- Ethereum must flip $1895 for a possible rally to $2k.

- Conviction patrons have dominated the market, with the RSI holding at 80.

Over the previous three days, Ethereum [ETH] has skilled a robust upswing, rising from $1.5k to surpass the extremely awaited stage of $1.8k.

Conviction patrons primarily drive the newest uptick, in response to Glassnode.

As such, Ethereum’s provide mapping exhibits that momentum patrons haven’t made any main transfer, whereas conviction patrons have been energetic since late March 2025.

This cohort has seen an enormous uptick in its RSI, which nonetheless holds at 80, signaling sturdy dominance. In contrast, sellers—who peaked across the sixteenth of April, noticed their RSI drop sharply to 50.

The constructive imbalance right here means that conviction patrons are presently holding sturdy and anticipate markets to rally to greater ranges.

Market cap expands as resistance thins forward

With conviction patrons pushing Ethereum above $1.8k, the altcoin noticed an uptick in its market cap, rising by 12%, reaching $219 billion.

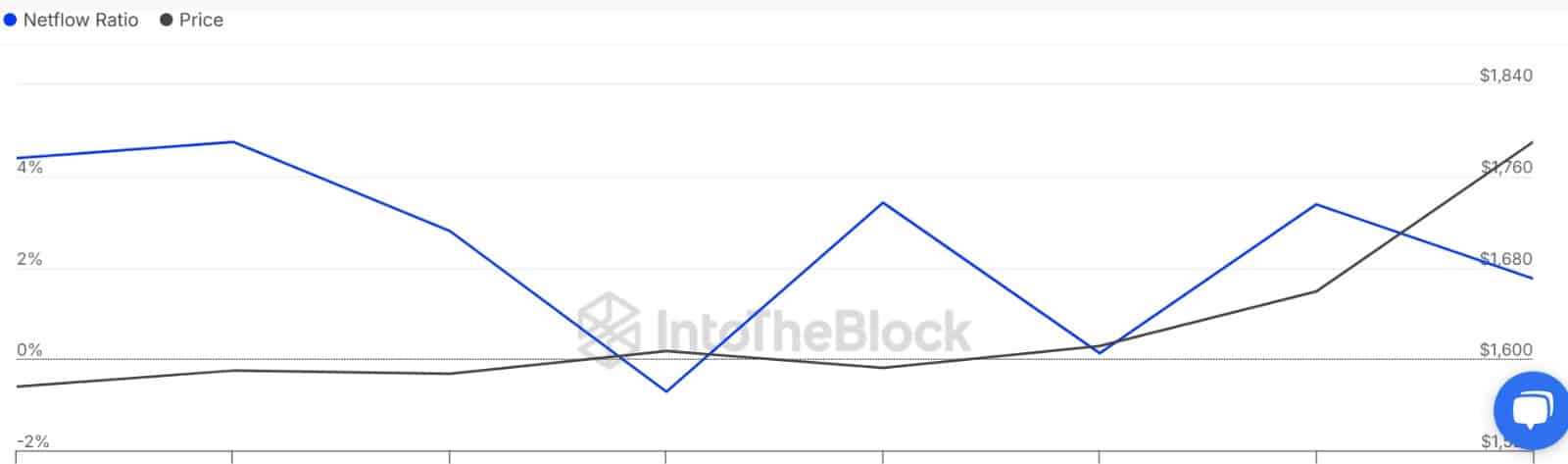

With this uptick, on-chain information exhibits solely modest resistance forward. The latest worth pump has left analysts eyeing a serious transfer. Inasmuch so, in response to IntoTheBlock, the subsequent vital promote wall is round $1860.

If that zone provides means, Ethereum may make a transfer again towards the psychological $2k stage.

Is a transfer towards $2k believable for ETH?

Based on AMBCrypto’s evaluation, Ethereum is seeing sturdy natural demand construct, signaling a possible transfer to the upside.

For starters, taking a look at sellers out there, they’ve virtually disappeared and are outweighed by patrons.

The truth is, indicators of natural demand are in all places.

