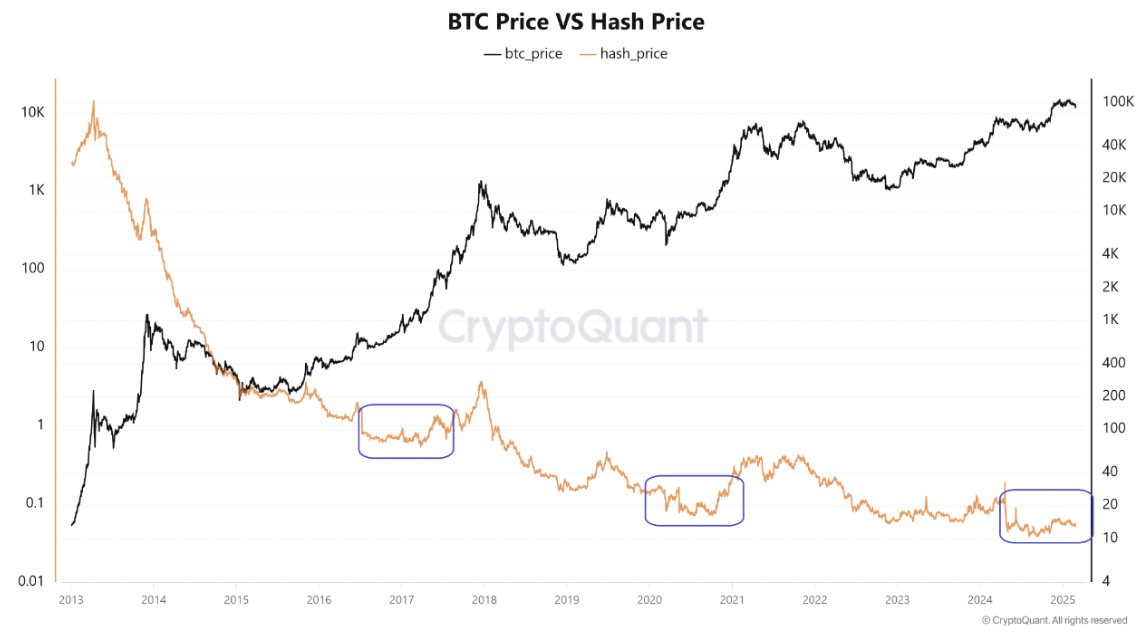

- Bitcoin’s decrease Hash Worth steered it might be nearing a value backside, probably signaling a rebound.

- Growing lively addresses and rising Inventory-to-Move ratio pointed to rising market confidence and shortage.

Bitcoin [BTC]’s current actions in Hash Worth aligned with previous patterns, suggesting the cryptocurrency may very well be approaching a backside. At press time, Bitcoin was buying and selling at $80,101.35, down by 7.67% within the final 24 hours.

Traditionally, decrease Hash Worth durations have marked Bitcoin’s value bottoming out, signaling {that a} potential rebound may very well be on the horizon.

As BTC exams these key ranges, it raises the query—may this be a super accumulation part earlier than the subsequent bull run?

Bitcoin’s in/out of the cash chart reveals fascinating insights into the present market sentiment. A big portion of BTC, roughly 75.30% (14.95 million BTC), stays “within the cash,” exhibiting most buyers are nonetheless in revenue.

Nonetheless, 23.23% (4.61 million BTC) of Bitcoin addresses are “out of the cash.” This exhibits that whereas most Bitcoin holders stay worthwhile, the market is just not with out its challenges.

