Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

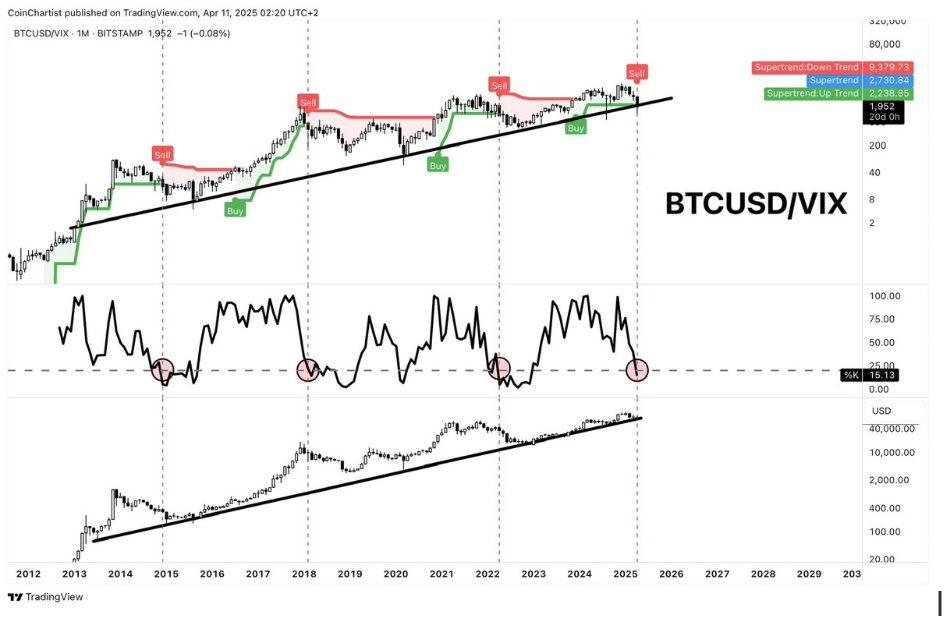

Technical knowledgeable Tony Severino has warned that the Bitcoin/VIX just isn’t as bullish as market contributors would possibly consider. As an alternative, the knowledgeable revealed that the present indicators level to the flagship crypto being in a bear market.

Bitcoin/VIX Factors To A Bear Market: Analyst

In an X post, Severino warned that the Bitcoin/VIX isn’t bullish as some crypto influencers would possibly paint it out to be. He remarked that the technical evaluation of it means that the present indicators are what market contributors are likely to see throughout Bitcoin bear markets. Nonetheless, the knowledgeable famous that the month isn’t over but, which means that these indicators might nonetheless flip bullish.

Severino beforehand highlighted a number of the explanation why he’s not bullish on Bitcoin and different crypto belongings. Again then, he alluded to BTC’s chart, which, primarily based on the Elliott Wave theory and different technical indicators, confirmed that the flagship crypto has doubtless topped on this market cycle.

Severino beforehand highlighted a number of the explanation why he’s not bullish on Bitcoin and different crypto belongings. Again then, he alluded to BTC’s chart, which, primarily based on the Elliott Wave theory and different technical indicators, confirmed that the flagship crypto has doubtless topped on this market cycle.

Amid Severino’s warning, crypto analysts like Saeed have provided a extra bullish outlook for Bitcoin. Saeed acknowledged that this correction is solely a healthy retracement and that the flagship crypto’s broader pattern continues to be bullish. The analyst highlighted $85,000 as the extent Bitcoin wants to interrupt above to succeed in new highs.

The macro facet additionally seems to be to be bullish for Bitcoin in the meanwhile. The most recent CPI and PPI inflation information, which had been launched, got here in decrease than expectations, elevating hopes of a Federal Reserve fee lower quickly. In line with a current report, Boston Fed President Susan Collins additionally assured that the US central financial institution is able to assist stabilize the market if essential.

With US President Donald Trump’s tariffs persisting, the US Fed might need to step in quickly, which is bullish for Bitcoin and different crypto belongings, as extra liquidity will stream into them.

