- Bitcoin is diverging from its beforehand noticed correlation with the inventory market

- Might the decoupling be a superb factor for BTC going ahead?

Bitcoin has maintained a major diploma of correlation with the inventory marketplace for fairly a while now. However what occurs if it loses this correlation and the way will it affect BTC’s value motion?

The inflow of institutional traders into Bitcoin and crypto normally is the primary purpose for the correlation with the inventory market. Cryptocurrencies subsequently benefitted from the inflow of liquidity from establishments that sought to diversify their investments.

Whereas this development did prevail for a while, current observations point out {that a} decoupling is perhaps going down.

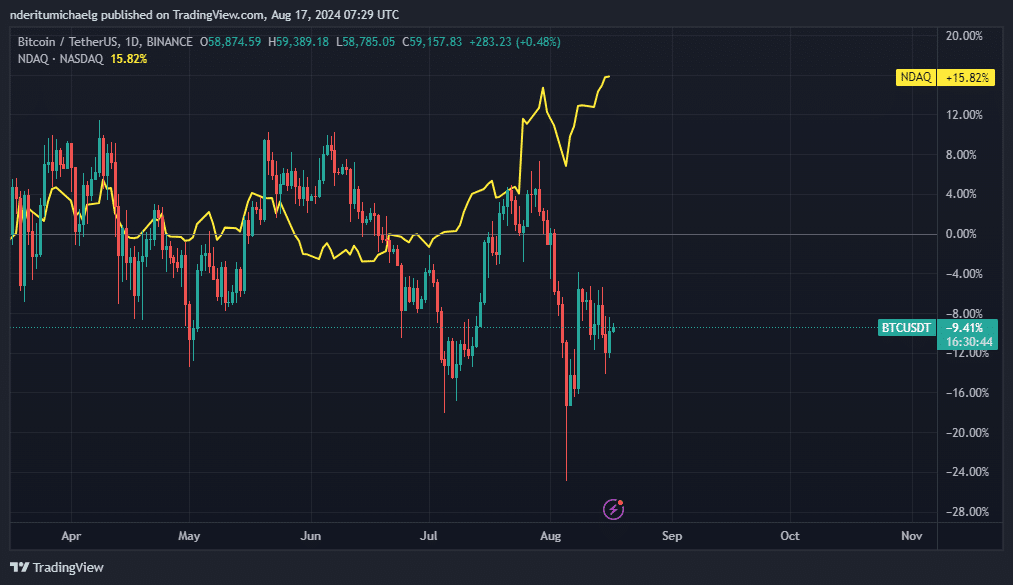

Bitcoin had been shifting in tandem with the NASDAQ up till not too long ago. Nonetheless, BTC’s bearish efficiency this month underscores rising divergence because the NASDAQ continues to soar on the charts.

An indication of the occasions?

Whereas some may even see Bitcoin’s decoupling from its correlation with the NASDAQ as a foul factor, it could grow to be the alternative. Recession fears not too long ago reached new peaks, elevating the chance of a significant inventory market crash. Nonetheless, many have additionally been questioning whether or not that will result in an analogous final result for Bitcoin and the remainder of the crypto market.

The decoupling raises hopes that Bitcoin could find yourself weathering a recession a lot better than the inventory market. Since BTC is not shifting in tandem with the NASDAQ, it additionally strengthens the plausibility of Bitcoin being considered as a protected haven asset in case a recession hits.

The tip of the correlation may promote the concept that Bitcoin is maturing as a definite asset. This may increasingly additional assist the flight to security narrative – An final result that will align with the shifting dynamics noticed not too long ago available in the market.

