- ETH was down 3.95% over the previous 24 hours.

- Ethereum whales have offered 684.1k ETH tokens over the previous day.

Over the previous three weeks, Ethereum [ETH] has remained caught as costs proceed to commerce inside a parallel channel. Over this era, ETH has traded between $2.4k and $2.7k.

This value stagnation has left most holders impatient and have began to promote — the rising promoting exercise has unfold even amongst long-term whales.

In reality, as per on-chain analyst @ai_9684xtpa, two dormant and outdated whales have began to dump their ETH holdings. Over the previous day, the 2 whales have offered a complete of 1.546.67 ETH.

One whale deposited 959.69 ETH price $2.54 million to OKX. After this accretion, this whale nonetheless holds 50,704 ETH tokens price $132 million.

The second whale offered 587 ETH price $1.56 million by means of Kraken. This whale has been promoting since March, having offloaded 14,398 ETH price $28.47 million.

The 2 deposits haven’t occurred in isolation however inside a broader promoting spree amongst whales. Over the previous day, Ethereum whales have offloaded a complete of 684.1k ETH tokens.

This alerts a large alternate outflow.

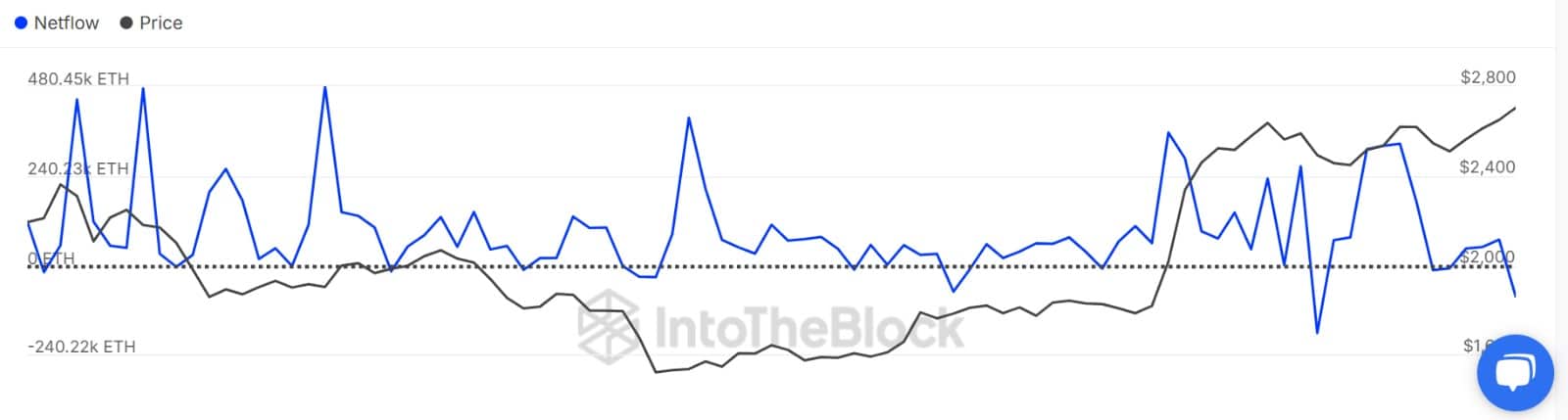

As such, giant holders’ netflow has dipped to unfavourable territory, hitting -83.5k. When a big holder’s netflow hits a unfavourable worth, it signifies that whales have offered greater than they’ve purchased.

Thus, there’s extra capital outflow, reflecting a robust insecurity from giant holders.

Along with the rising promoting exercise from whales, the Ethereum market has been taken over by sellers. Taker’s buy-sell ratio, sellers have dominated, with the metric dropping to a weekly low.

When this metric drops to a unfavourable worth, it means that sellers are outpacing patrons.

This promoting exercise has seen the alternate provide ratio surge to a weekly excessive. This not solely arises from elevated promoting exercise, but additionally dangers additional promote stress.

Oversupply results in decrease costs if demand drops.

Affect on ETH

Undoubtedly, the rising promoting exercise throughout the market has negatively affected Ethereum’s value motion, which dropped 3.95% during the last day till press time.

Due to this fact, a continuation of the present promoting exercise might see ETH breach the consolidation vary and drop to $2324.

Nonetheless, if the market manages to soak up the sell-side stress, the altcoin will proceed to carry throughout the vary and commerce between $2.4k and $2.7k. A breakout from this zone will want a cooldown in promoting exercise.