BTC: The rising exercise on the blockchain suggests…

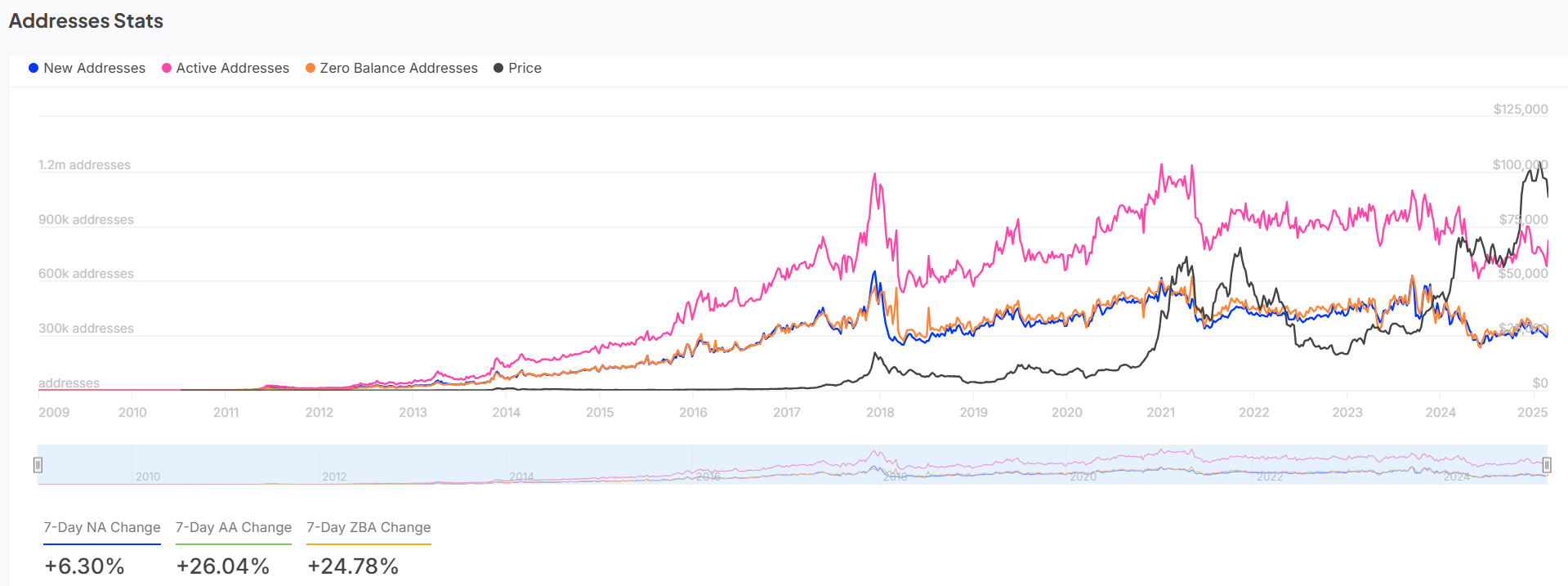

Bitcoin’s deal with statistics provide additional insights into the market’s path. Energetic addresses have elevated by 6.30% over the past 7 days, reflecting rising participation within the Bitcoin community.

The pink line, representing lively addresses, exhibits a gentle rise, intently mirroring Bitcoin’s value actions. In the meantime, the variety of zero-balance addresses has risen by 24.78%, signaling that many new customers are actively holding or buying and selling Bitcoin quite than abandoning their wallets.

This surge in exercise, particularly with the rise in new addresses (26.04% over the previous week), means that market confidence is rising. This might result in a value rebound if BTC continues to achieve momentum.

Breakout forward? Technical indicators present…

Bitcoin’s technical evaluation exhibits essential assist and resistance ranges.

On the time of writing, BTC was testing assist at round $80,216, a stage that has seen earlier value reactions. Nonetheless, the downward trendline and the breakdown of key assist ranges recommend BTC is beneath stress.

Moreover, the Stochastic RSI studying of two.23 indicators an oversold situation, which regularly precedes a value reversal. The Bollinger Bands additionally level to a tightening sample, indicating that volatility could enhance quickly.

These technical indicators recommend BTC may both bounce from this assist stage or break down additional, relying on future market developments.

BTC stock-to-flow ratio: Growing shortage fuels…

Bitcoin’s Inventory-to-Move ratio has surged by 100% within the final 24 hours, reaching 2.1152M. This means a rise in Bitcoin’s shortage, as the speed of latest provide continues to lower.

The rising Inventory-to-Move ratio means that, whereas BTC faces short-term value volatility, its long-term worth proposition stays intact.

As fewer BTC cash are launched to circulation over time, shortage will drive up demand, probably pushing costs greater.

Is Bitcoin getting ready for a rebound?

Based mostly on present evaluation, Bitcoin is approaching a possible backside. The decrease Hash Worth, mixed with rising lively addresses, indicators a possible value reversal.

Though technical indicators just like the Stochastic RSI level to an oversold situation, Bitcoin is prone to expertise elevated shopping for exercise. Shortage continues to drive worth.