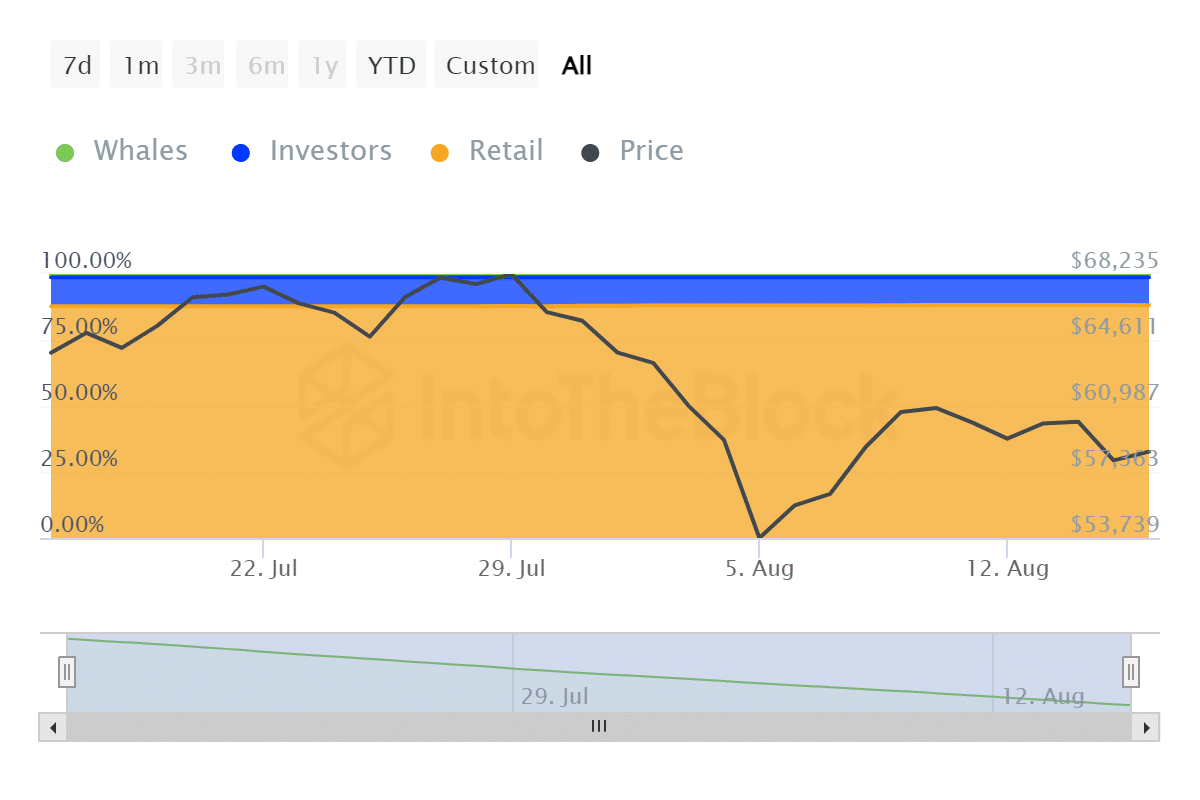

For instance – BTC’s lower cost tag during the last 4 weeks has attracted extra HODLing. In truth, roughly 80% of Bitcoin holders are at present in revenue, regardless of the current dip – A sign of robust demand at decrease costs.

The retail class of the cryptocurrency’s holders added, on common, 2.91 million BTC to their addresses within the final 4 weeks. Establishments contributed to promote strain by roughly 80,000 BTC. In the meantime, whale holdings remained unchanged over the identical interval.

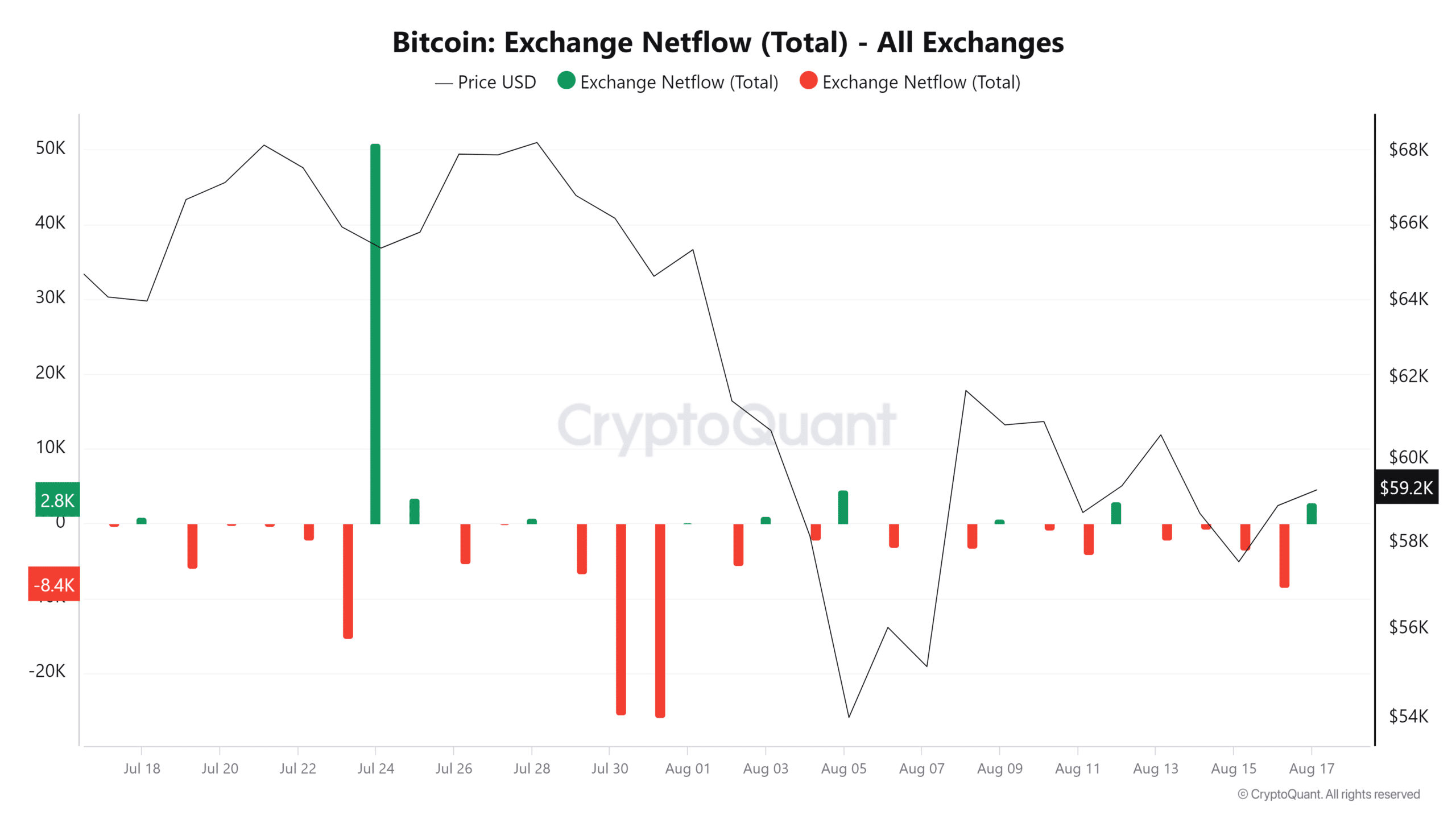

Lastly, Bitcoin’s change flows highlighted why Bitcoin’s value has been shifting in its press time vary.

Alternate netflows had been unfavourable over the previous few days. Nonetheless, they noticed a shift into optimistic netflows during the last 24 hours, indicating outflows in favor of an uptrend.

Bitcoin’s newest value actions replicate the directional uncertainty within the brief time period. Proper now, it’s underpinned by the dearth of a robust sufficient catalyst for a robust up or downward swing.