- Ethereum confirmed regular value motion with sturdy assist, whale exercise, and cautious investor sentiment.

- Whale accumulation suggests potential for a breakout, however resistance round $2,250 stays a key hurdle.

Ethereum’s [ETH] latest value motion has been regular, however removed from uneventful. Beneath the floor, shifting investor habits and notable on-chain actions are starting to outline the present market construction.

As ETH trades inside a decent vary, accumulation patterns, whale exercise, and trade flows recommend a market at an inflection level — elevating questions on whether or not this indicators quiet power or simply non permanent stability.

Help builds, however confidence stays measured

Ethereum is sitting on a powerful pocket of investor assist between $1,886 and $1,944, the place over 3 million addresses collected 6.12 million ETH.

This cluster now represents a key psychological and technical base — if ETH slips under, it may set off broader promoting.

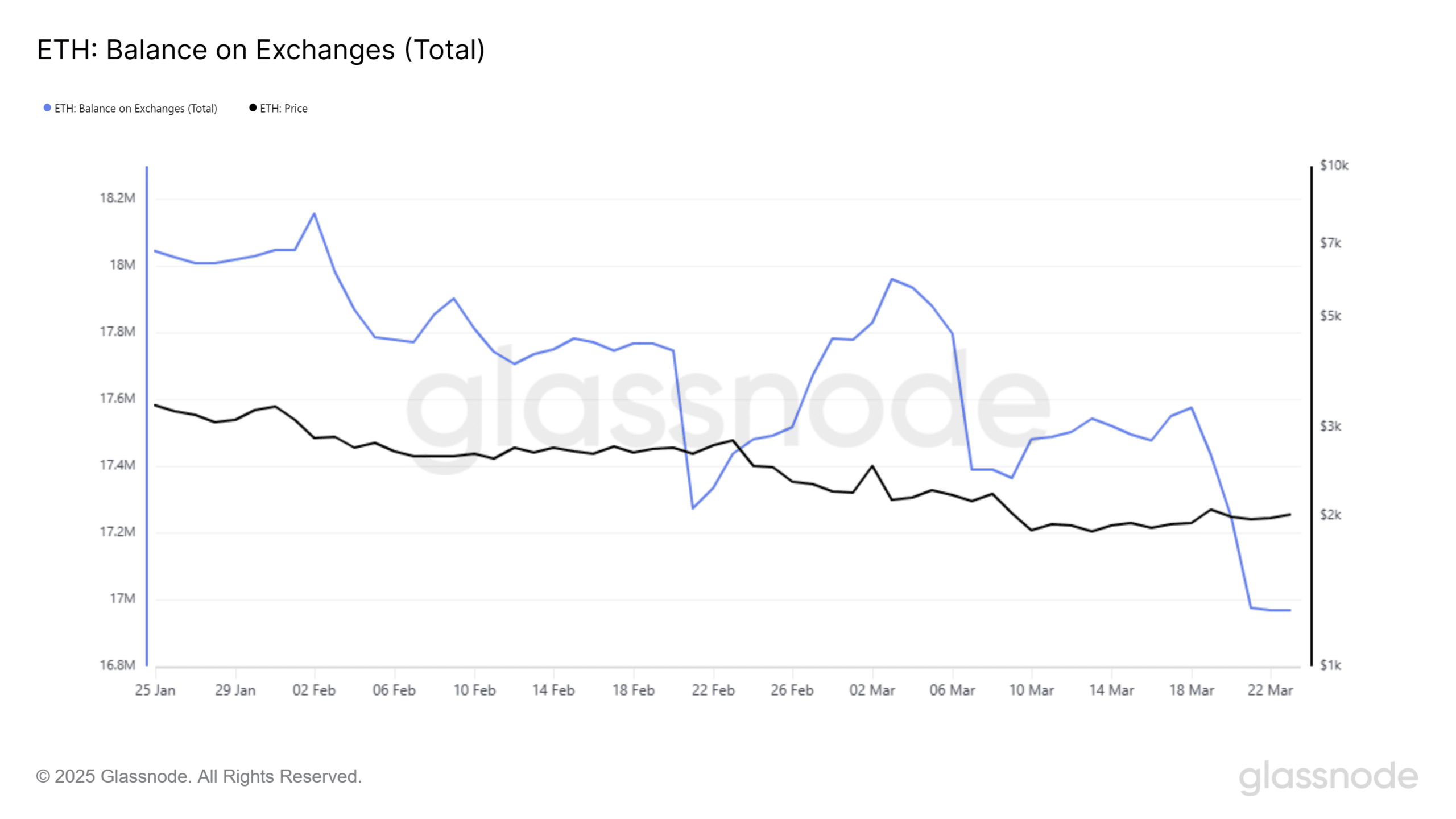

On the provision aspect, over 1.20 million ETH has quietly moved off exchanges prior to now 48 days, suggesting a drop in near-term promoting stress.

