- Analysts predicted that Ethereum might outperform Bitcoin resulting from key indicators.

- Ethereum spot ETF inflows and ascending worth channels indicated potential worth targets as much as $10,000.

Ethereum [ETH] has to date been unable to maintain up the tempo with Bitcoin’s [BTC] constant upward momentum.

Whereas Bitcoin has registered new all-time highs in latest weeks, Ethereum nonetheless stays 36.2% lower away from its all-time excessive of $4,878 registered in 2021.

On the time of writing, ETH traded at a worth of $3,111 down by 0.6% up to now day and roughly 1% up to now week. This efficiency disparity has raised questions on whether or not Ethereum can catch as much as Bitcoin.

Regardless of this lackluster motion, some market analysts remained optimistic about Ethereum’s potential.

One such analyst, Ali, lately expressed a constructive stance on social media, predicting that ETH will quickly outperform Bitcoin.

Ali’s confidence stemmed from a number of indicators, together with the “alt season indicator.”

In response to him, each market cycle traditionally experiences a part the place Ethereum outpaces Bitcoin, however this has but to happen within the present cycle. Ali seen this as a possible shopping for alternative.

What’s supporting Ethereum’s upside?

Ali additionally highlighted the MVRV (Market Worth to Realized Worth) metric as a major indicator for Ethereum’s future efficiency.

The MVRV metric measures the ratio between the market worth and realized worth of an asset, providing insights into whether or not an asset is overvalued or undervalued.

Ali famous that when Ethereum’s MVRV Momentum crosses its 180-day transferring common (MA), it traditionally indicators a interval of outperformance for the cryptocurrency.

Though Ethereum’s worth lately elevated from $2,400 to $2,800, this cross has but to happen, suggesting additional upside potential.

Along with the MVRV metric, Ali pointed to a rise in inflows to ETH spot ETFs. He defined that buyers have shifted from distribution to accumulation, with ETH spot ETFs amassing over $147 million in ETH.

Furthermore, Ethereum whales have reportedly bought over $1.40 billion value of ETH, additional supporting Ali’s bullish outlook.

In response to Ali, Ethereum’s potential worth trajectory might contain testing resistance ranges at $4,000 and $6,000, with a bullish situation projecting a goal as excessive as $10,000 if Ethereum mirrors the S&P 500’s worth motion.

Inspecting market place

Whereas Ali’s evaluation supplied a promising outlook for ETH, analyzing key metrics might present additional insights into whether or not Ethereum might realistically outperform Bitcoin.

