- Ethereum’s change provide has plunged to its lowest stage in 9 years.

- Might this provide squeeze set off a worth surge?

The provision of Ethereum [ETH] on exchanges has dropped to its lowest stage since 2016, signaling a liquidity squeeze that helps a medium-term bullish outlook.

With sell-side stress easing and accumulation rising, may ETH reclaim the important $3.5K resistance within the close to time period?

Key technicals flash bullish

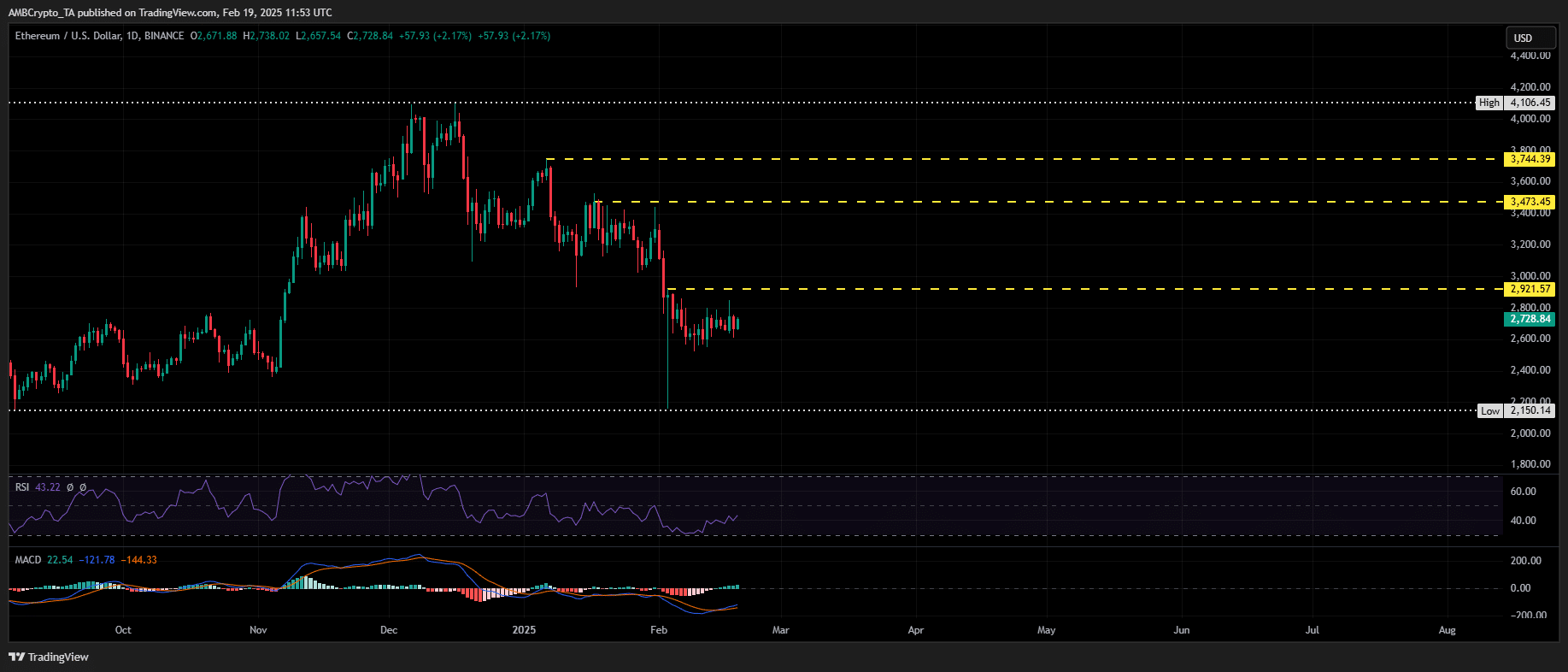

Regardless of no indicators of overheating, Ethereum stays 32% under its post-election peak of $4,016, having fashioned 4 consecutive decrease lows.

This time, nonetheless, the RSI has bottomed out, and a bullish MACD crossover is taking form – suggesting ETH’s consolidation might be constructing momentum for a breakout.

But, historic patterns counsel warning. Earlier recoveries did not breach key resistance as demand struggled to soak up promote stress.

Nevertheless, Ethereum’s spot change supply has plunged to a 9-year low of 8.2 million ETH.

With tightening liquidity and potential demand acceleration, circumstances are aligning for a provide shock – one that would gasoline a breakout previous key resistance ranges.

Mapping Ethereum’s subsequent main resistance zone

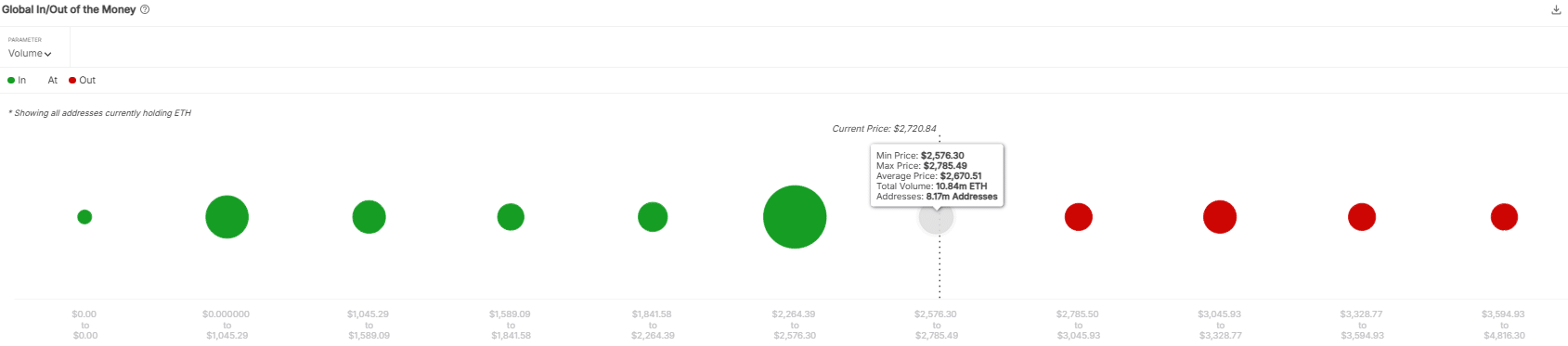

Ethereum faces a important resistance at $2,785, the place 8.10 million addresses would flip worthwhile, exposing $20 billion to potential promote stress.

Whereas spot reserves hit a 9-month low, signaling accumulation, traders offloaded over 2 million ETH into exchanges in February, elevating considerations about mounting promote stress.

Weak demand from U.S. and Korean traders additional threatens upside momentum, probably trapping leveraged longs within the futures market.

If demand fails to get better, Ethereum may face a pullback towards $2,264, the place 62.38 million ETH is concentrated.