- Analysts predict a 200% value surge for Ethereum based mostly on historic chart patterns and cycles.

- Liquidity flows again to Ethereum, strengthening assist and positioning for a possible rally.

Regardless of Ethereum’s [ETH] comparatively muted efficiency just lately, analysts are pointing to indicators {that a} main value surge may very well be imminent.

With technical indicators and market habits aligning in a means that has traditionally preceded vital rallies, some specialists are predicting a possible 200% improve in worth.

As we enter February — usually a powerful month for ETH — many are questioning if this marks the start of the following huge rally for the coin.

Ethereum: Potential for 200% surge

ETH’s current chart patterns have ignited hypothesis amongst analysts a few potential rally. Observing the ETH/BTC pair, specialists are noting parallels with 2021’s explosive run, which delivered a 180% achieve in simply two months.

The information suggests Ethereum could also be poised for an additional related surge, with the present cycle resembling historic accumulation zones adopted by breakout rallies.

A potential 200% rally isn’t out of the query, notably as ETH approaches the four-year cycle pivot, which has traditionally marked the beginning of serious upward developments.

The four-year cycle

Ethereum has exhibited notable cyclical patterns, notably in 2017 and 2021, the place it skilled vital value surges.

In 2017, ETH’s value elevated by roughly 9,380%, reaching round $881.94 by year-end.

Equally, in 2021, ETH’s market capitalization surpassed $250 billion for the primary time, indicating substantial development.

These historic developments counsel a sample of serious development roughly each 4 years.

As we strategy the following cycle, analysts are contemplating whether or not ETH is poised for an additional substantial rally, probably validating predictions of a 200% improve.

Liquidity flows again to Ethereum

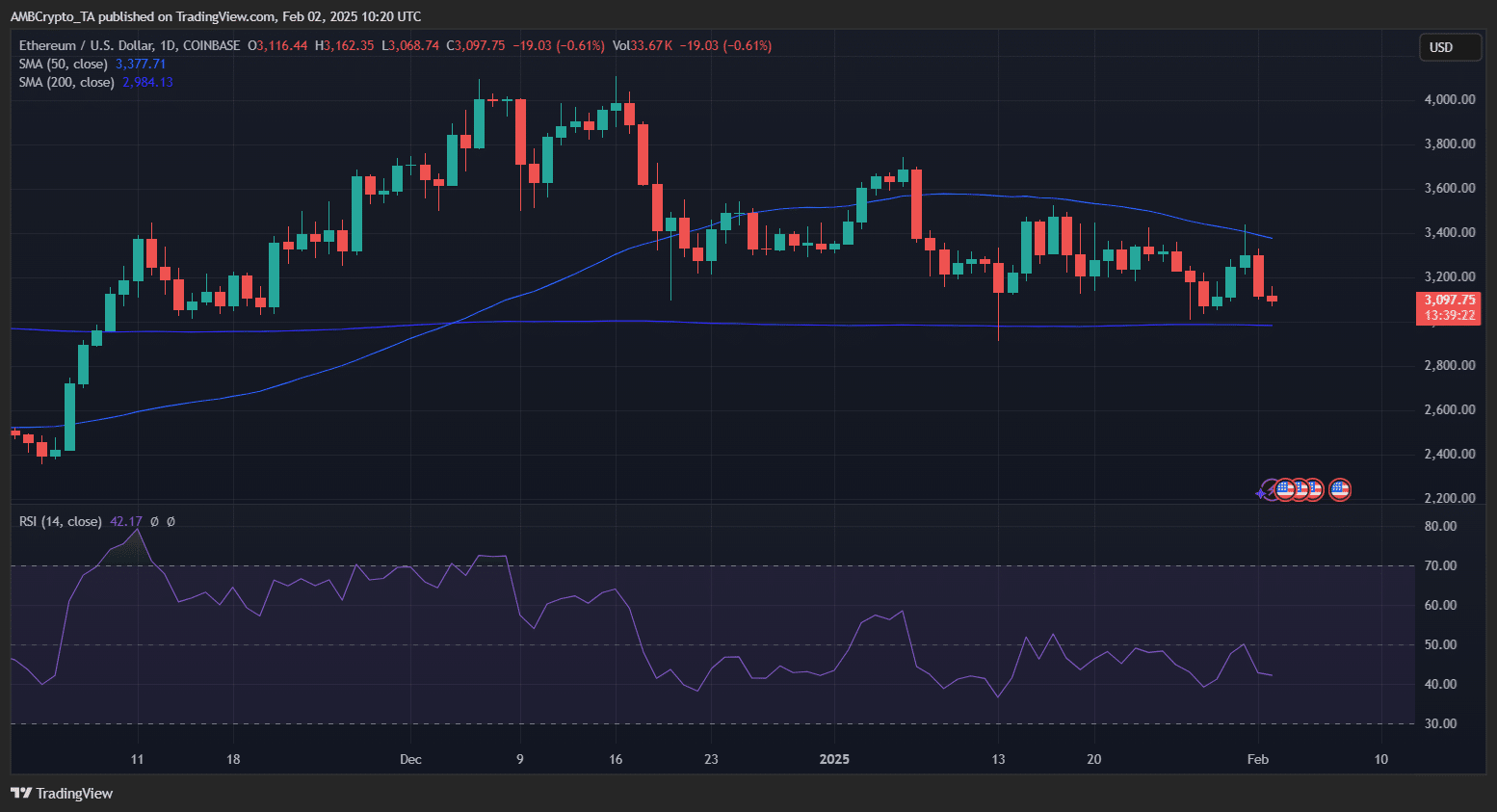

Ethereum’s short-term value motion showcased a wrestle to keep up ranges above $3,100, with RSI close to the oversold territory at 42.17, hinting at potential accumulation.

The 50-day SMA remained above the 200-day SMA, signaling residual bullish momentum — however the hole is narrowing.

Ethereum was holding its important assist close to $2,984, a decisive degree that might dictate the following transfer.

Learn Ethereum’s [ETH] Price Prediction 2025-26

In the meantime, liquidity developments favor Ethereum as capital flows back from Solana. Over the previous 24 hours, Solana has bridged 4x extra capital to Ethereum than vice versa, signaling renewed investor confidence in ETH.

This inflow of liquidity may function a tailwind, supporting Ethereum’s protection of present ranges whereas positioning it for a possible rebound.