- Specialists imagine that ETH may dip to the decrease finish of the falling wedge, at present round $2,200

- Important shopping for strain will be seen round this zone too

Regardless of favorable developments just like the introduction of an Ethereum Spot ETFs within the U.S, the world’s largest altcoin is but to hit new all-time highs.

Actually, over the previous week, ETH has declined by 6.62% on the charts. No marvel then {that a} crypto analyst is predicting that this downtrend might lengthen itself. Particularly as ETH seeks some stability earlier than a potential rally.

Falling wedge – Short-term decline, potential for large upswing

In accordance with analyst Carl Runefelt’s daily chart analysis, ETH is at present buying and selling inside a falling wedge – A sample typically resulting in a major rally after a interval of decline.

This ‘decline-to-rally’ sample sometimes emerges when the asset hits its lowest level throughout the wedge — The assist degree. For ETH, this key degree seems to be round $2,200. This can be a degree the analyst marked on the chart, one the place substantial shopping for strain will be noticed too.

The analysts believes that if ETH rebounds from this assist degree, it might see an 80.47% hike. This might doubtlessly push the altcoin to $4,000, with additional positive aspects possible too.

He added,

“As soon as a breakout happens, there’s a robust risk #Ethereum might rise again to $4K.”

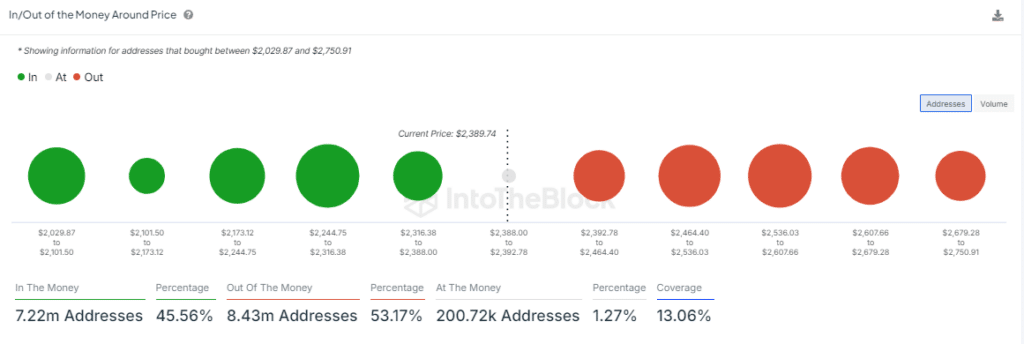

To confirm the power of the $2,200 assist, AMBCrypto carried out an evaluation of its personal.

‘In-the-Cash’ merchants anticipated to drive the rally

AMBCrypto’s evaluation utilizing IntoTheBlock’s In and Out of Cash Round Worth (IOMAP) instrument, which identifies key assist and resistance ranges by highlighting the place important asset holdings are concentrated, revealed that the $2,200 zone is a key space for purchasing strain.

In accordance with the IOMAP, a serious assist degree is at $2,218.93, the place over 1.59 million ETH is held in revenue by addresses. This might act as important shopping for strain if ETH’s worth drops to this degree.

Nonetheless, the IOMAP additionally steered that ETH may not fall as little as $2,218.93, earlier than reversing. There’s a robust risk of a reversal round $2,281, the place over 2.17 million consumers maintain a mixed complete of 1.01 million ETH.

Moreover, Hyblock’s cumulative liquidation level delta revealed a adverse delta. Merely put, the next variety of quick positions in comparison with lengthy positions, indicating a bearish market development.

Additional decline possible for ETH

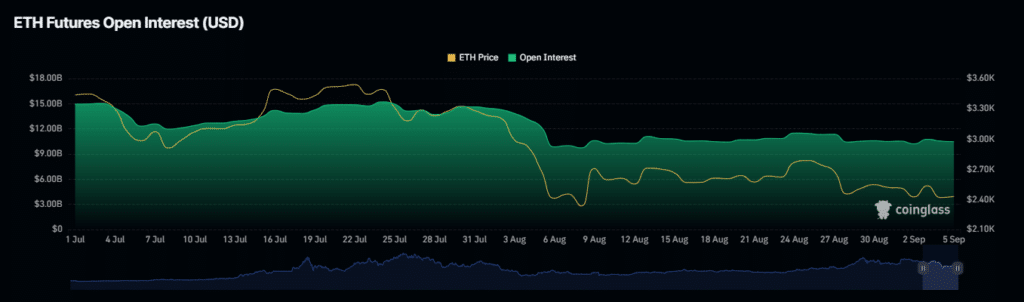

Taking a step additional, AMBCrypto’s evaluation steered that ETH may be approaching a decline.

This assertion will be supported by a notable drop within the OI-weighted funding charge — recorded via Coinglass. It fell from 0.0043% on 4 September to 0.0023% at press time.

The OI-weighted funding charge adjusts the funding charge based mostly on the asset’s Open Curiosity, indicating that retail traders are keen to drive ETH’s worth decrease.

If this decline continues, a fall to the $2,200 assist zone will develop into more and more possible.