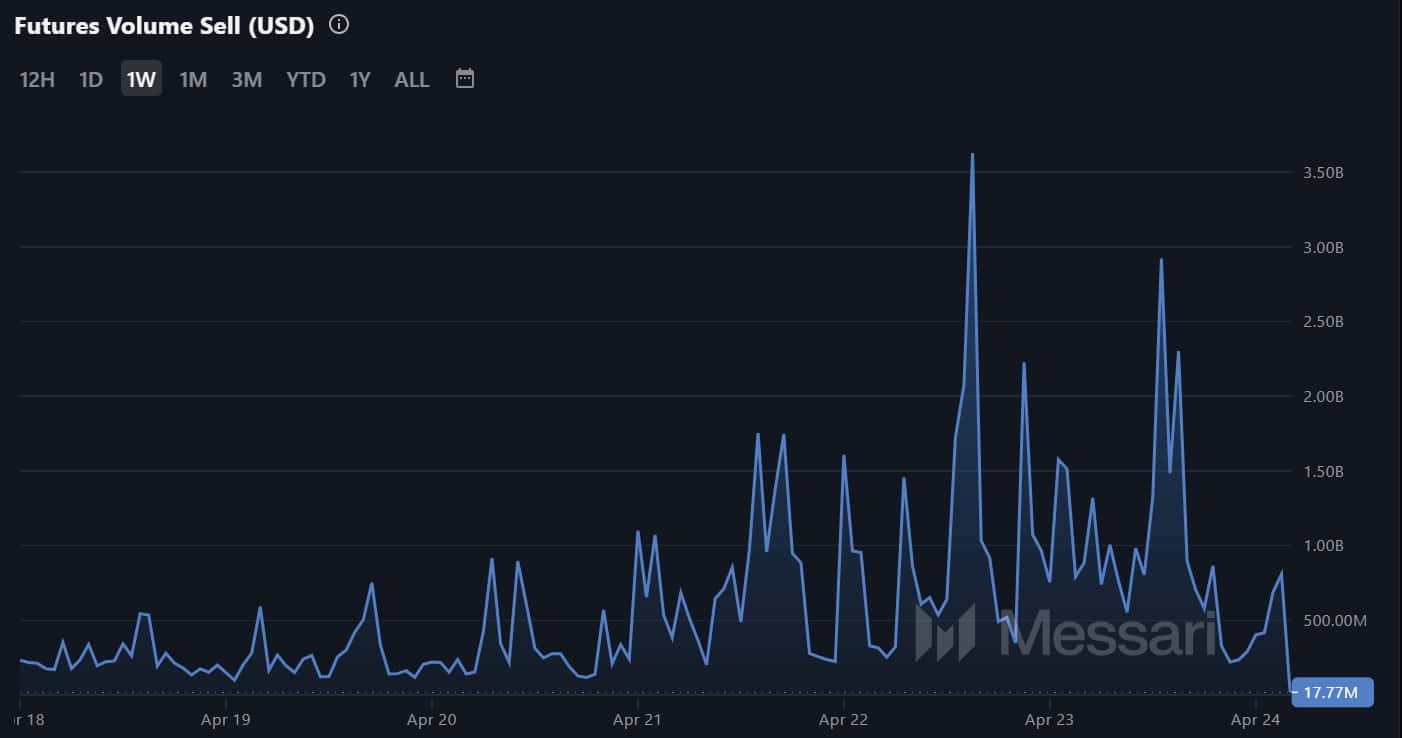

Futures Quantity Promote has declined to $17.7 million over the previous week, whereas purchase quantity is $20 million, a distinction of $3 million.

On prime of that, whales aren’t exiting.

As a result of ETH Massive Holders Netflow to Change Netflow Ratio has declined to 1.76%. A drop right here signifies that whales are sending much less ETH into alternate, reflecting accumulation habits from giant holders.

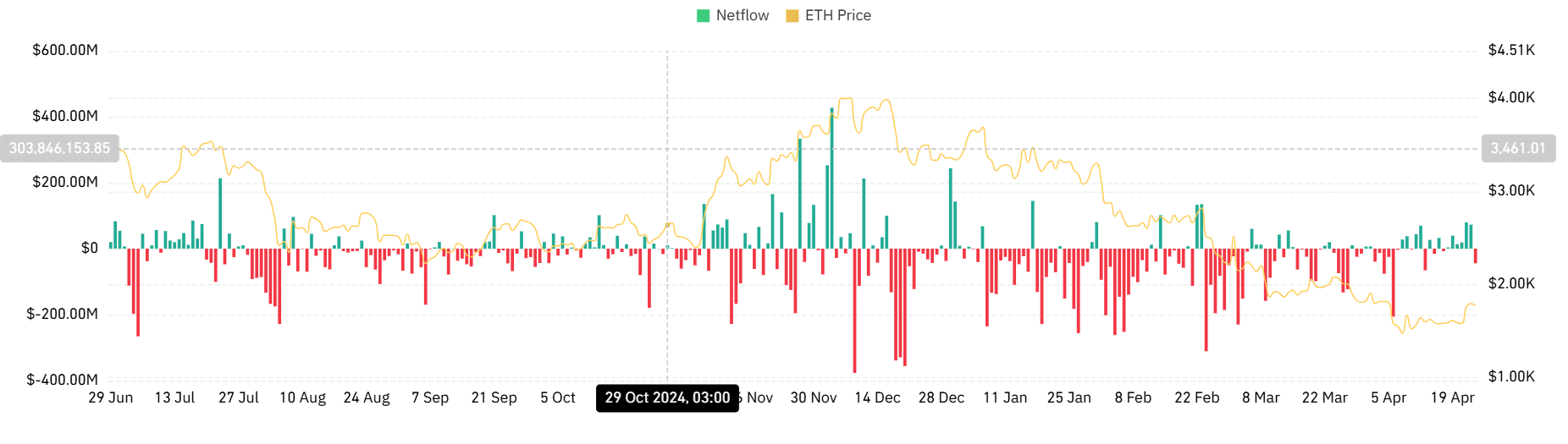

Lastly, Ethereum’s Spot Market has cooled down and ETH is recording damaging alternate netflow.

Over the previous day, Netflow has dropped to -$44.4 million, after six days of consecutive constructive netflow.

Such an enormous shift means that traders are presently shopping for greater than they’re promoting reflecting an accumulation pattern.

ETH should reclaim $1.8K to maintain the rally alive

Having mentioned that, ETH nonetheless wants to carry above $1.8K for this bullish setup to remain intact.

Based on Glassnode, if worth flips the $1,895 cost-basis cluster—the place 1.64 million ETH is concentrated—a clear run towards $2K is probably going.

Nevertheless, if bulls lose steam right here, ETH dangers revisiting the $1.6K help zone.