- Ethereum’s value reclaimed $2,350, with technical indicators supporting a possible rally in direction of $3,260

- Altcoin’s netflow evaluation alluded to shifting market sentiment

Ethereum’s value motion has captured the eye of merchants these days, with key indicators hinting on the potential for a powerful upward transfer. In actual fact, the crypto has exhibited resilience, reclaiming crucial value ranges and demonstrating patterns that traditionally precede rallies.

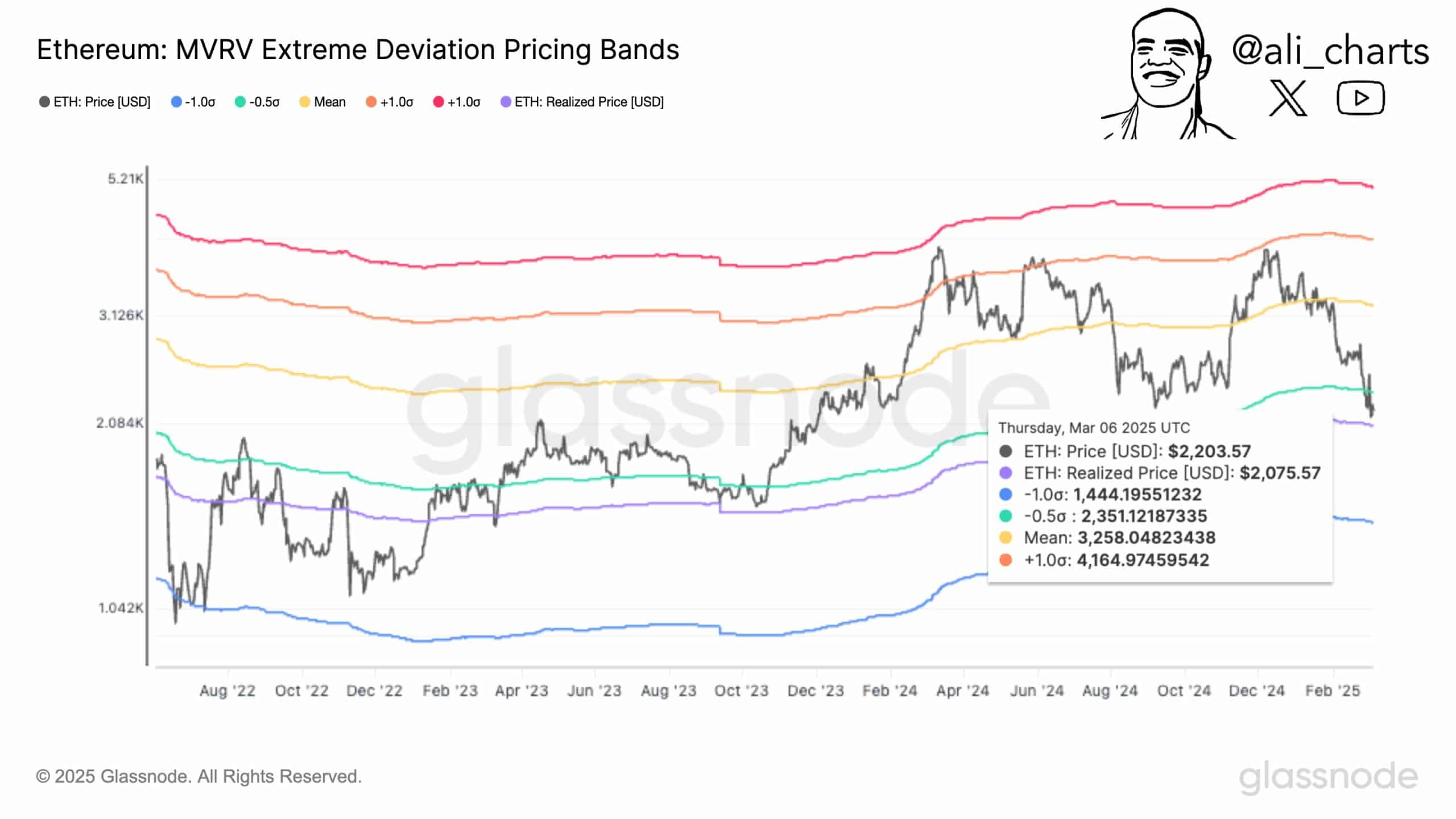

Ethereum[ETH] reclaimed $2,350 on the charts, with technical indicators supporting a possible rally in direction of $3,260. On 6 March, ETH was buying and selling at $2,203.57, with the realized value at $2,075.57.

The altcoin’s pricing bands recognized key ranges, with ETH breaking above an important threshold – An indication of robust bullish momentum.

Historic traits revealed that related breakouts led to cost surges, such because the rise from $1,042k in August 2022 to $3,126k by August 2024. This sample urged that ETH’s newest transfer alluded to accumulation and decreased promoting stress.

Therefore, a rally to $3,260 is perhaps possible, providing a possible 48% upside. Nonetheless, failure to carry $2,351 might push ETH all the way down to $1,444 – A attainable 34% decline.

Trade withdrawals – That means?

