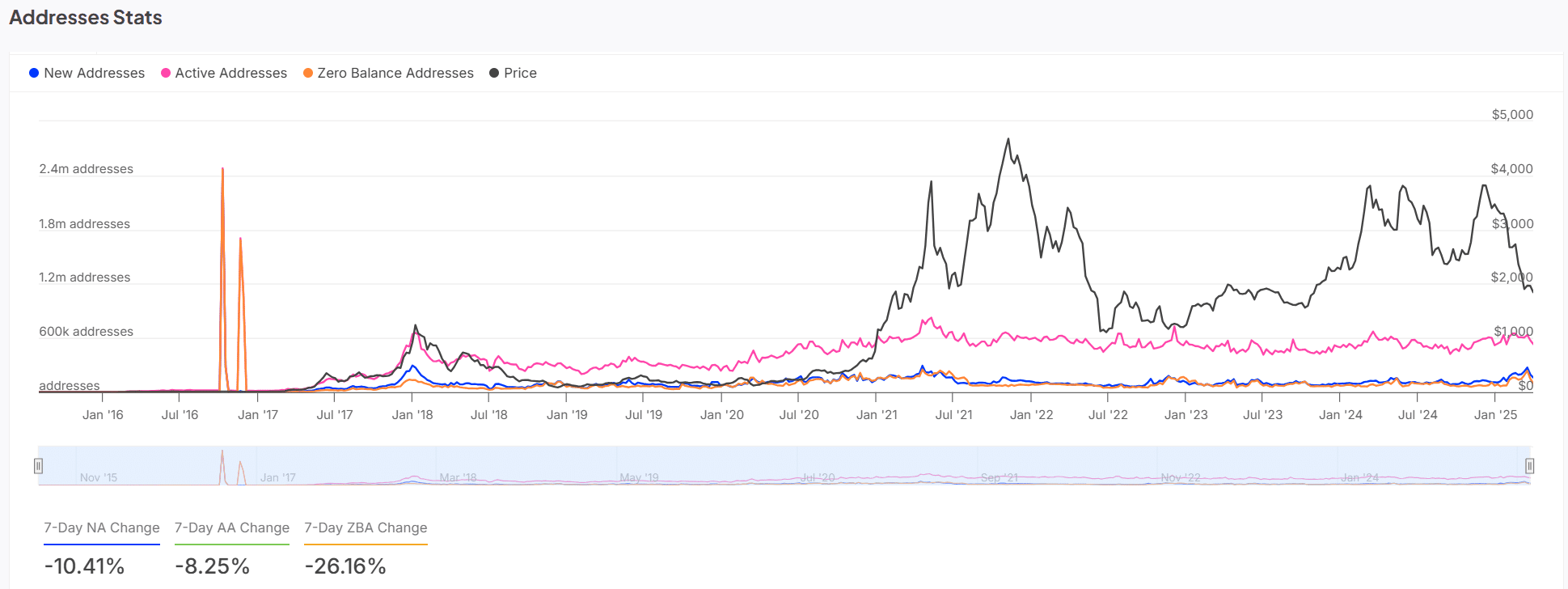

Handle stats present declining community demand

Ethereum’s on-chain metrics reveal a decline in consumer exercise. Over the previous week, new addresses decreased by 10.41%, and lively addresses dropped by 8.25%. Concurrently, zero-balance addresses elevated by 26.16%, signaling an increase in pockets abandonment.

These tendencies point out a pullback by each new and current customers, highlighting a contraction in community participation. This decline displays weakening demand fundamentals.

As fewer customers transact or maintain Ethereum, market stability weakens additional. Consequently, low consumer engagement may amplify bearish strain within the coming weeks.

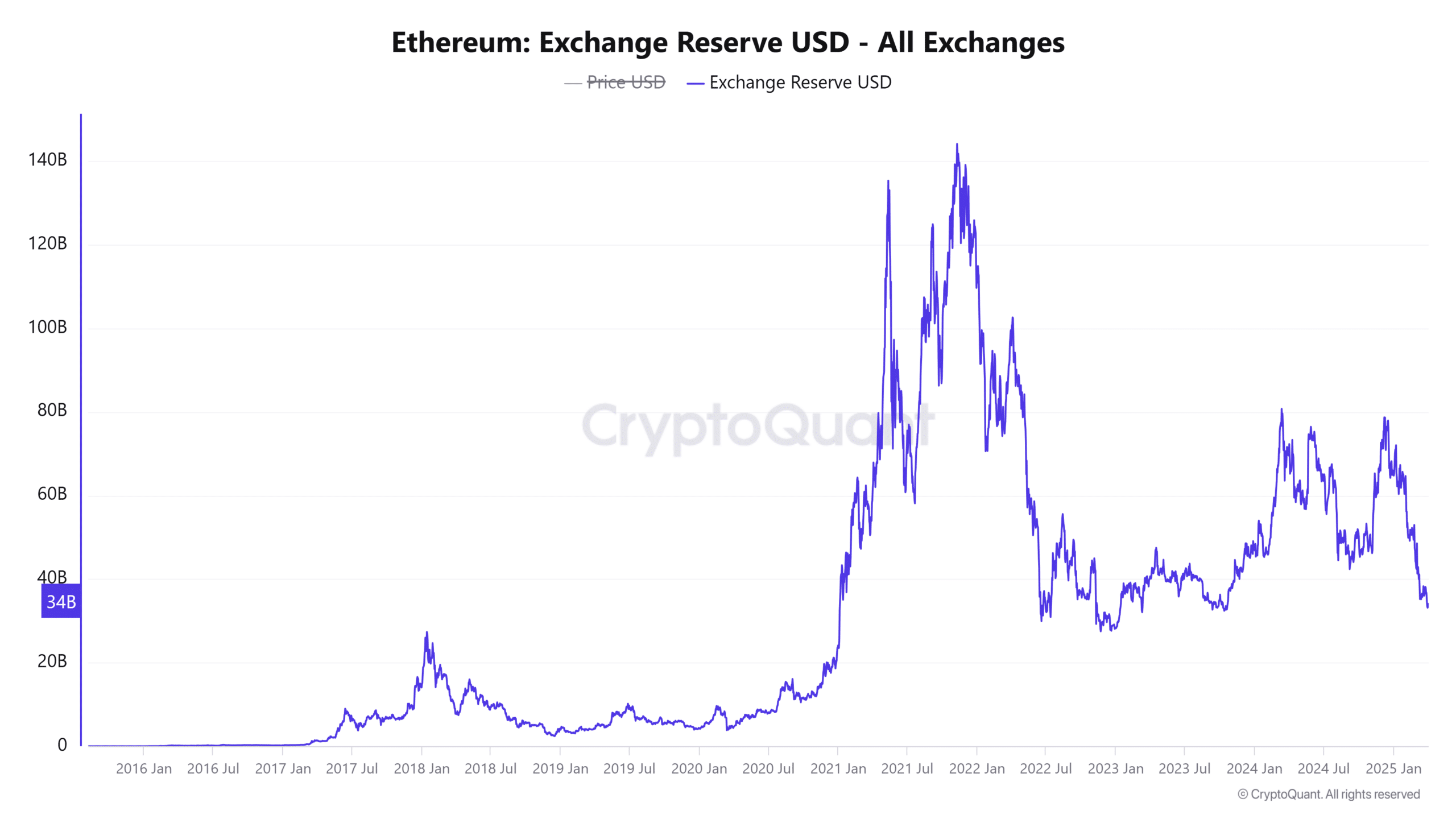

Ethereum alternate reserves climb as promote strain will increase

The full worth of Ethereum held on exchanges has elevated to $33.98 billion, up by 0.77% over the previous 24 hours. Rising alternate reserves typically point out that extra traders are getting ready to promote quite than maintain.

This habits aligns with the wave of whale exits and decreased on-chain exercise. Due to this fact, elevated reserves recommend that additional draw back strain may emerge if demand doesn’t decide up.

Sellers presently dominate the sentiment, and till this development shifts, value motion could proceed to face resistance.

What subsequent for ETH

Ethereum seems to be headed for a short-term correction. A 63.8% lower in whale transactions, a 0.77% rise in alternate reserves, and a 26.16% uptick in zero-balance addresses all point out weakening demand and heightened promoting strain.

Whereas the formation of a double backside sample hints at the potential of a rebound, the absence of sturdy shopping for momentum will increase the probability of an extra decline.