- Ethereum confirmed indicators of restoration after testing the $2,400 zone and surged by 4%, outpacing Bitcoin.

- Does this imply the altcoin may problem BTC’s dominance?

Ethereum [ETH] confirmed indicators of energy, outpacing Bitcoin with a acquire of over 4% within the final 24 hours.

Traditionally, a bullish divergence between Ethereum and Bitcoin has been a robust indicator of a worth pattern reversal for ETH.

Put merely, such divergences have incessantly led to important surges in Ethereum’s worth, with ETH typically outperforming Bitcoin throughout market volatility.

So, is historical past repeating itself? AMBCrypto investigates.

Historical past exhibits ETH outperforms in September

AMBCrypto’s evaluation of the ETH/BTC weekly chart revealed that Ethereum skilled important rallies in September 2016 and 2019, peaking round mid-September.

Coincidentally, this 12 months, the Federal Reserve is ready to chop rates of interest on the 18th of September.

Given these previous patterns, the timing of the Fed’s fee reduce is perhaps extra than simply coincidence.

Historic information means that ETH typically performs properly round this time of 12 months, and a fee reduce may present further market momentum, probably inflicting the worth to achieve the $2,800 resistance degree.

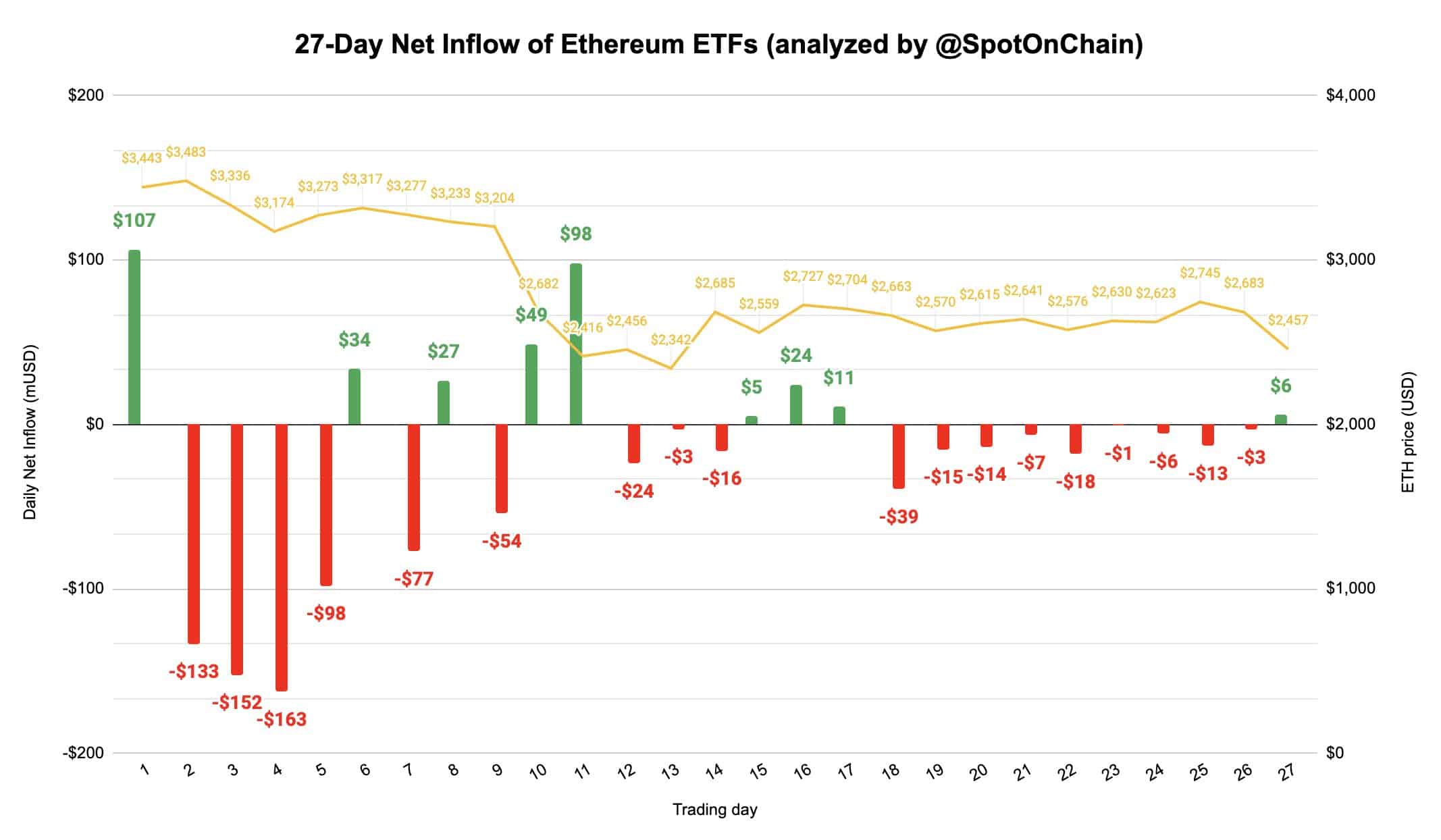

Including to the optimism, ETH’s web influx yesterday ended a 9-day outflow streak. Moreover, BlackRock’s ETHA noticed an influx of $8.4M after 5 buying and selling days with zero web flows.