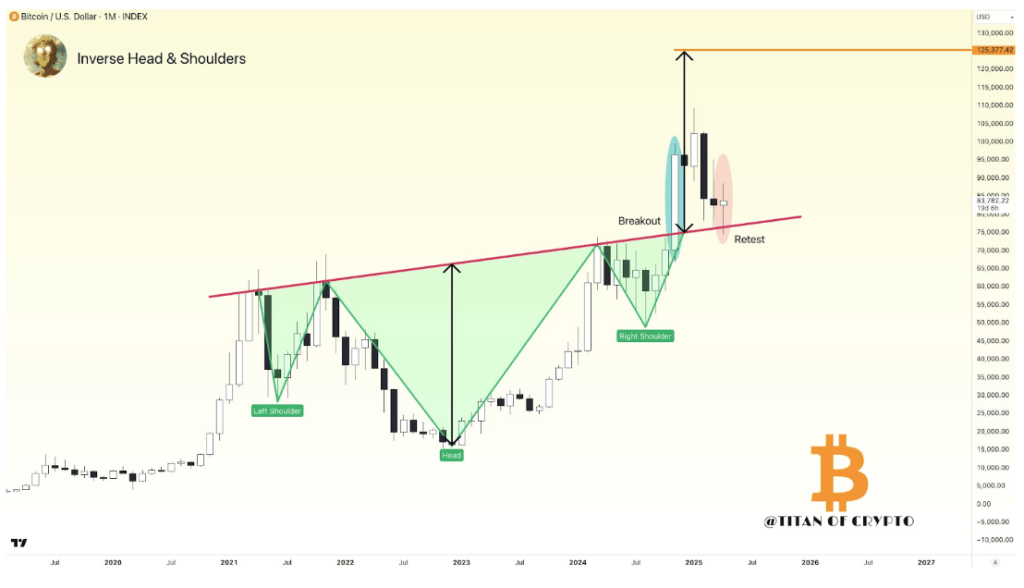

Bullish Technical Evaluation For BTC

In a current X put up, crypto analyst Titan of Crypto revealed that Bitcoin is forming an inverse Head-and-Shoulders sample, though it nonetheless seems to be like a clear retest for now. He remarked that if this sample performs out, the flagship crypto might attain $125,000 this 12 months, marking a brand new all-time excessive (ATH).

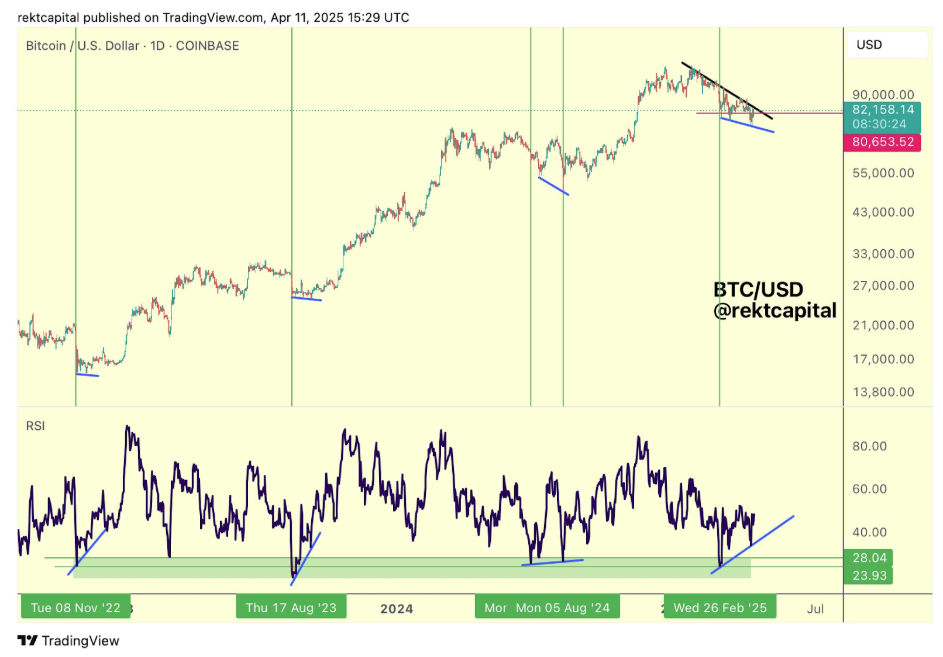

In the meantime, crypto analyst Rekt Capital revealed that Bitcoin is growing one other Larger Low on the Relative Power Index (RSI) whereas forming Decrease Lows on the value. He famous that all through the cycle, BTC has fashioned bullish divergences like this on a couple of events. This can be a constructive for the flagship crypto, as every divergence has at all times preceded reversals to the upside, indicating that BTC might once more rally to the upside quickly.

Associated Studying

On the time of writing, Bitcoin value is buying and selling at round $83,400, up over 3% within the final 24 hours, in response to data from CoinMarketCap.

Featured picture from Pexels, chart from TradingView