Nonetheless, value has remained largely rangebound, implying that at the same time as traders maintain, they’re not speeding to purchase both. On this setting, stability might say extra about warning than conviction.

Whale accumulation surges as ETH crosses $2K

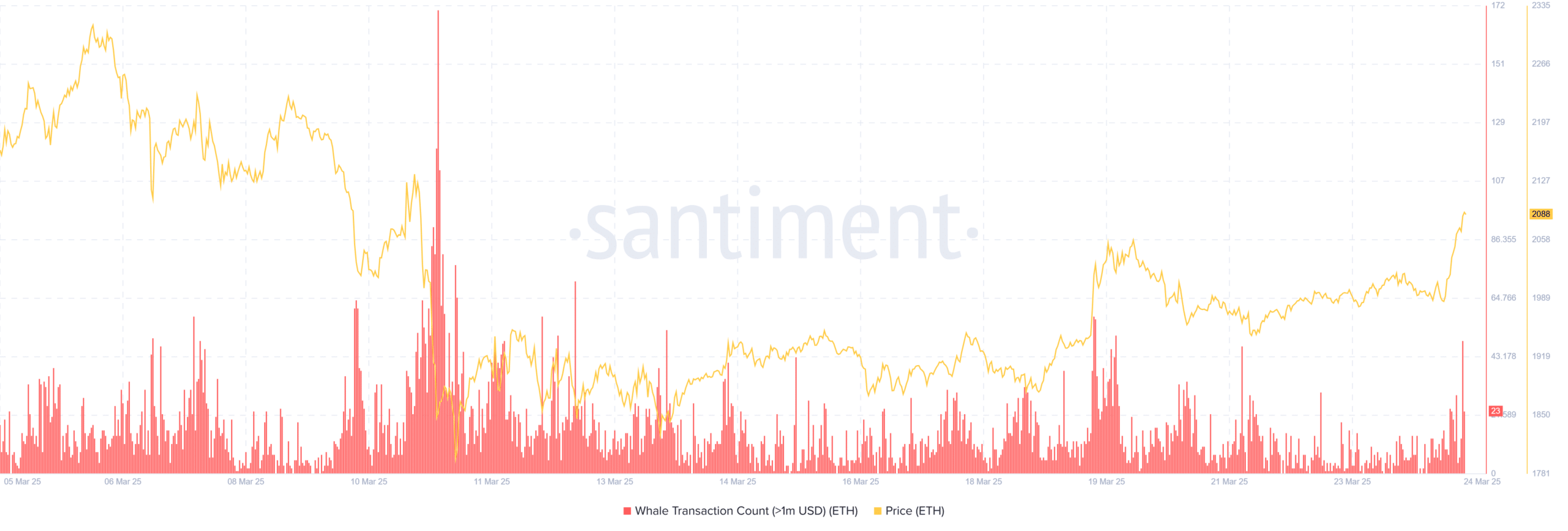

Ethereum whales have stepped up aggressively, scooping up almost 470,000 ETH over the previous week.

This surge in large-value transactions got here simply as ETH reclaimed the $2,000 mark, suggesting whales are positioning forward of a possible breakout.

Santiment knowledge confirmed a pointy uptick in whale transaction rely starting the nineteenth of March, including weight to the concept institutional and high-net-worth gamers see present value ranges as an accumulation zone, not a neighborhood high.

