- 72 crypto ETF filings sign rising institutional curiosity past Bitcoin and Ethereum.

- SEC’s new management below Atkins might fast-track ETF approvals and regulatory readability.

Because the broader crypto market experiences renewed momentum, consideration is popping to a wave of pending ETF purposes that might reshape investor entry to digital property.

Eric Balchunas on pending crypto ETFs

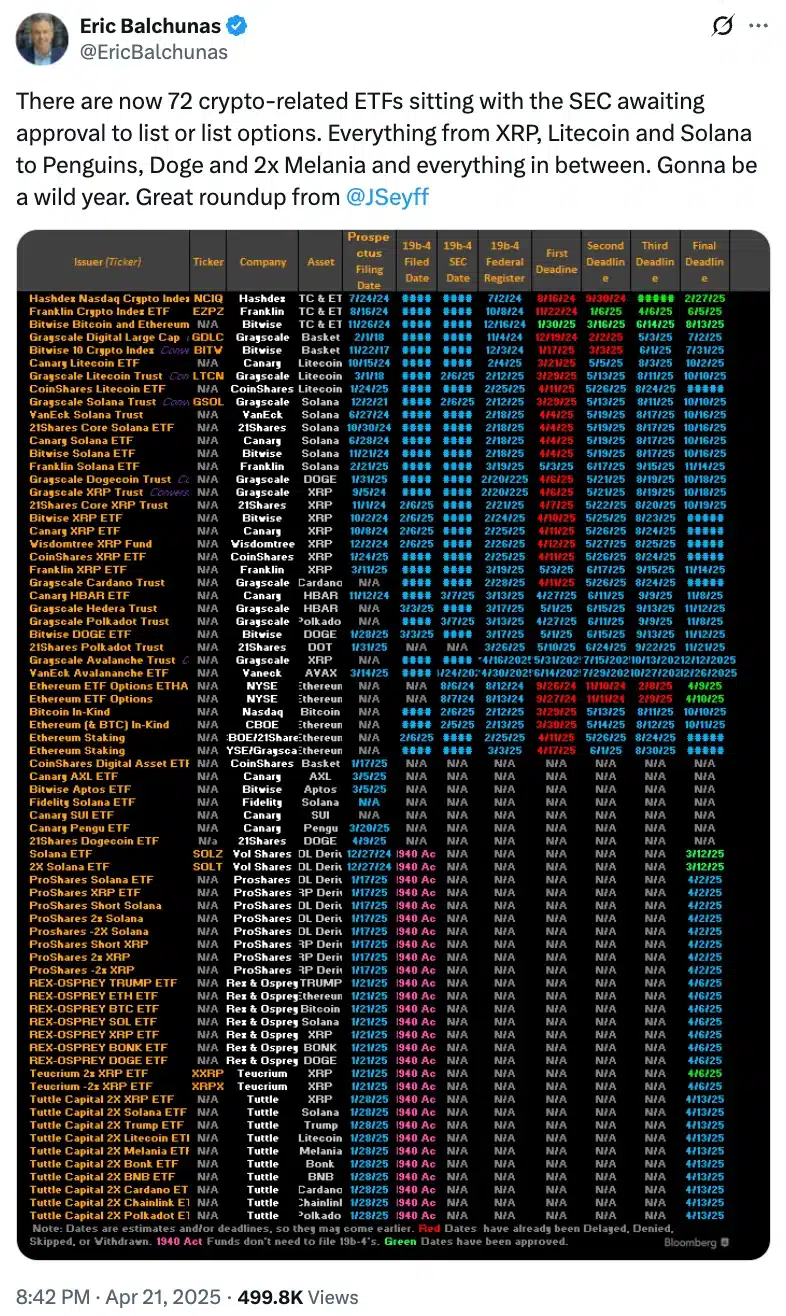

Bloomberg’s senior ETF analyst Eric Balchunas highlighted the rising variety of crypto-related ETF proposals awaiting SEC approval.

The queue presently stands at 72 proposals. Fellow analyst James Seyffart compiled the listing, confirming the substantial development in purposes.

These filings span a variety of merchandise, together with spot ETFs, options-based choices, and leveraged or inverse funds.

Notably, main property like Ripple [XRP], Solana [SOL], Litecoin [LTC], and Dogecoin [DOGE] are all represented.

Unexpectedly, XRP tops the listing with 10 filings, underscoring its rising reputation amongst fund issuers amid evolving market dynamics.

Regardless of mainstream crypto ETFs different ETFs be a part of the path

Whereas mainstream cryptocurrencies dominate the majority of ETF filings, there’s a noticeable shift towards merchandise impressed by web tradition and speculative tendencies.

A brand new wave of risk-heavy choices, similar to leveraged and memecoin-themed ETFs, has emerged, capturing consideration for his or her daring method.

One standout is the “Melania 2x” ETF by Tuttle Capital, which exemplifies the rising urge for food for novelty-driven crypto publicity.

The filings come from a various mixture of issuers, starting from trade veterans like Bitwise, Grayscale, and VanEck to newer entrants similar to Canarx, CoinShares, and Tuttle Capital.

As anticipated, the property featured in latest ETF filings weren’t chosen arbitrarily; they replicate a mixture of sturdy market capitalization, energetic consumer engagement, and heightened investor demand.

Solana, for example, has drawn consideration not only for its worth efficiency but additionally for its high-speed blockchain and increasing function in NFTs and DeFi.

This evolving ETF panorama signifies that institutional curiosity is broadening past Bitcoin [BTC] and Ethereum [ETH], pointing towards a extra diversified method to digital asset publicity.

Will Paul Atkins undertake a distinct technique in comparison with Gary Gensler?

That being mentioned, with Paul Atkins’ management, the SEC additionally seems poised to take a extra constructive method to crypto regulation, with a renewed give attention to offering clearer steering for digital asset markets.

Remarking on the identical, Atkins just lately advised Congress,

“A prime precedence of my chairmanship can be to work with my fellow commissioners and Congress to offer a agency regulatory basis for digital property via a rational, coherent, and principled method.”

Evidently, Atkins’ dedication to resolving longstanding trade considerations marks a pointy departure from the extra inflexible stance of his predecessor, Gary Gensler.

This additionally raises optimism {that a} wave of ETF approvals may quickly speed up crypto adoption within the U.S.

The truth is, whereas the U.S. steps up its crypto recreation, worldwide momentum can be build up.

South Korea, for example, is reportedly contemplating the approval of Bitcoin ETFs ought to Japan transfer ahead with its personal regulatory easing, signaling a broader, world shift towards embracing cryptocurrency funding merchandise.