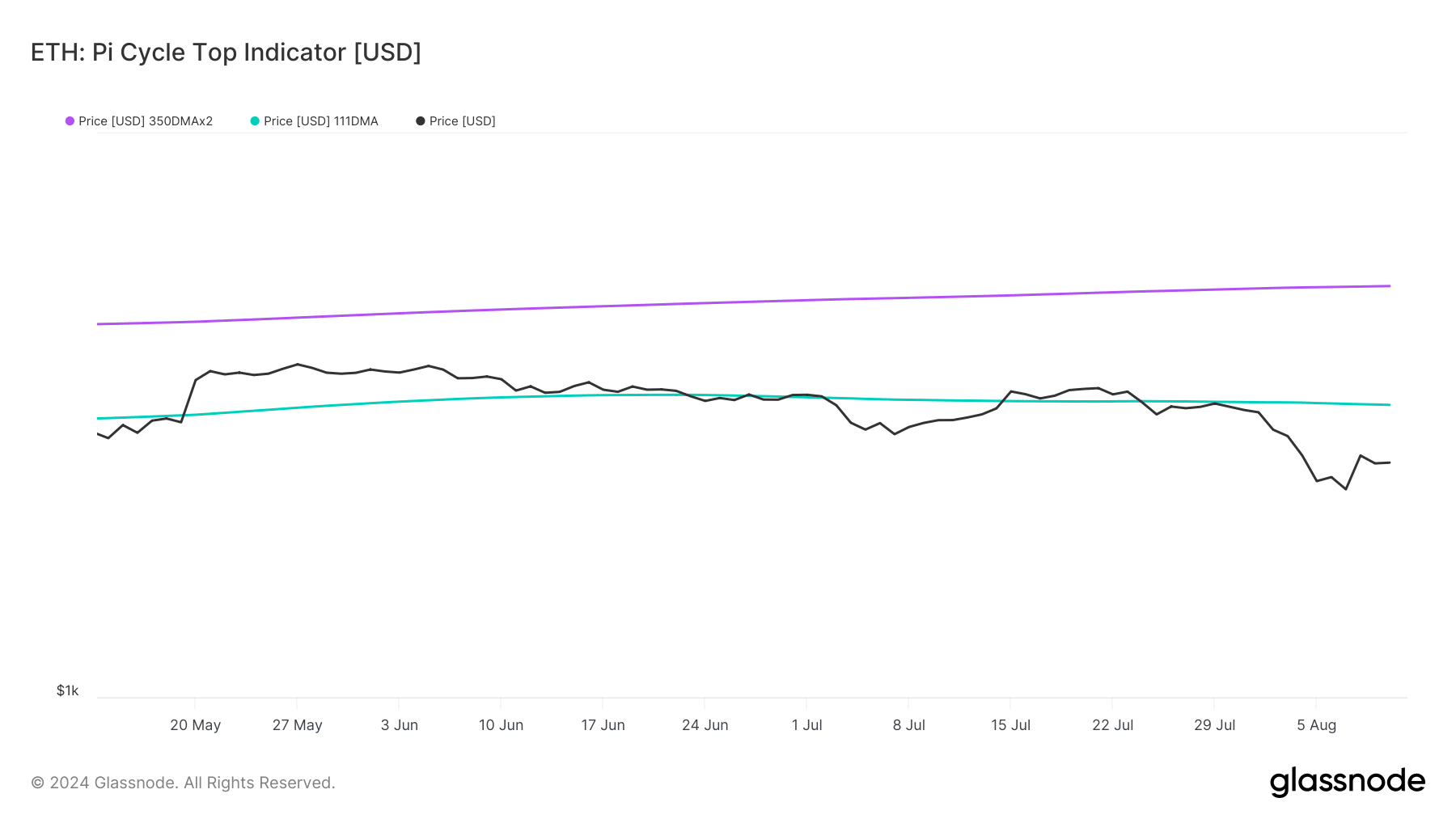

- The Pi Cycle Prime indicator revealed that ETH’s potential market backside was at $3k.

- Most metrics appeared bullish on ETH, however just a few market indicators recommended in any other case.

After per week of almost double-digit worth drops, Ethereum [ETH] confirmed indicators of restoration up to now 24 hours. In truth, if the newest knowledge is to be thought of, then ETH would possibly quickly showcase a large bull rally if it manages to reclaim a selected mark.

Let’s have a more in-depth take a look at what’s occurring.