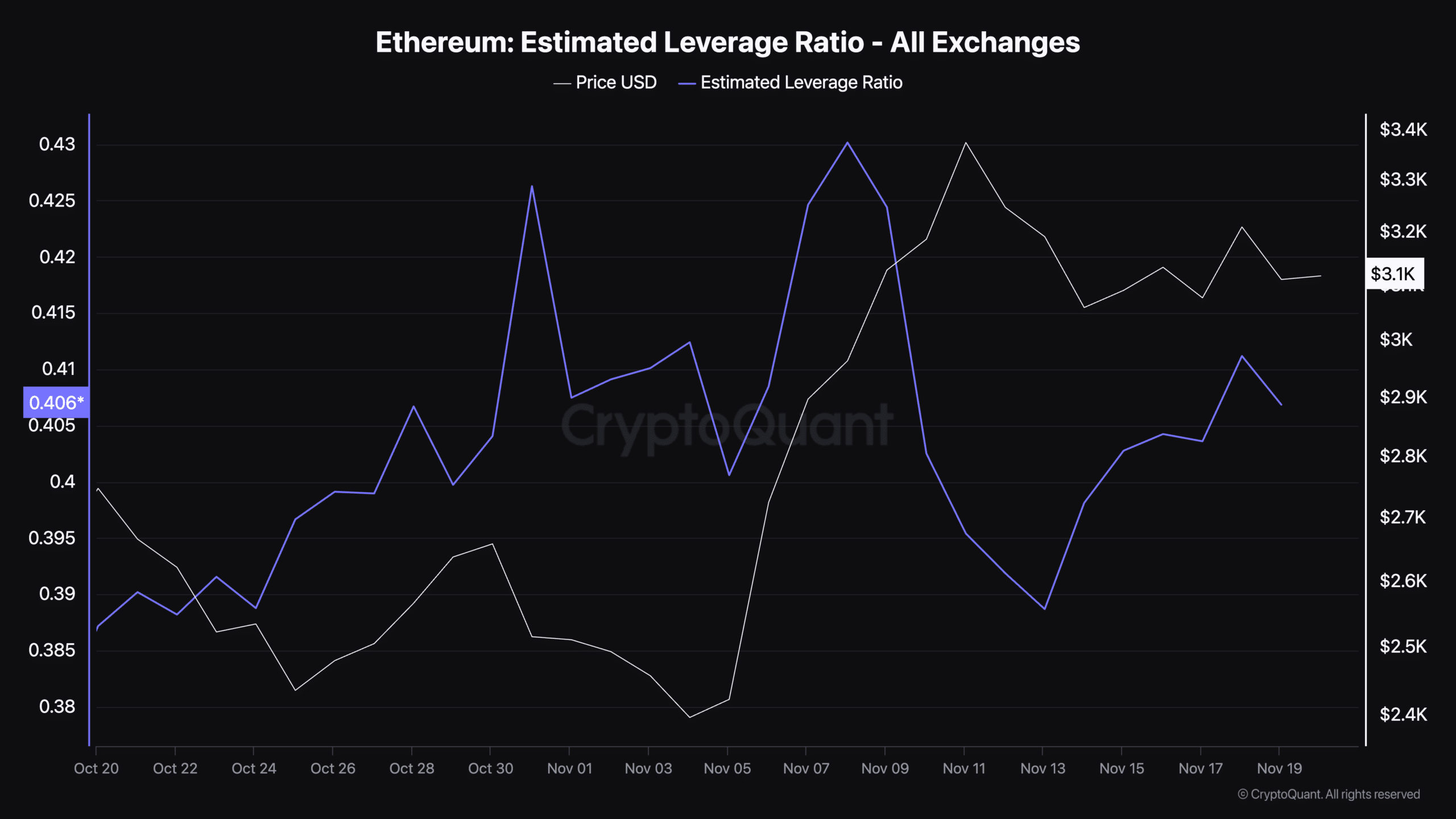

One such metric is the Estimated Leverage Ratio, which displays the extent of leverage utilized by merchants within the derivatives market.

A excessive leverage ratio usually indicated elevated threat and potential volatility, whereas a decline could recommend decreased hypothesis.

In response to data from CryptoQuant, Ethereum’s estimated leverage ratio has dropped to 0.40 as of the nineteenth of November, after peaking at 0.430 earlier within the month.

This decline could point out decreased speculative exercise, probably paving the best way for extra secure progress.

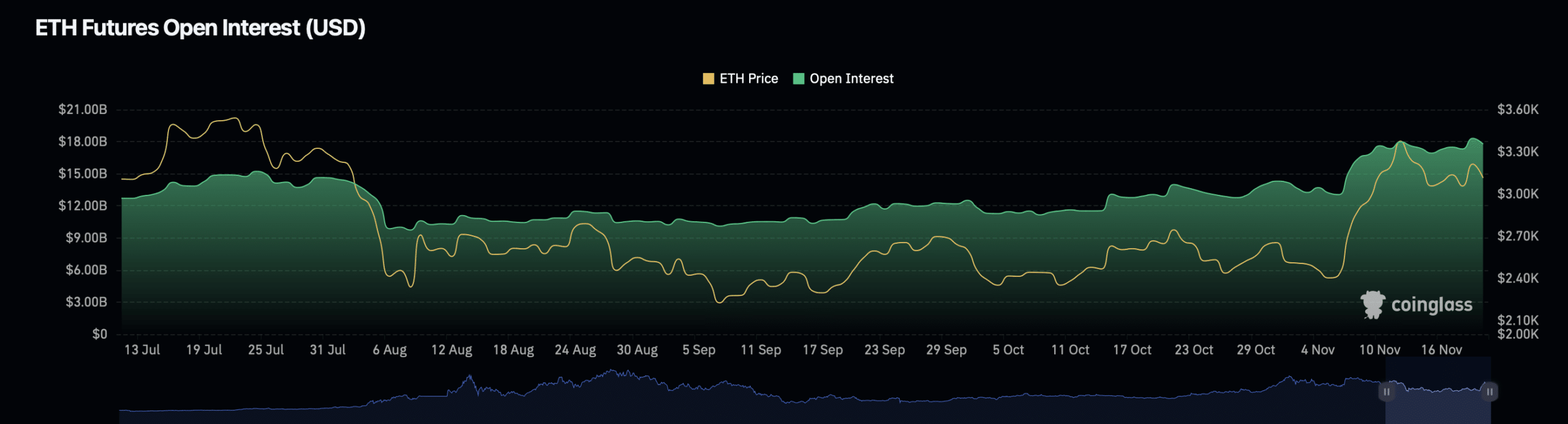

Knowledge from Coinglass additional revealed that Ethereum’s Open Curiosity has declined by 0.09%, bringing its present valuation to $17.88 billion.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Moreover, the Open Curiosity quantity for ETH has decreased by 30%, now standing at $31.10 billion.

These developments might point out a interval of consolidation and decreased market exercise for ETH, providing each challenges and alternatives for future progress.