Ethereum has been struggling to regain momentum, buying and selling under the vital $2,800 mark since final Thursday. Bulls are in hassle as the value stays trapped underneath key provide ranges, leaving traders involved about Ethereum’s short-term future. Many who anticipated a bullish 12 months for the second-largest cryptocurrency at the moment are questioning their outlook after final week’s large promoting strain took ETH from $3,150 to $2,150 in lower than two days.

Associated Studying

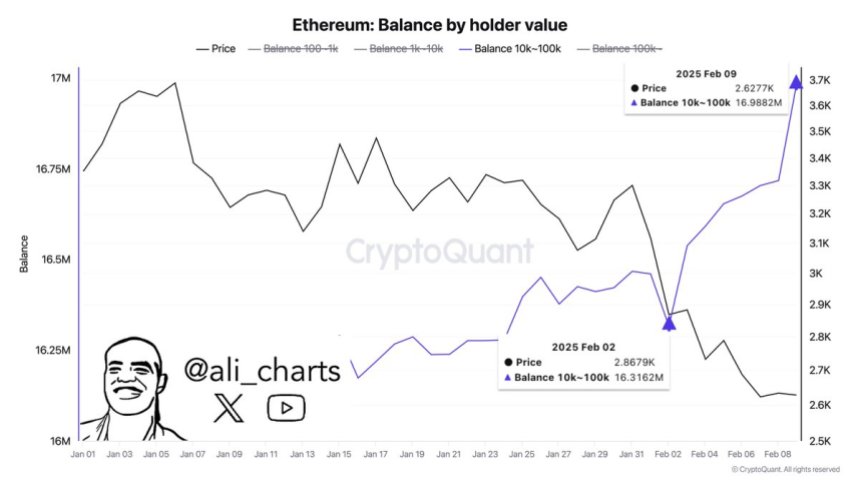

The latest value motion has amplified worry and uncertainty amongst retail traders, with many persevering with to promote amid the market turbulence. Nevertheless, on-chain metrics inform a distinct story, signaling rising confidence from bigger gamers. Key information shared by prime crypto analyst Ali Martinez reveals that whales have amassed over 600,000 Ethereum prior to now week, whilst retail traders stay cautious. This divergence highlights a vital pattern out there—retail traders seem scared and reactive, whereas large gamers are quietly shopping for up ETH at discounted costs.

Because the market grapples with indecision and volatility, this accumulation by whales might set the stage for a major shift in momentum. If bulls handle to reclaim the $2,800 and $3,000 ranges, Ethereum could start a restoration rally. For now, all eyes are on whether or not the divergence will result in a turning level in ETH’s value motion.

Ethereum Buyers Are Divided: Retail Fears Vs. Whales Belief

Ethereum stays in a difficult place after final week’s dramatic sell-off, which noticed the value drop from $3,150 to $2,150 in lower than 48 hours. Regardless of a robust restoration again into the $2,700 vary, ETH has struggled to reclaim key provide ranges, leaving many traders cautious. The value stays trapped under essential resistance at $2,800, with bulls needing to push above the $3,000 mark to shift the bearish pattern and regain market confidence.

Key metrics shared by crypto analyst Ali Martinez reveal a promising pattern amidst the uncertainty. Whales have amassed over 600,000 Ethereum prior to now week, signaling robust shopping for exercise from large gamers.

This accumulation pattern is a stark distinction to the cautious conduct of retail traders, lots of whom proceed to promote amid worry and uncertainty. The divergence between whale accumulation and retail promoting suggests that giant traders stay optimistic about Ethereum’s long-term prospects, whilst short-term value motion stays shaky.

Associated Studying

This whale exercise provides hope to traders who imagine Ethereum nonetheless has the potential to surge this 12 months. A breakout above $3,000, which aligns with the 200-day shifting common, might mark a major turning level for ETH, sparking a rally towards larger value ranges. Till then, ETH stays in a vital part because it navigates between bearish strain and the potential for restoration.

ETH Worth Motion: Key Ranges To Reclaim

Ethereum is at the moment buying and selling at $2,620, trying to reclaim the $2,700 mark because it battles towards key provide ranges. Bulls are underneath strain to interrupt by resistance at $2,800 and $3,000, as reclaiming these ranges would signify a reversal of the day by day downtrend that has continued since late December. The $3,000 mark holds explicit significance, because it aligns with the 200-day shifting common, a broadly watched indicator that alerts long-term power when costs maintain above it.

A profitable push above the $3,000 degree might ignite a robust rally, with Ethereum concentrating on larger value ranges rapidly. Such a transfer would restore confidence out there and sign a possible bullish pattern for ETH, which has struggled to regain its footing following final week’s dramatic sell-off.

Associated Studying

Nevertheless, if Ethereum fails to carry above the $2,600 mark, the outlook turns into bearish. A breakdown under this degree might open the door to additional declines, with ETH probably testing decrease demand zones within the coming days. The market stays at a vital juncture, and Ethereum’s potential to reclaim and maintain key ranges will decide its short-term route as traders intently monitor the subsequent strikes.

Featured picture from Dall-E, chart from TradingView