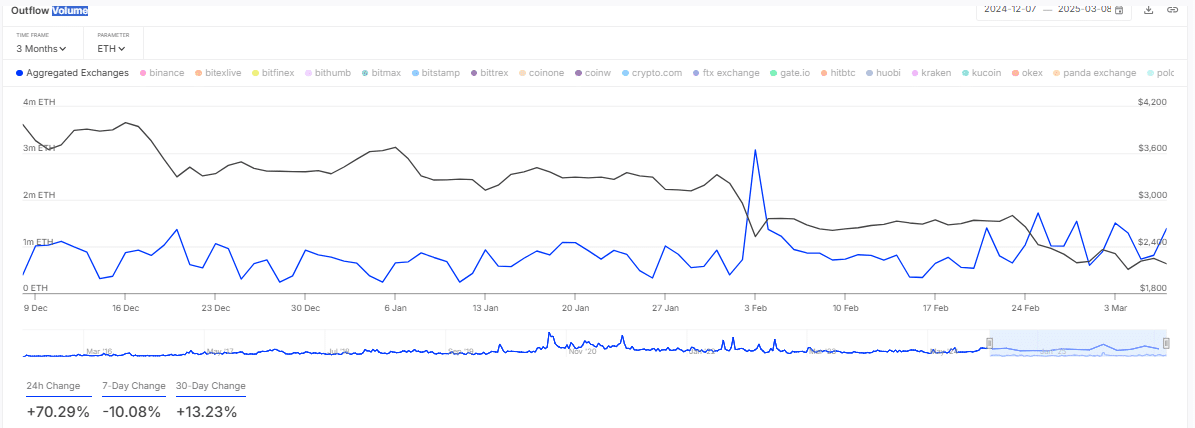

Over $500 million price of ETH was withdrawn from exchanges, indicating an uptick in accumulation amongst merchants. The outflow quantity chart on 8 March confirmed a 24-hour change of +70.29% – A 7-day change of -10.08% and a 30-day hike of +13.23%.

3 March’s outflows peaked at 1 million ETH, valued at $2.4 billion, earlier than declining to 400k ETH by 6 March. The sharp 24-hour surge mirrored robust shopping for stress, lowering obtainable provide on main exchanges.

The 30-day pattern bolstered the long-term accumulation sample, usually a precursor to cost hikes. Nonetheless, the 7-day decline pointed to short-term profit-taking, which might momentarily gradual momentum.

This sample resembled early 2024 when outflows preceded a 20% value soar. If outflows proceed, ETH might transfer in direction of $2,600. Conversely, if promoting stress returns, ETH may retest $2,200 on the charts.

Bearish indicators amid outflow traits

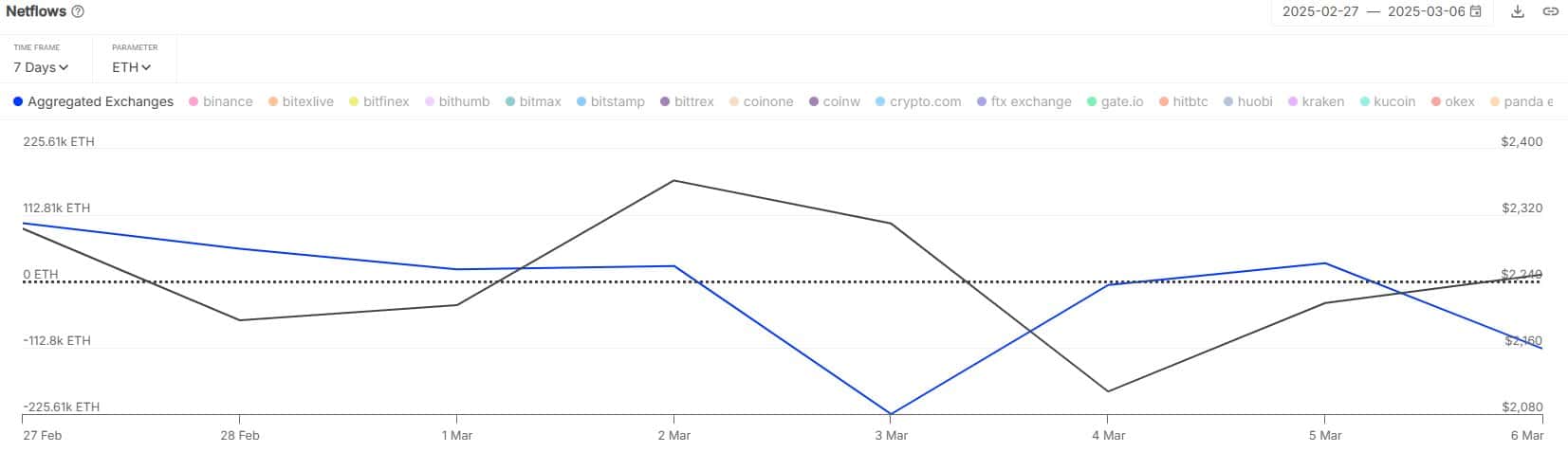

Ethereum’s netflow evaluation highlighted shifting market sentiment.

Web outflows peaked at -225.61K ETH on 5 March, equal to $540 million at $2,400 per ETH, earlier than lowering to -112.81K ETH the subsequent day. The 7-day and 30-day netflow declines indicated ongoing accumulation, lowering obtainable provide on platforms like Coinbase and Kraken.

This pattern traditionally preceded rallies, as seen in February 2024, when an analogous outflow sample led to a 15% value hike. If sustained, this pattern might push ETH to $2,800. Nonetheless, if inflows surge, promoting stress might push ETH to $2,100 – Signaling a attainable reversal.

A bullish horizon for the altcoin?

On the time of writing, Ethereum’s trajectory appeared bullish, pushed by robust technical indicators and accumulation traits. ETH was buying and selling at $2,203.57, with projections hinting at a possible hike to $3,260 – Marking a 48% enhance.

Trade withdrawals additionally climbed to 400k ETH, valued at $960 million, whereas netflows remained damaging and reinforcing decreased promoting stress. Traditionally, ETH surged by 20% in 2024 following related patterns, supporting a transfer in direction of $2,800 by mid-March.

If ETH holds agency above $2,351, additional upside is perhaps probably. A drop beneath $2,200, nevertheless, may point out a correction in direction of $1,444, reflecting a possible 34% decline.