Key Notes

- BlackRock’s Ethereum ETF accumulation of three million tokens represents 2.5% of whole provide, signaling huge institutional adoption.

- SEC regulatory approval for in-kind ETF redemptions offers essential readability that might speed up institutional capital flows into Ethereum.

- Anniversary milestone celebrations mixed with technical resilience above $3,800 positions ETH for potential breakout towards $4,000 resistance degree.

Ethereum

ETH

$3 867

24h volatility:

1.1%

Market cap:

$466.78 B

Vol. 24h:

$33.65 B

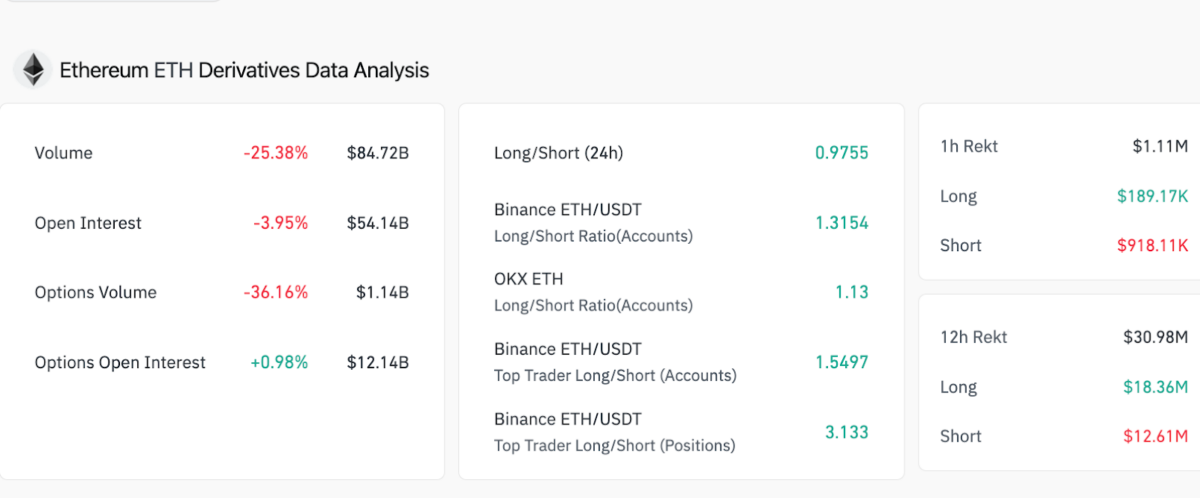

value motion held regular at $3,802 on July 30, regardless of a broader market cooldown forward of the US Fed’s rate announcement. Notably, ETH Open Curiosity dropped $2 billion intraday to $54.1 billion, and futures buying and selling quantity slid 32% to $84.7 billion, according to Coinglass.

Ethereum Derivatives Evaluation | Supply: Coinglass, July 30, 2025

Ethereum’s resilient spot value motion, regardless of huge deleveraging on Wednesday seems pushed by a trident of bullish elements.

First, the Ethereum ecosystem celebrated its 10-year anniversary, with prime crypto stakeholders and builders sharing commemorative messages and milestones on Tuesday, drawing world consideration and boosting market sentiment.

🎉 joyful tenth birthday Ethereum!

💰 MoonPay is giving freely 1 ETH ($3,780) to at least one particular person on X to have fun

💜 the winner will likely be chosen and notified on July 31

✅ like this publish and comply with to enter pic.twitter.com/wc38bgKH1S

— MoonPay 🟣 (@moonpay) July 30, 2025

Second, the US SEC has authorised in-kind redemptions for each Bitcoin

BTC

$118 784

24h volatility:

0.4%

Market cap:

$2.36 T

Vol. 24h:

$46.08 B

and Ethereum ETFs. This regulatory readability is vital, because it opens the door for extra environment friendly capital inflows and institutional participation.

Third, institutional demand for ETH is accelerating. Bloomberg ETF analyst Nate Geraci reported this week that the BlackRock iShares Ethereum ETF now holds over 3 million ETH.

iShares Ethereum ETF now holds over 3 million ether…

Simply hit 2mil again on July twelfth.

Present whole provide of eth = 121mil pic.twitter.com/ab9a6BHulw

— Nate Geraci (@NateGeraci) July 30, 2025

Which means Blackrock alone now holds 2.5% of ETH’s whole 120 million circulating provide, affirming Commonplace Chartered analysts’ current projection that ETH ETFs might ultimately seize as much as 10% of whole provide.

Evidently, these three catalysts performed key roles in anchoring Ethereum value firmly above $3,800 at press time, even regardless of broader market consolidation which noticed the likes of

XRP

$3.15

24h volatility:

0.8%

Market cap:

$186.51 B

Vol. 24h:

$5.91 B

and

SOL

$181.2

24h volatility:

0.3%

Market cap:

$97.55 B

Vol. 24h:

$6.30 B

take important haircuts intraday.

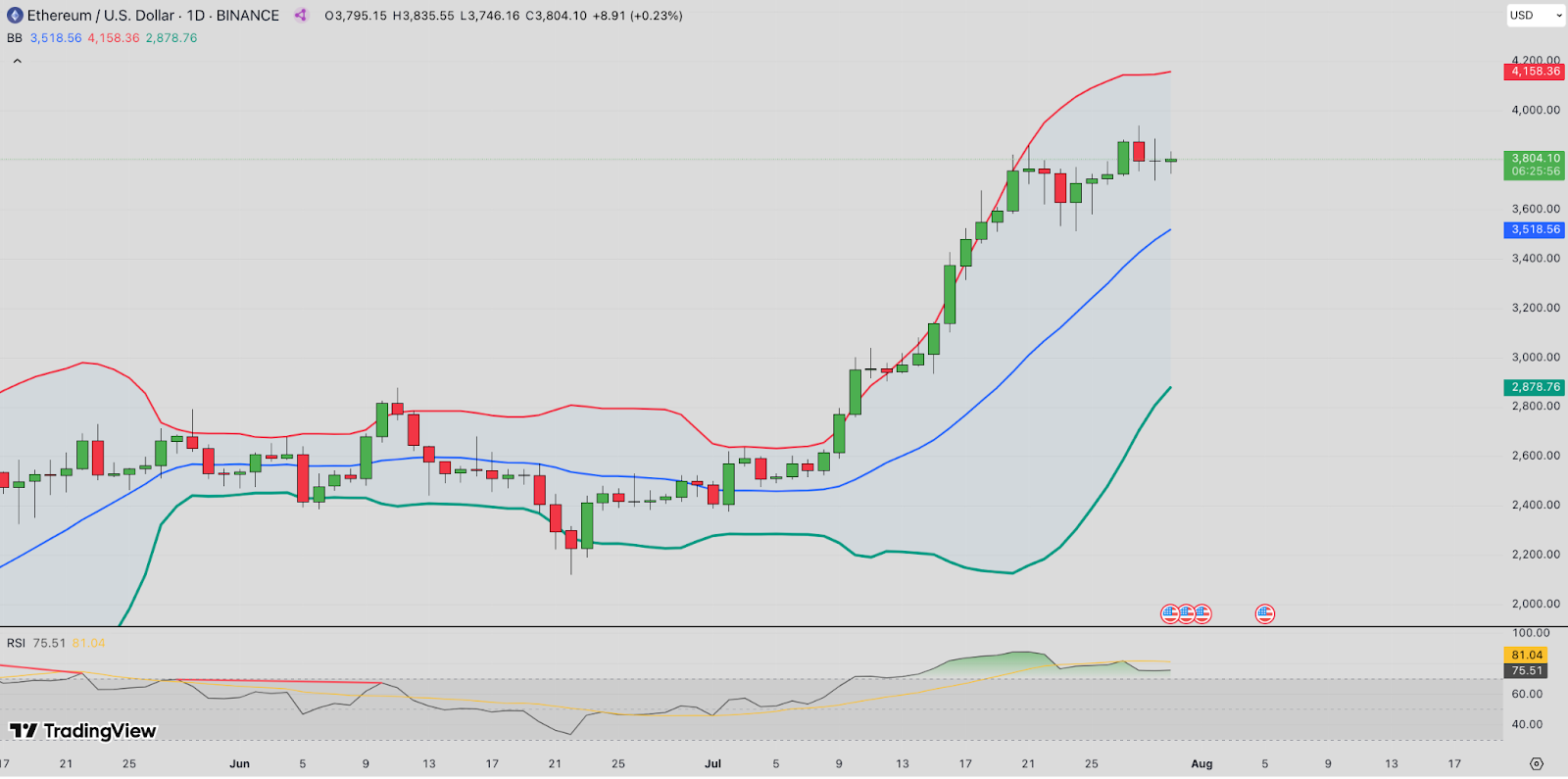

ETH Worth Prediction: Can Bulls Break Previous $4,158 Resistance?

Ethereum presently trades at $3,802, consolidating just under the higher Bollinger Band at $4,158, which marks a vital resistance degree. The Bollinger Bands have expanded, signaling robust volatility, whereas the midline assist rests close to $3,518.

The RSI stands at 75.48, flirting with overbought territory however nonetheless beneath final week’s excessive of 81.04, suggesting room for a breakout earlier than a full reset.

Ethereum Worth Prediction | Supply: TradingView

If bulls push ETH above $4,158, the subsequent long-term goal might be round $4,500, final seen throughout the 2021 bull cycle. On the draw back, failure to carry the $3,750 zone would open draw back threat towards $3,520 assist, aligning with the 20-day shifting common.

Greatest Pockets In Demand as Ethereum Merchants Transfer to Safe Income

As Ethereum eyes a breakout above the $4,000 milestone value degree, savvy merchants are securing income in non-custodial wallets, drawing consideration to Greatest Pockets’s ongoing token presale.

Greatest Pockets Presale

The $BEST Token powers the Greatest pockets ecosystem and goals to disrupt the $11 billion non-custodial pockets market. With over $14.3 million raised, $BEST token seems poised for main beneficial properties as the continued ETH rally attracts in new market individuals. Go to the official Best Wallet website to enter the presale earlier than the subsequent value replace.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.