Key Notes

- Gumi’s board authorized buying 6 million XRP tokens price $17 million between September 2025 and February 2026.

- The corporate positions XRP as a progress asset complementing Bitcoin’s stability function of their dual-cryptocurrency technique.

- SBI Holdings partnership influenced the choice, aligning with Japan’s RLUSD stablecoin launch plans for early 2026.

Gumi confirmed its board of administrators authorized the acquisition of XRP

XRP

$2.80

24h volatility:

5.8%

Market cap:

$166.28 B

Vol. 24h:

$7.33 B

to enhance the corporate’s current Bitcoin publicity.

According to the official announcement, Gumi’s board authorized a strategic funding of two.5 billion Japanese Yen ($17 million) in XRP, concentrating on the acquisition of 6 million tokens via a phased strategy spanning September 2025 to February 2026

In February 2025, the corporate invested 1 billion Japanese Yen ($6.6 million) into Bitcoin, marking its first allocation into crypto. The brand new plan extends this strategy, with XRP purchases scheduled between September 2025 and February 2026.

【お知らせ】

当社は、ブロックチェーン事業の成長戦略として 、25 億円のXRPを購入することを決議しました。

SBI ホールディングスが中核的に推進する国際送金・流動性ネットワーク戦略において重要な役割を担うXRP のエコシステム拡大への貢献を通じ、同事業の収益機会の拡大を目指してまいります。… pic.twitter.com/Bse5SQ1ptX— gumi公式 (@gumi_pr) August 29, 2025

The corporate hints that the XRP acquisition displays a longer-term technique to align its stability sheet with blockchain-driven income alternatives. By including Ripple’s token, Gumi seeks to strengthen its dominance inside the rising international funds and remittance ecosystem supported by XRP.

Gumi additionally emphasised that XRP, in contrast to Bitcoin

BTC

$108 331

24h volatility:

3.5%

Market cap:

$2.16 T

Vol. 24h:

$51.86 B

, gives monetary utility past store-of-value properties. Bitcoin will stay the corporate’s income-generating and stability asset, whereas XRP is meant to offer entry to progress areas in blockchain-based monetary companies.

Gumi XRP Purchases Deepens Ripple-SBI Holdings’ Partnership

Gumi cited its shareholder relationship with SBI Holdings as a key issue within the choice. SBI is Ripple’s largest accomplice in Japan and co-manages SBI Ripple Asia, a three way partnership targeted on deploying blockchain fee programs throughout Japan and wider Asian markets. The corporate described XRP as “strategically appropriate” with its operations given SBI’s affect.

Ripple and SBI not too long ago introduced plans to introduce the RLUSD stablecoin into Japan by early 2026, aiming to offer enterprises with a regulated and dependable settlement possibility. Gumi stated the XRP buy aligns with this broader technique, because the token continues to anchor cross-border funds and liquidity networks within the area.

The corporate confirmed it is going to consider its Bitcoin and XRP holdings at market worth each quarter, reporting features and losses via its revenue assertion. This strategy emphasizes intent to handle digital property with transparency and combine them into its monetary reporting construction.

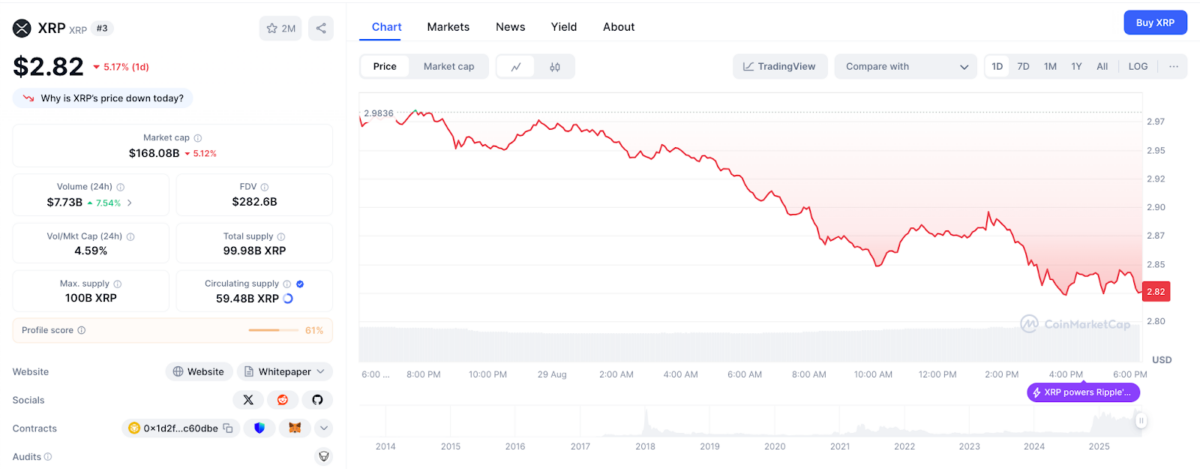

Ripple (XRP) Worth Motion as of August 29, 2025 | Supply: Coinmarketcap.com

Along with its Bitcoin holdings, XRP’s central role in cross-border payments infrastructure, notably in remittances and liquidity provision gives various use circumstances By adopting a dual-asset technique, the corporate expects to stability stability via Bitcoin and progress potential via XRP publicity.

When it comes to worth response, Ripple (XRP) worth is buying and selling at $2.82 down 5% intraday as profit-taking intensified on Friday after shedding the very important $3 assist earlier within the week.

Finest Pockets Presale in Demand as XRP Adoption Expands in Japan

As XRP adoption strengthens throughout funds and liquidity companies, international demand for safe multi-chain options like Finest Pockets (BEST) is on the rise. Finest Pockets is positioned itself as a brand new modern platform for merchants managing property like XRP alongside different tokens.

Finest Pockets Presale

The venture has raised over $15 million in its ongoing presale, attracting buyers with low transaction charges, aggressive staking rewards, and early entry to decentralized functions. Its built-in multi-chain compatibility makes it an interesting possibility for customers in search of seamless motion between XRP, Bitcoin, and different property.

With discounted entry tiers nonetheless open earlier than the subsequent presale worth improve, potential individuals can safe BEST tokens straight via the official Best Wallet platform.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.