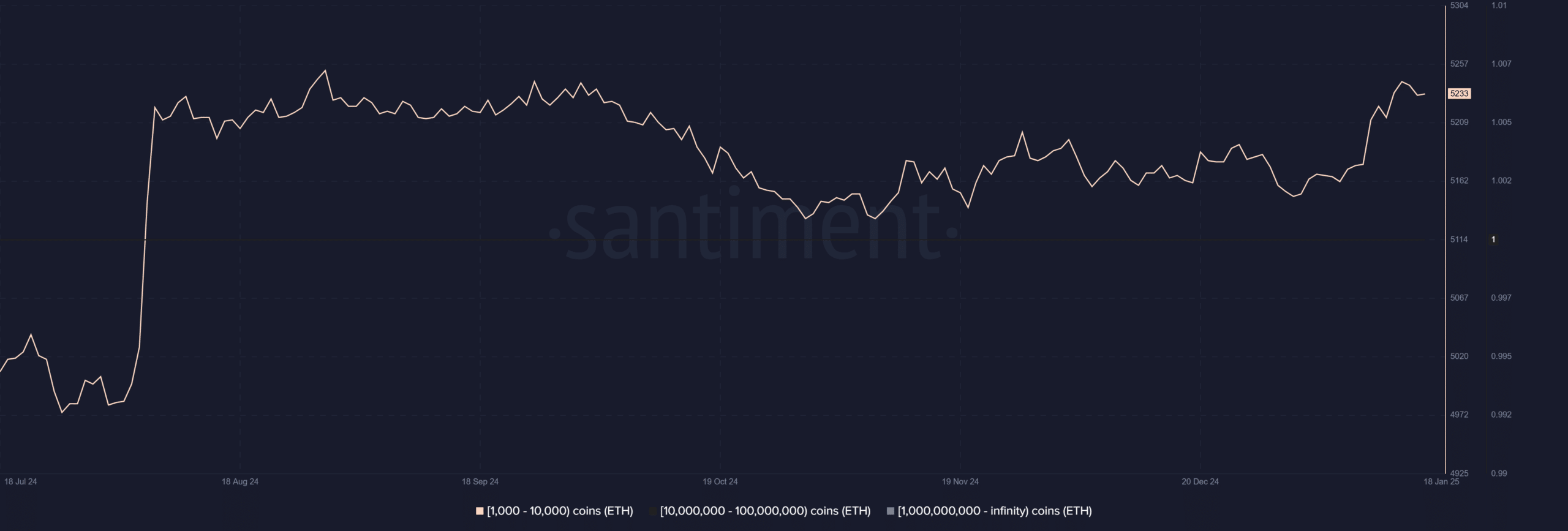

- Whale sentiment hit a 6-month excessive as addresses holding 1,000-10,000 ETH elevated their positions

