- Ethereum’s MVRV momentum neared a bullish cross, with technical indicators signaling sturdy upward potential

- Increased derivatives exercise and quick liquidations lent gasoline to Ethereum’s bullish momentum

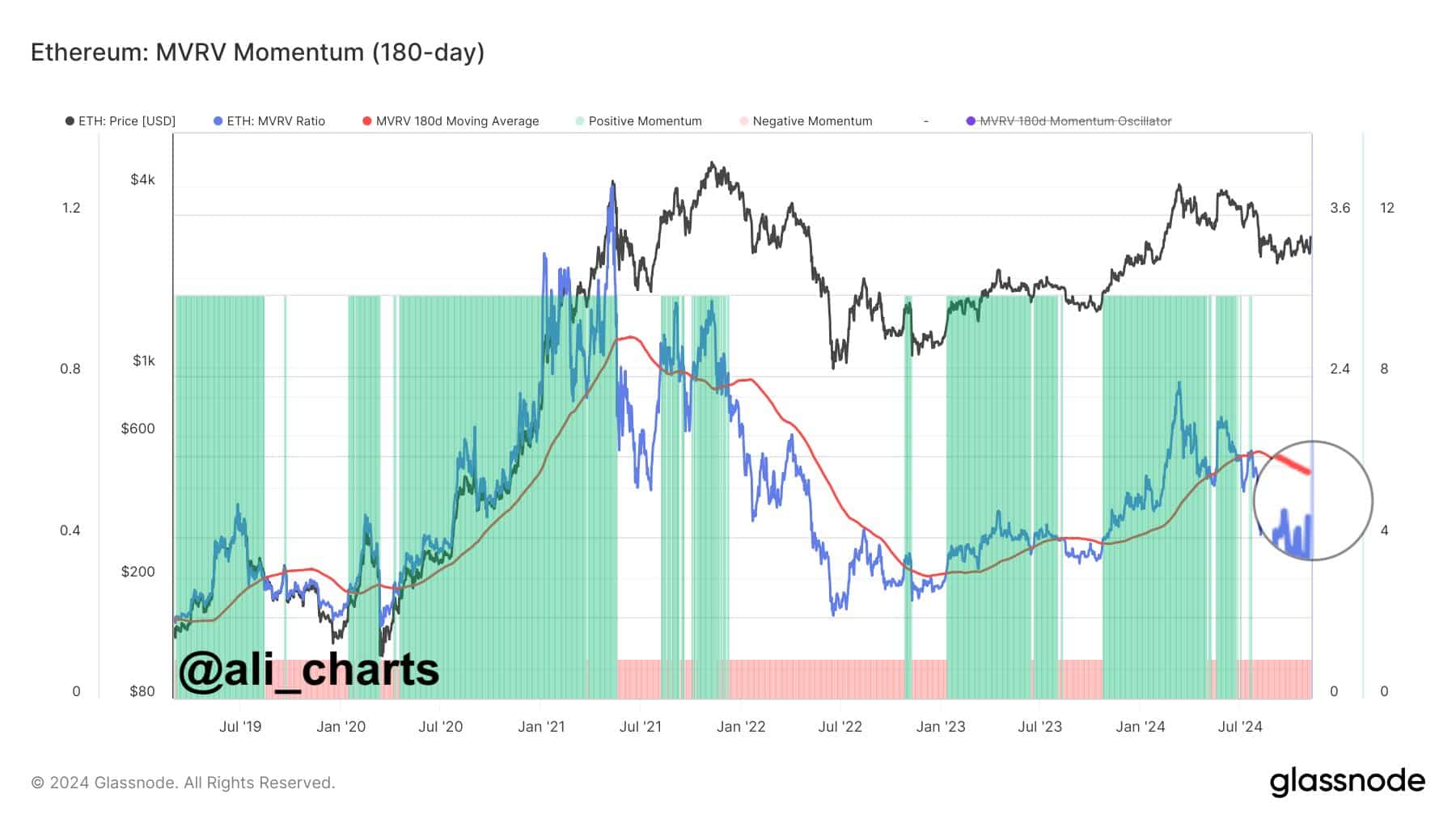

Ethereum [ETH], on the time of writing, was gaining traction because it appeared to be approaching a important MVRV Momentum cross above the 180-day shifting common—A historic indicator of bullish efficiency. This sign, carefully watched by merchants, usually marks the beginning of Ethereum’s strongest uptrends by highlighting when ETH is undervalued, relative to the typical revenue margin of its holders.

Following ETH’s current rally from $2,400 to $2,800, the crypto group is eyeing this cross as a possible catalyst for additional positive factors.