Bulls are buckling up

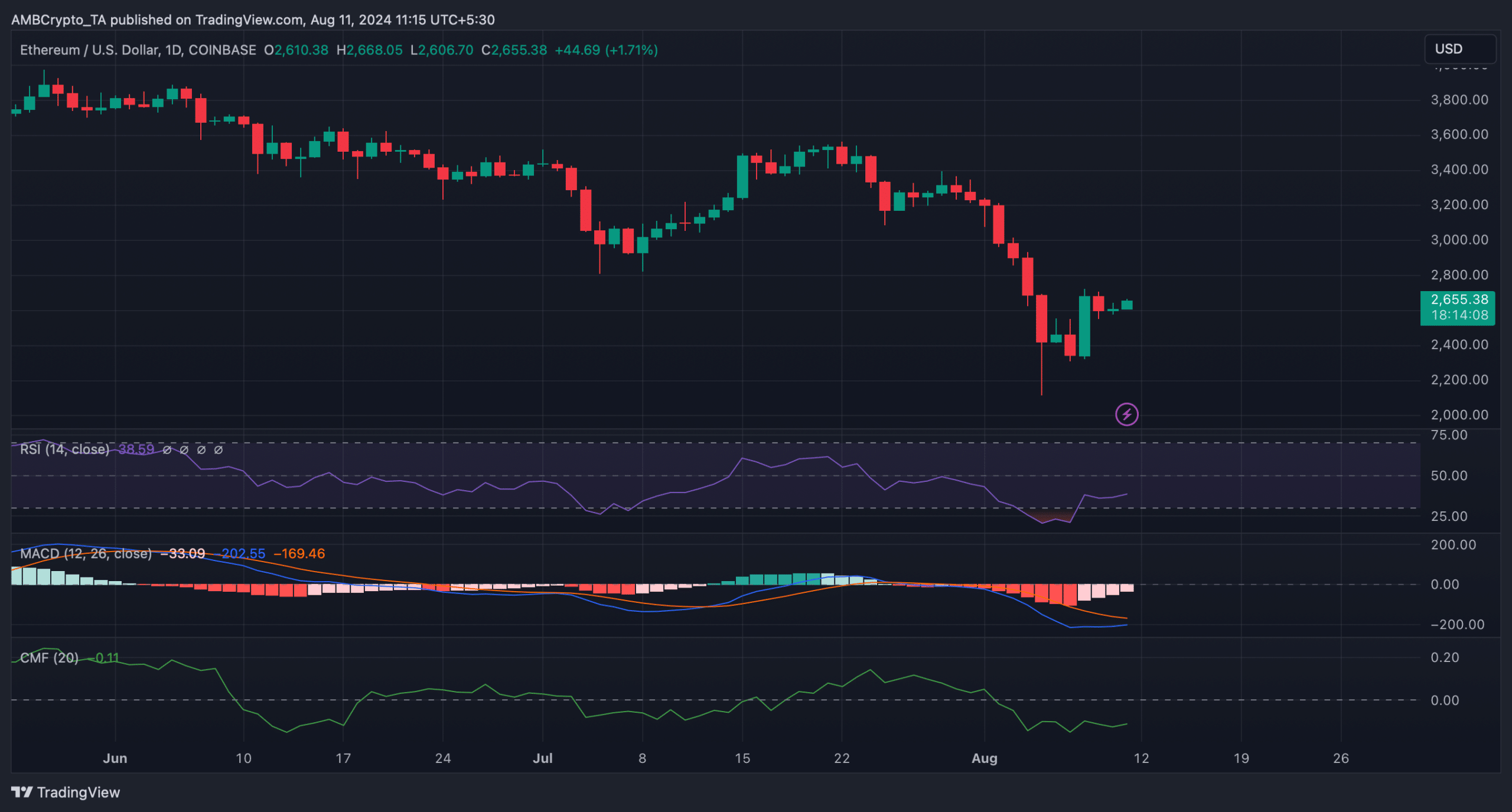

As per CoinMarketCap’s data, Ethereum’s worth dropped by greater than 8% within the final week. Issues took a U-turn within the final 24 hours because the king of altcoins’ worth surged by 1.7%.

On the time of writing, ETH was buying and selling at $2,650 with a market capitalization of over $318 billion.

Whereas that occurred, Crypto Tony, a well-liked crypto analyst, lately posted a tweet highlighting an fascinating replace. As per the tweet, if ETH reclaims $2,850, then ETH would possibly get again on observe and would possibly even start a recent bull rally.

Odds of ETH reclaiming $2,850

AMBCrypto evaluation of Glassnode’s knowledge revealed an fascinating metric. ETH’s Pi Cycle Prime indicator revealed that ETH has been buying and selling nicely beneath its potential market backside of $3k.

Due to this fact, it appeared more likely for the king of altcoins to reclaim $2,850. If the metric is to be believed, then ETH had a market high of over $5.3k.

We then took a take a look at CryptoQuant’s data to raised perceive what to anticipate from the token. We discovered that its trade reserve was dropping, which means that purchasing strain was sturdy.

Its Coinbase premium was inexperienced, indicating that purchasing sentiment was dominant amongst US buyers. Its switch quantity additionally elevated within the final 24 hours, which was bullish.

Aside from these, issues within the derivatives market additionally appeared fairly optimistic. For instance, ETH’s taker purchase/promote ratio revealed that purchasing sentiment was dominant within the derivatives market.

Extra purchase orders have been stuffed by takers. Furthermore, one other bullish metric was the funding fee, which was rising.

The technical indicator MACD additionally displayed the opportunity of a bullish crossover, additional suggesting a continued worth improve.

Learn Ethereum (ETH) Price Prediction 2024-25

Nonetheless, the Relative Energy Index (RSI) moved sideways.

The Chaikin Cash Move (CMF) had a price of -0.11, which means that it was nicely below the impartial mark. Each the RSI and CMF indicated that buyers would possibly witness just a few slow-moving days forward.