- Ethereum was buying and selling at a key resistance zone.

- An impulse transfer greater is anticipated, however merchants must be cautious of a breakout.

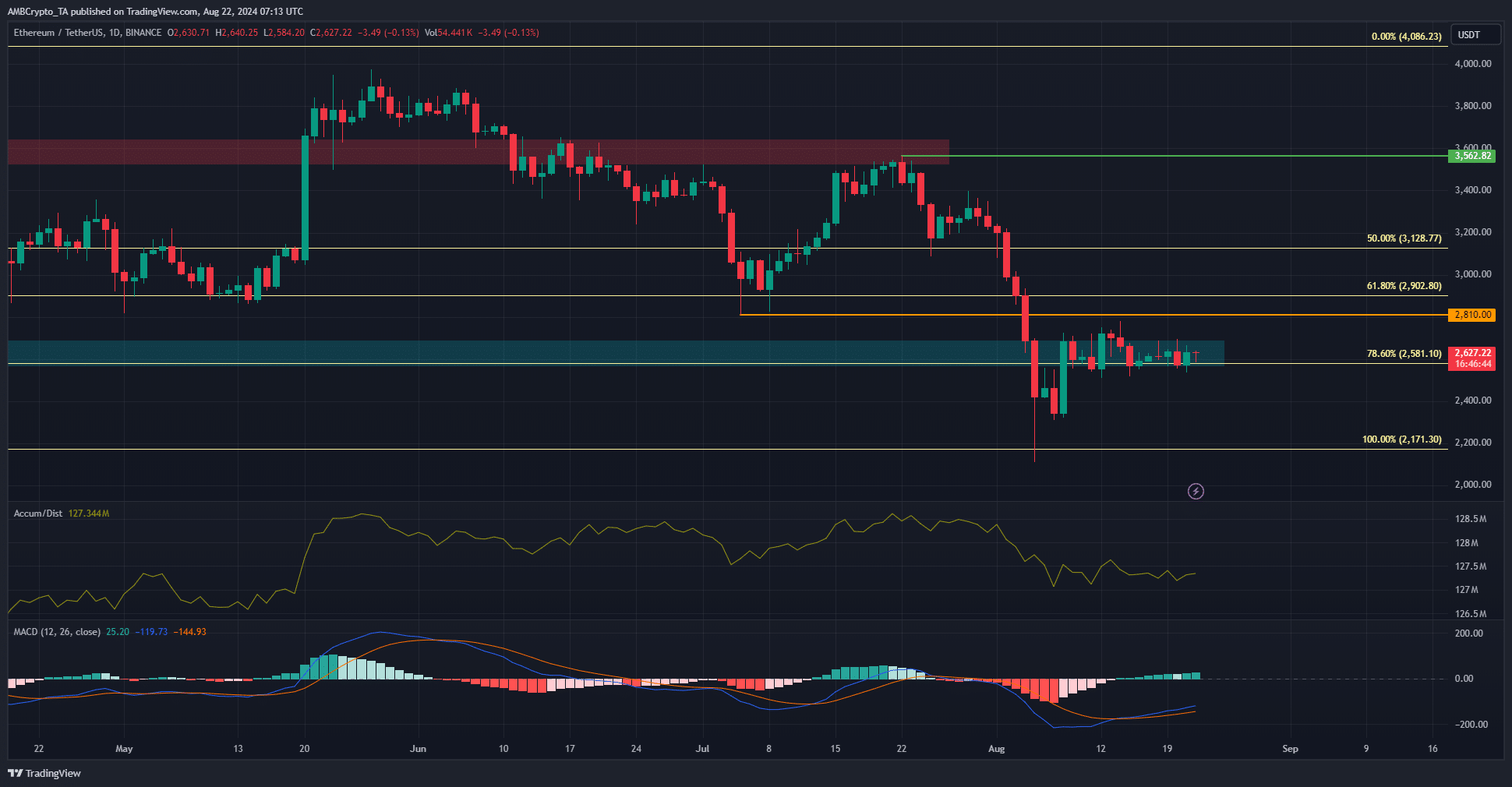

Ethereum [ETH] was laboring in a long-term downtrend. The worth has been caught within the $2550-$2730 zone for practically two weeks now. The long-term downtrend and the bull vs bear case have been examined intimately in a current AMBCrypto report.