In comparison with this, data confirmed that BTC’s web move remained strongly destructive for the second day.

Moreover, no U.S. Bitcoin ETFs noticed an influx yesterday, and Grayscale Mini (BTC) recorded its first-ever outflow.

In brief, this comparability reveals a stark distinction in market sentiment between ETH and BTC.

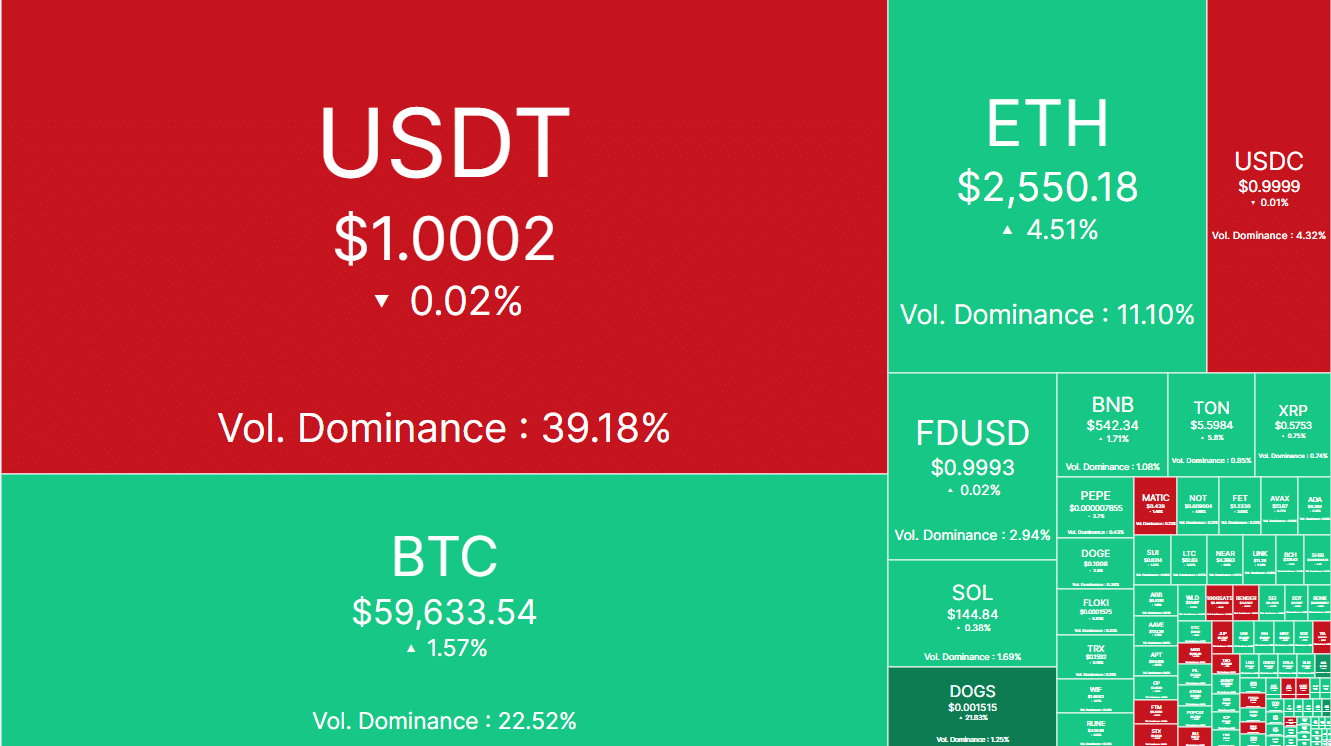

Whereas Bitcoin struggles to interrupt above the $60K resistance, Ethereum has surged roughly 4% since yesterday.

Nonetheless, AMBCrypto notes that to solidify this thesis, on-chain information should align with Ethereum’s dominance. So, does it?

Ethereum stays inferior in dominance

For the time being, Ethereum has proven indicators of restoration after testing the $2,400 zone. Analysts imagine that ETH wants to interrupt by way of the $2,600 resistance ranges for a possible rebound.

At press time, the altcoin was buying and selling at $2,550. Regardless of this, ETH trails behind BTC in quantity dominance.

A better quantity dominance for Bitcoin suggests it’s extra actively traded and has higher liquidity available in the market. Consequently, regardless of durations of bearish downturn, Bitcoin tends to rebound extra reliably.

Learn Ethereum (ETH) Price Prediction 2024-25

In distinction, Ethereum’s probabilities of restoration are extra depending on Bitcoin’s efficiency.

In different phrases, ETH market sentiment is influenced by BTC’s general efficiency. If Bitcoin declines, Ethereum is more likely to observe swimsuit, reinforcing BTC’s dominance over its counterpart.