At press time, ETH was buying and selling at $2,829.58, following a 7.19% hike within the final 24 hours. Nonetheless, as this cross is but to happen, there should still be extra room for Ethereum’s momentum to construct. Therefore, the query – Does this imply a significant rally could also be on the horizon?

ETH chart evaluation – Technical indicators sign energy

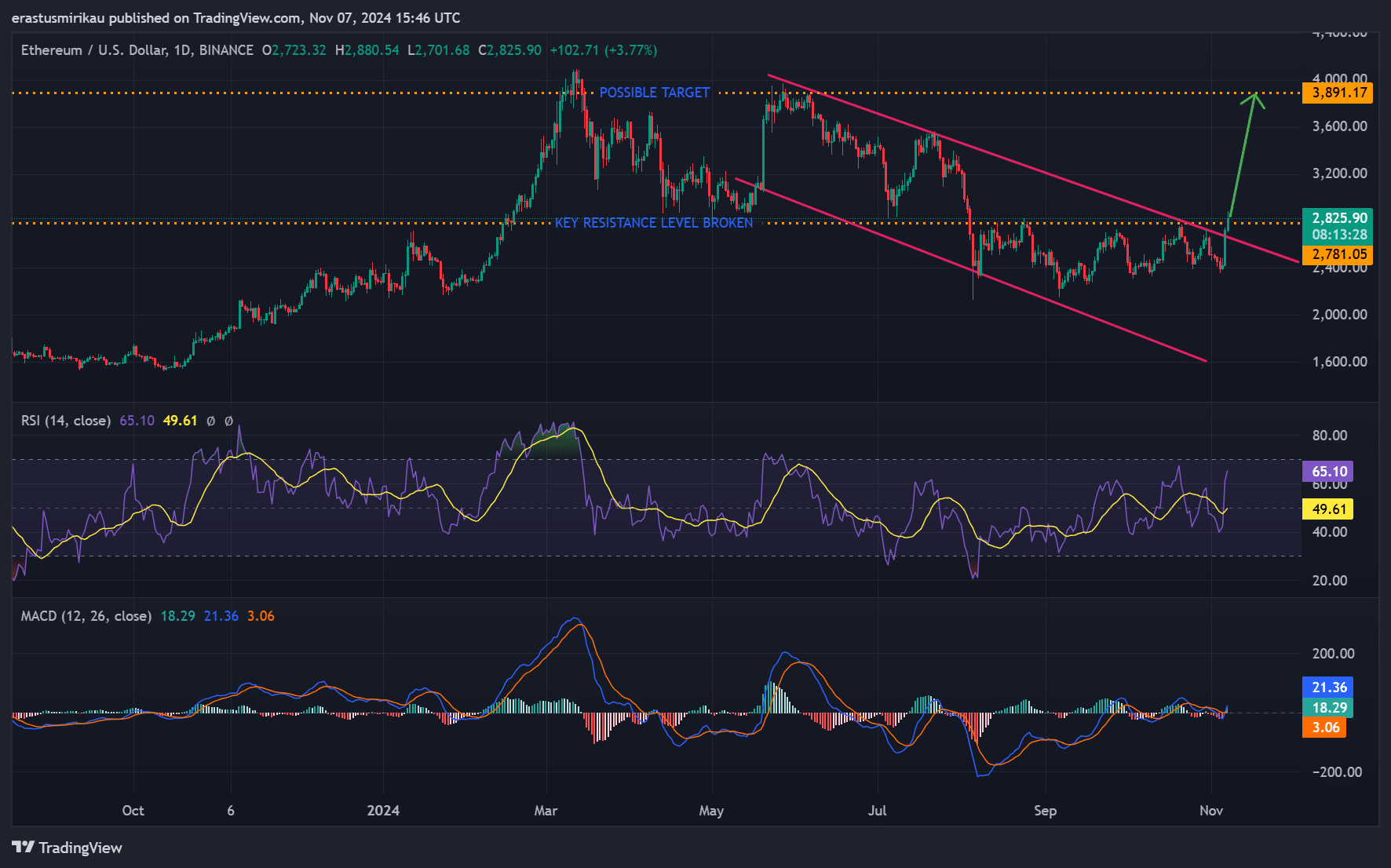

Inspecting Ethereum’s each day chart, key technical indicators revealed a promising outlook. ETH not too long ago broke above a descending channel, indicating a shift in momentum. At press time, the RSI had a price of 65.10, barely beneath the overbought threshold. This recommended that there’s nonetheless room for additional upward motion.

In the meantime, the MACD crossed above the sign line, confirming a bullish pattern that would assist additional positive factors if shopping for strain continues. This confluence of indicators highlighted ETH’s sturdy place because it neared a important resistance, setting the stage for a attainable run in the direction of its subsequent goal of $3,891.

ETH derivatives knowledge – Rising investor curiosity

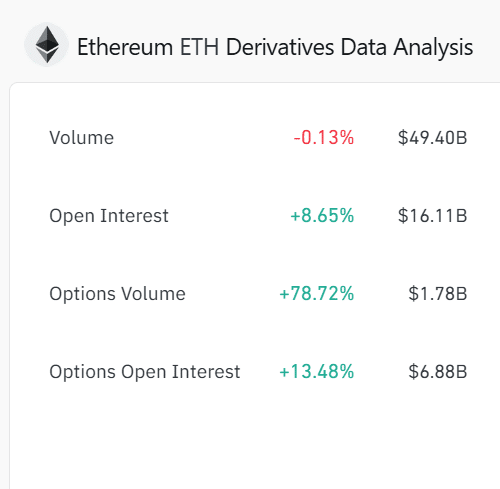

Ethereum’s derivatives knowledge strengthened this optimistic outlook. Open curiosity climbed by 8.65% to $16.11 billion, exhibiting higher dealer engagement. Moreover, Choices Open Curiosity grew by 13.48% – Totaling $6.88 billion – Whereas Choices quantity surged by 78.72%.

This hike in exercise alluded to confidence in Ethereum’s near-term progress potential. Particularly as extra traders place themselves for potential positive factors.

Ethereum liquidation ranges – Shorts face strain

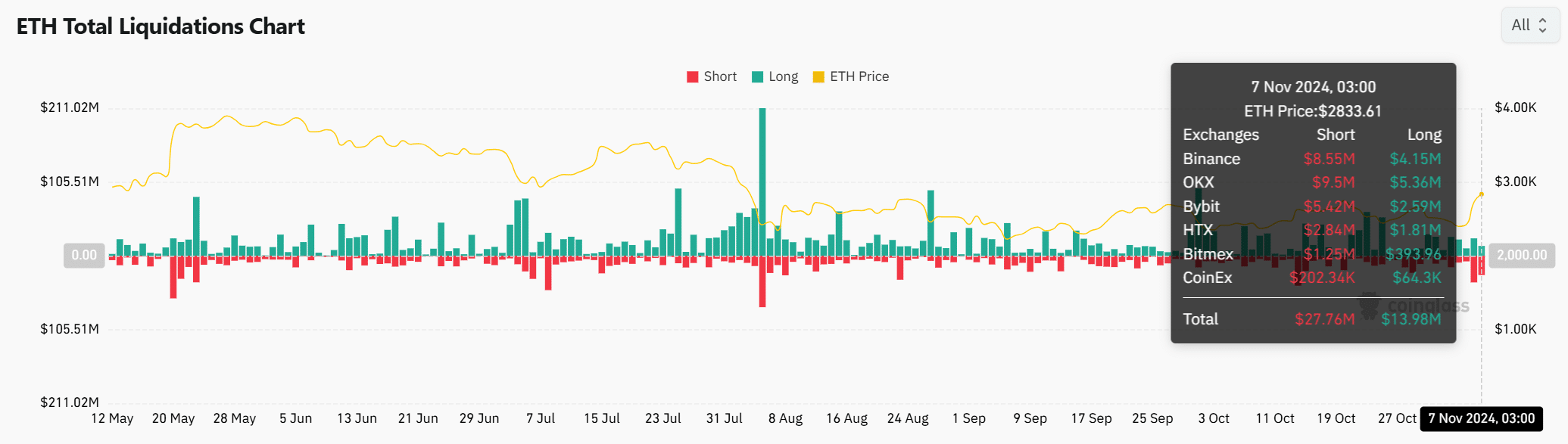

Liquidation knowledge additional underscored ETH’s present dynamics. On 7 November, complete liquidations hit $41.74 million, with shorts comprising $27.76 million. This wave of quick liquidations highlighted mounting strain on bearish positions, which might drive additional buy-side assist.

If Ethereum’s worth continues to climb, further quick liquidations might comply with, amplifying bullish momentum.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Will Ethereum’s MVRV momentum cross affirm a rally?

With Ethereum nearing an important MVRV Momentum cross, sturdy technical indicators, higher derivatives exercise, and quick liquidations all pointed to a possible rally. Nonetheless, warning could also be warranted till the cross happens.

If confirmed, this sign might push Ethereum towards its $3,891 goal. Will ETH proceed north and meet bullish expectations, or will resistance maintain it again? Ethereum’s subsequent strikes are essential and can be carefully watched.