An investigation revealed that Ethereum customers have been more and more choosing personal transactions which devour extra gasoline. This added to the volatility to the bottom price and will drawback community customers.

Is that this an accumulation section earlier than the following bullish enlargement?

The market construction on the day by day timeframe was nonetheless bearish. The worth constriction round $2.6k over the previous two weeks might be paving the best way for a pointy transfer upward. It is because the stoop in early August left behind some imbalances on the chart.

But, even when ETH rallies to $3k, it may not be sufficient to provoke a breakout. The A/D indicator confirmed bulls have been detached throughout the current consolidation and lacked the power to push costs greater.

Therefore, a transfer upward could be pushed by liquidity and never demand and may be reversed thereafter.

Spot demand makes a case for a bearish short-term ETH value prediction

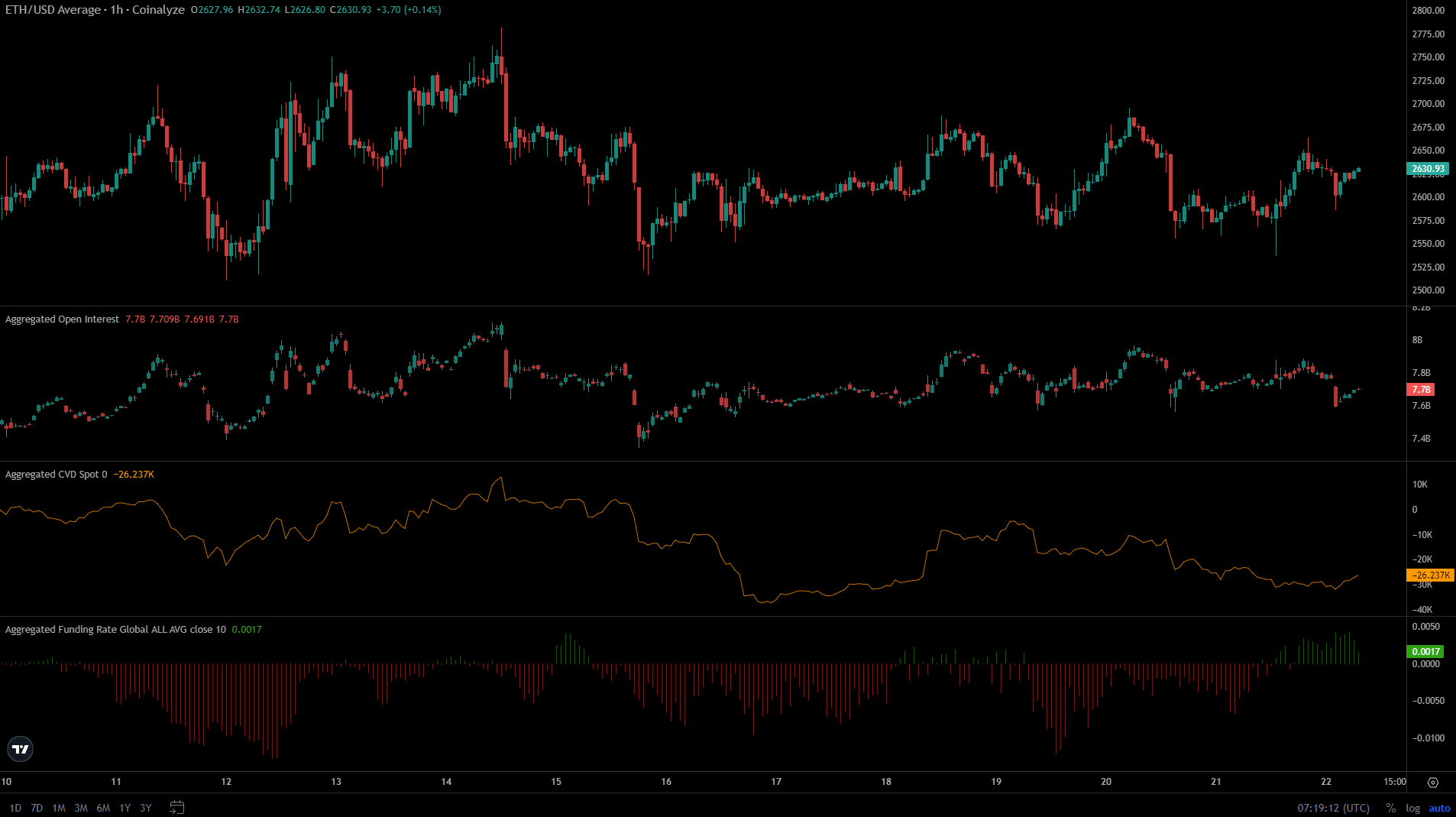

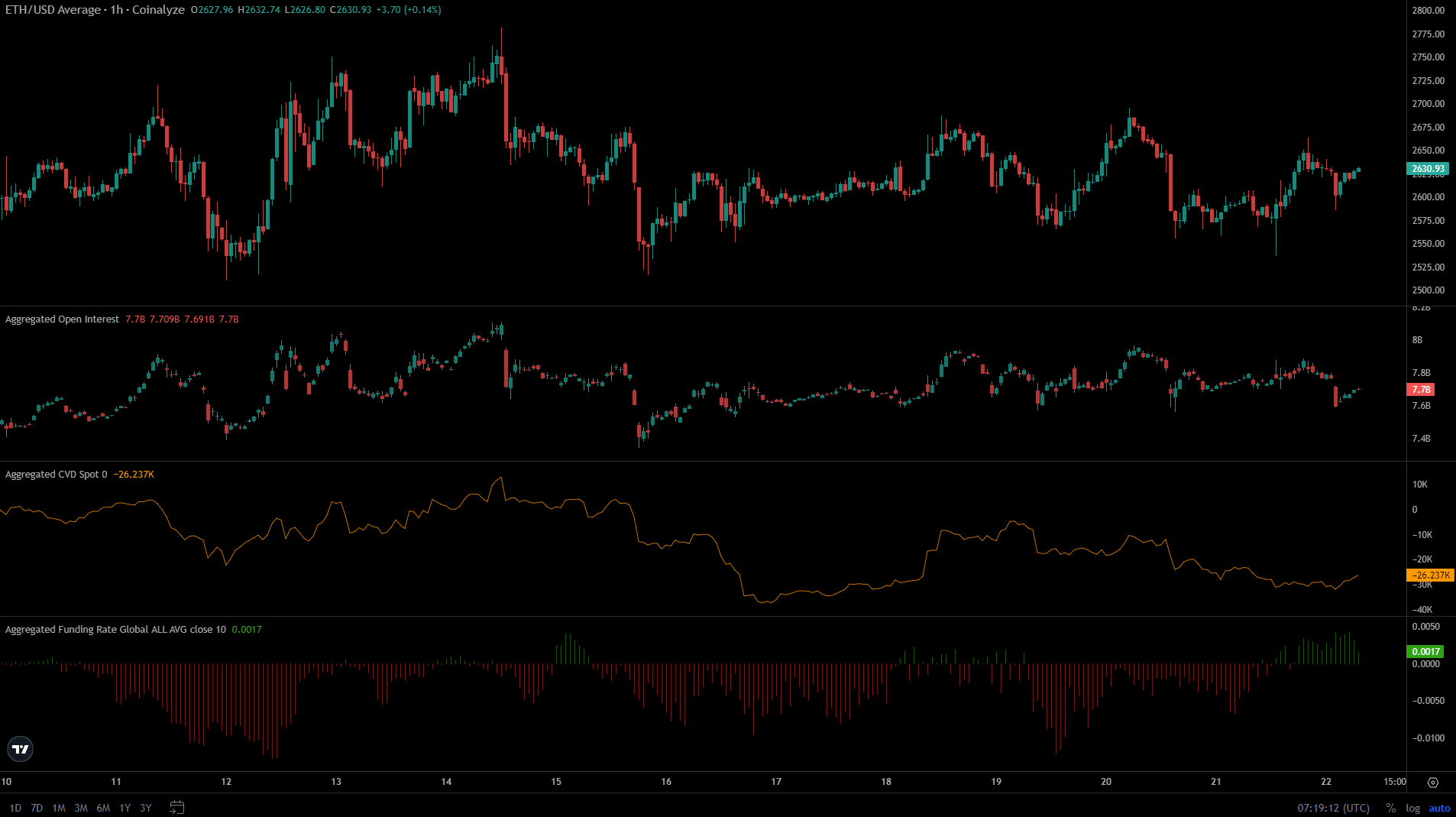

Supply: Coinalyze

On the decrease timeframes, the Open Curiosity behind Ethereum has been fluctuating alongside the worth for the reason that 18th of August. It outlined a scarcity of conviction within the futures market.