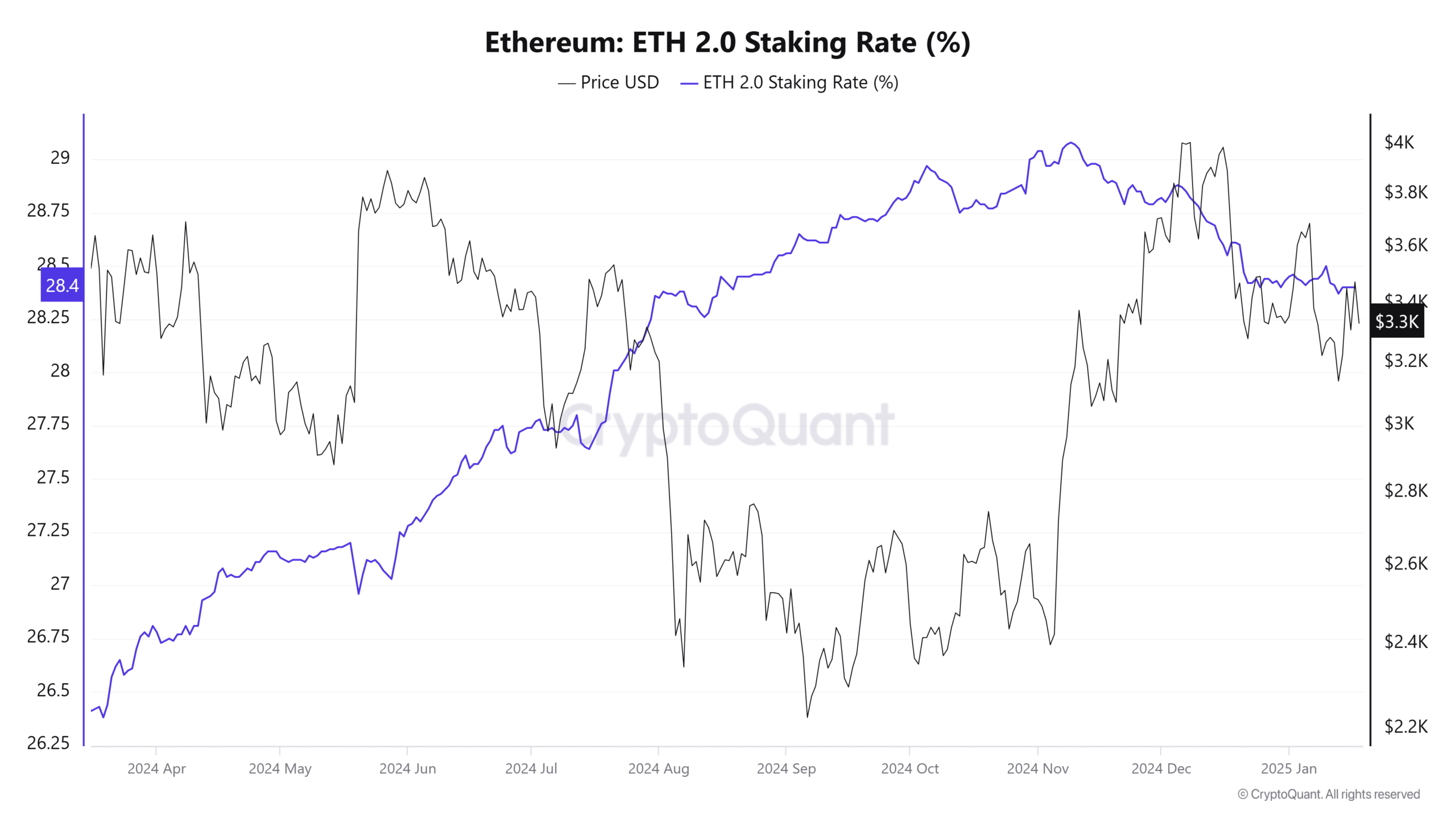

- ETH’s staking price has climbed steadily from 26.25% to twenty-eight.4% since early 2024

In a big shift reshaping Ethereum’s possession panorama, whale addresses have expanded their management to roughly 43% of the overall ETH provide. This marks a dramatic hike from a 22% share in early 2023, in accordance with IntoTheBlock’s knowledge.

In reality, massive holders have collected over 330,000 ETH (Valued at greater than $1 billion) prior to now week alone, with many now leveraging staking alternatives to strengthen their positions.

A dive into Ethereum’s whale habits

When analyzing the Santiment index for addresses holding between 1,000-10,000 ETH, the focus sample turns into extra pronounced.

The evaluation confirmed it has reached its highest ranges since August 2024. On-chain knowledge additionally revealed that these addresses have maintained constantly excessive sentiment, regardless of market volatility – An indication of sturdy conviction of their accumulation technique.

The newest surge in whale addresses coincided with Ethereum’s value stability above $3,000, indicating strategic positioning forward of potential market actions.

This uptick in confidence additionally corresponded with institutional staking participation – An indication of a strategic strategy to accumulation.

Ethereum staking panorama amplifies focus

Ethereum‘s staking price has proven exceptional resilience, climbing from 26.25% in early 2024 to holding regular at 28.4% at press time.

This upward trajectory has endured, regardless of important value fluctuations between $2,200 and $3,800, demonstrating long-term holder conviction. On the time of writing, over 34 million ETH have been staked.

Supporting this whale accumulation pattern, staking knowledge from Dune Analytics revealed a extremely concentrated ecosystem.

Coinbase leads centralized trade staking with 3.27 million ETH (39.24% market share), adopted by Binance with 2.14 million ETH (25.73%) and Kraken with 886,625 ETH (10.61%). What this focus means is that simply three exchanges management over 75% of all exchange-staked ETH.

The liquid staking sector is much more placing, the place Lido has emerged because the dominant power with 9.59 million ETH staked – Commanding an amazing 89.49% market share.

Market implications

The convergence of whale accumulation and staking focus raises essential questions on market dynamics. With over $1 billion price of ETH collected in per week and main establishments controlling important staked positions, the market has proven indicators of larger institutional entrenchment.

Whereas institutional involvement brings stability and legitimacy, the rising focus of energy raises considerations about market manipulation dangers and community decentralization. The latest $1 billion accumulation by whales and their important staking presence might have an effect on market liquidity and value discovery mechanisms too.

– Reasonable or not, right here’s ETH market cap in BTC’s phrases

Lastly, aggressive whale accumulation and concentrated staking positions hinted at a maturing market construction. By extension, it confirmed that institutional gamers have been establishing long-term strategic positions.