Ethereum value motion hints at restoration, however resistance looms

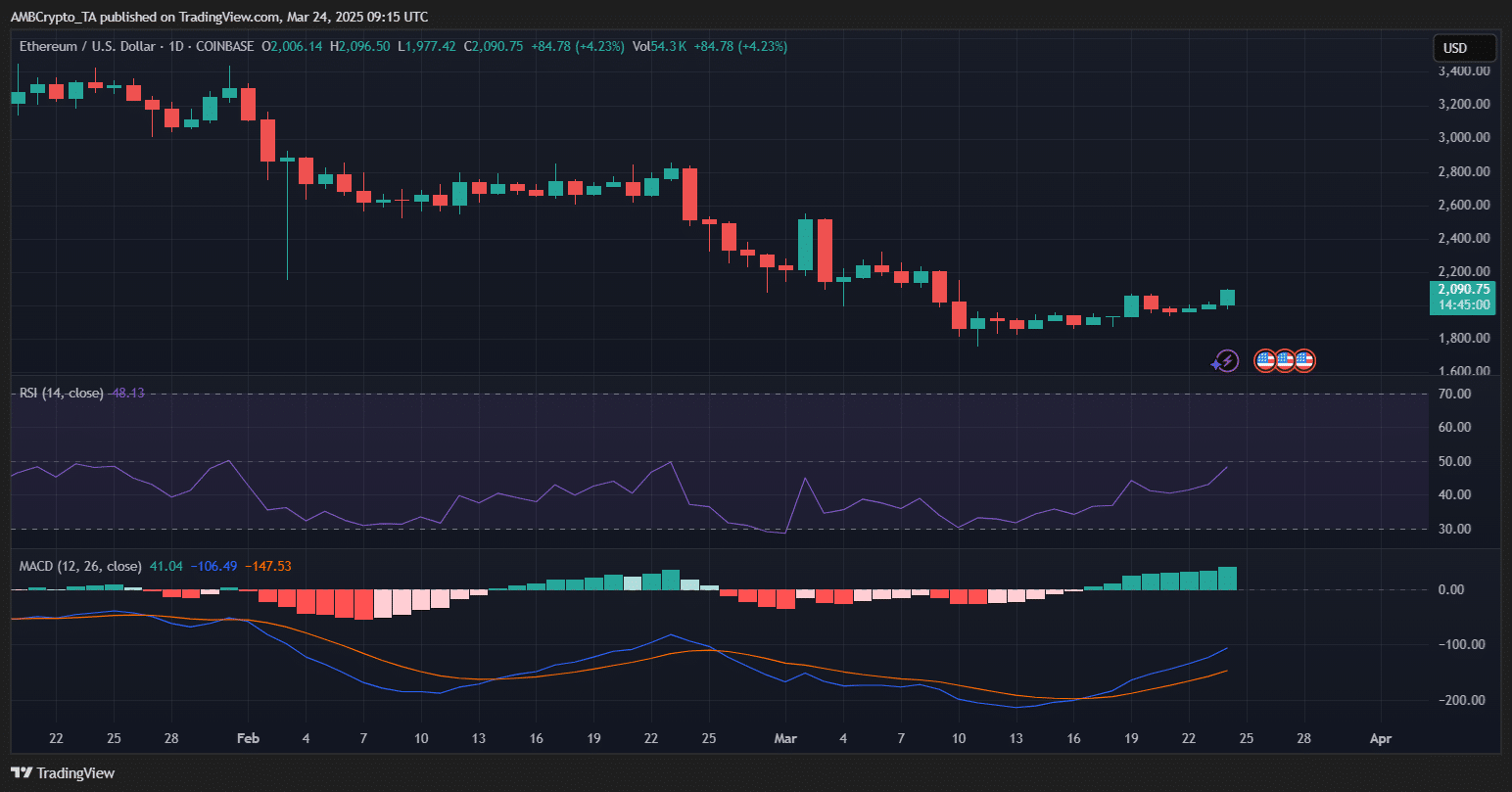

Ethereum posted a 4.23% achieve to commerce round $2,090, signaling a possible short-term restoration.

The each day chart exhibits bullish indicators starting to kind: the MACD has flipped into inexperienced territory, with the MACD line crossing above the sign line — typically seen as a bullish crossover.

Moreover, the RSI has climbed to 48.43, reflecting bettering purchaser power with out but breaching overbought situations.

Regardless of these indicators, ETH nonetheless faces resistance close to the $2,200-$2,250 vary, final seen in early March. A profitable shut above this zone may open the door to a retest of the $2,400 degree.

Nonetheless, if momentum stalls, ETH may pull again to retest $2,000 as assist.

For now, whale accumulation and bettering on-chain sentiment look like giving Ethereum the gas it wants — however a clear breakout continues to be wanted to substantiate a broader pattern reversal.