The funding price, which had been adverse, climbed into optimistic territory. This was an indication that speculators have been going lengthy, nevertheless it was not a robust bullish signal.

However the decline within the spot CVD was a bearish sign that strengthened the shortage of demand behind ETH.

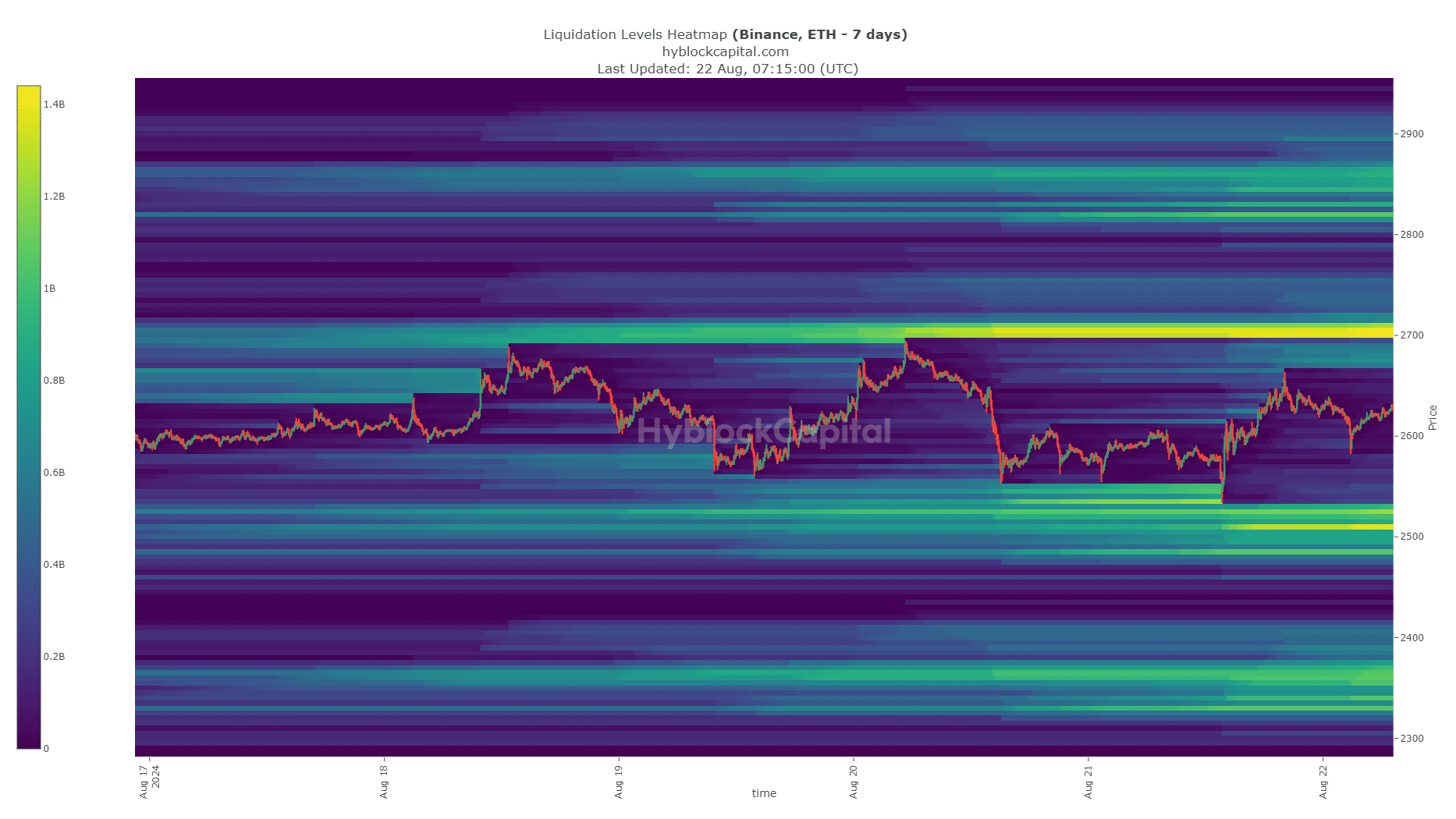

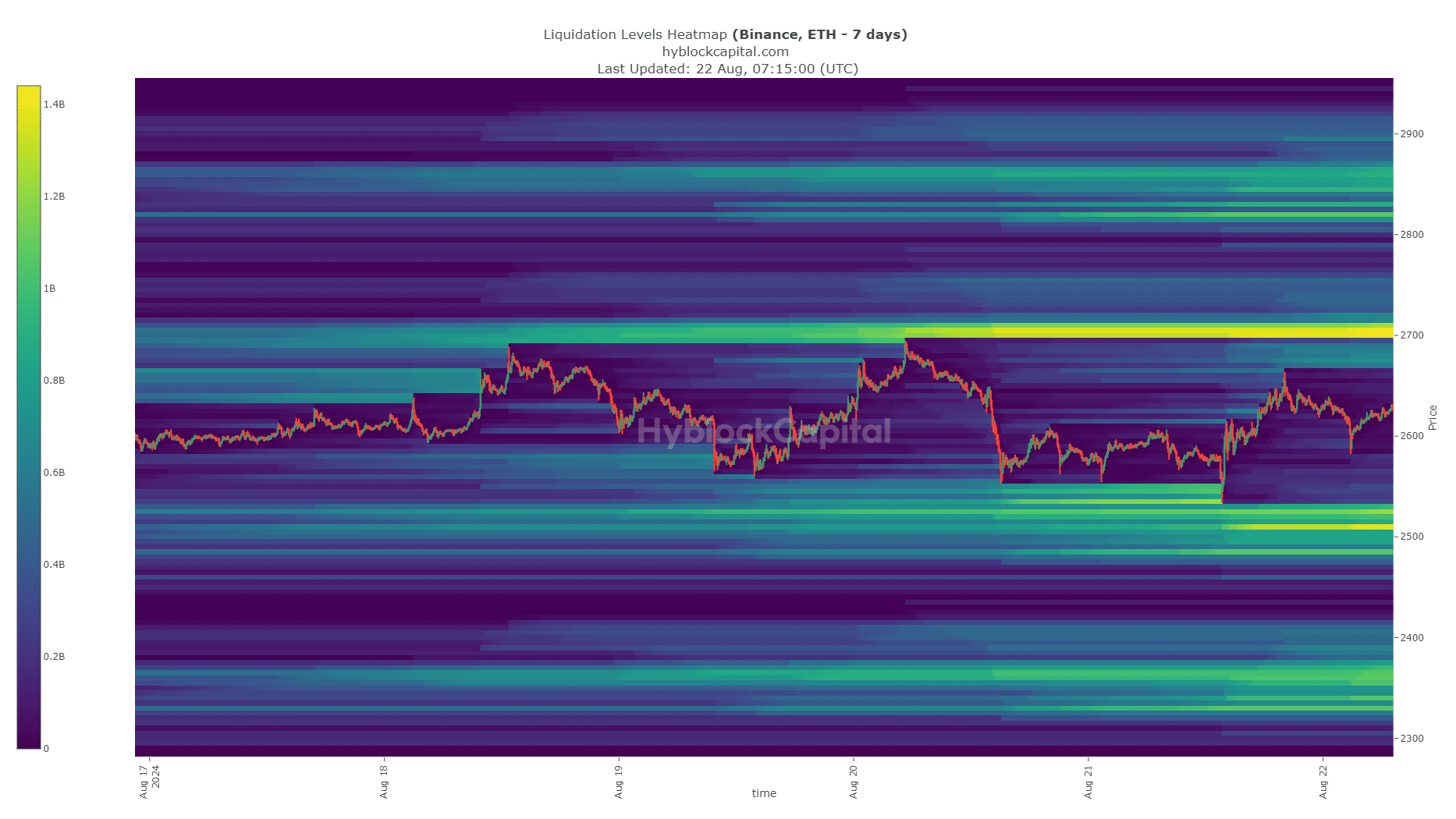

Supply: Hyblock

The liquidation heatmap highlighted $2.7k and $2.5k because the short-term value targets. As issues stand, a transfer towards $2.7k appeared extremely seemingly within the coming days.

Subsequently, the short-term Ethereum value prediction is bullish, and a transfer towards $2850 was additionally potential.

Is your portfolio inexperienced? Verify the Ethereum Profit Calculator

Such a transfer could be pushed by the magnetic zone and would seemingly reverse. Therefore merchants can look ahead to alternatives to promote the bounce reasonably than purchase ETH close to the $2.9k-$3k resistance zone.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion