- VanEck analysts consider that BTC may very well be set for a robust restoration

- Analysts cited sturdy community exercise and a decline in funding prices in BTC Futures

In accordance with VanEck’s month-to-month report on Bitcoin [BTC], the world’s largest digital asset has proven exceptional resilience currently. It’s, in truth, now mirroring its earlier market recoveries, it stated.

VanEck’s analysts, Mathew Sigel and Nathan Frankovitz, noted that BTC’s sturdy community exercise and a drop in future funding prices may very well be indicators of a possible sturdy restoration.

“Bitcoin community exercise stayed strong with an 83% surge in Ordinals inscriptions, whereas funding prices for Bitcoin futures dropped, reflecting a threat urge for food seen in earlier market recoveries.”

BTC funding price mirrors Might and July recoveries

Notably, BTC funding charges – Charges paid by merchants to carry perpetual futures contracts – dropped to comparable ranges in the course of the Might and July recoveries.

“Over the previous 30 days, the 7 DMA annualized price of funding Bitcoin futures has dropped from ~11.6% to ~8.8% for a relative decline of ~24%. These ranges point out a threat urge for food much like these seen throughout market recoveries following 20%+ BTC worth drops in early Might and July of this 12 months.”

Regardless of the constructive set-up for BTC, the current decline in August slashed addresses with earnings by about 9%. General, BTC customers with unrealized earnings had been 84%, as per the report. The remainder of the customers in losses had been principally short-term traders.

Nevertheless, the analysts famous that the current drawdowns had been regular retracements throughout BTC bull markets.

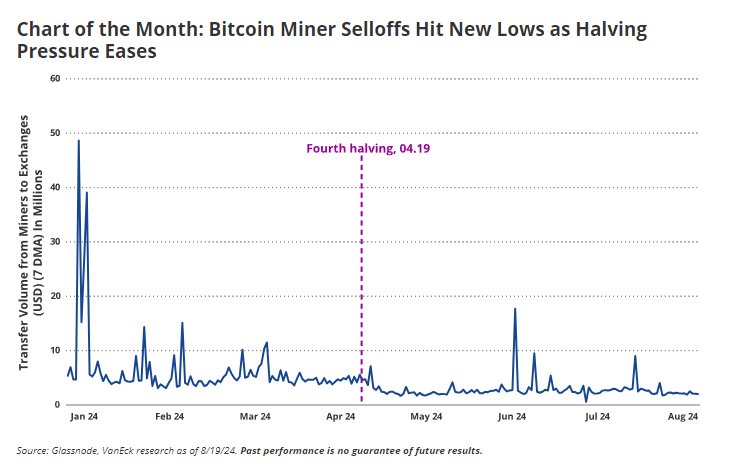

Moreover, strain from BTC miners has been truly fizzling out, as famous by the decline in miners’ sell-offs.

“Switch volumes from miners to exchanges fell 21% over the previous 30 days, suggesting stabilization from miners after their post-halving promoting elevated considerably in June and July.”

On the time of writing, Bitcoin’s larger timeframe chart was bullish after mounting above the short-term provide space at $63k and reclaiming the 200-day SMA (Easy Shifting Common).

![Is Bitcoin mirroring its previous market recoveries? VanEck thinks so... 3 Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2024/08/BTCUSD_2024-08-24_10-22-17.png)