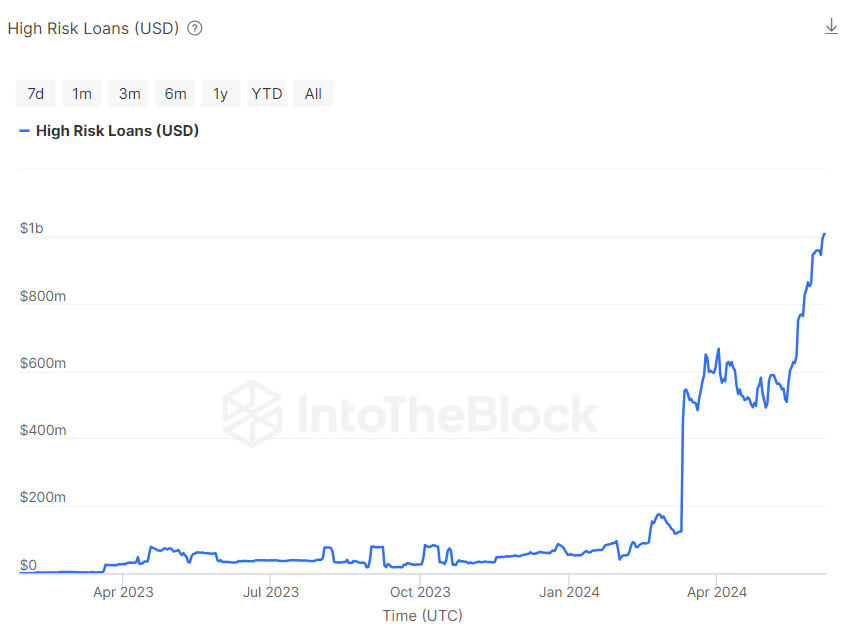

According to a report by data analytics company IntoTheBlock, the volume of high-risk loans on the prominent Aave Protocol is reaching high levels as general loan volume in the DeFi space records multi-year highs. This development is believed to stem from investors exploring various investment strategies in a bid to maximize profits in a highly anticipated crypto bull run.

Aave’s High-Risk Loans 5% Short Of Liquidation Threshold

In its weekly newsletter on June 8, IntoTheBlock highlights that DeFi loans are currently estimated at $11 billion representing the peak value seen in the last two years. As the largest lending protocol, Aave accounts for over 50% of these figures with its users having borrowed about $6 billion.

Notably, $1 billion of this debt is categorized as high-risk loans which are placed against volatile collateral. Currently, these loans present substantial risk, with the values of their collateral asset within 5% of their set liquidation threshold.

For context, the margin call level or liquidation threshold is a predetermined point at which an asset’s value falls to a level where the lender or broker requires the borrower to add more collateral to maintain the loan or position. Failure to meet this requirement may result in the automatic liquidation of such collateral.

When collateral assets hover around this critical threshold as with the high-risk loans on Aave, any minor dip may lead to widespread liquidations. This normally results in the loss of such assets for the borrower. However, in certain conditions where a rapid price decline occurs, the borrower may incur additional losses which may be transferred to their account balance on the lending platform.

Furthermore, liquidations from these high-risk loans may exacerbate market volatility, which may result in more price loss, leading to more liquidations in a downward spiral. In addition, many assets getting liquidated at once can create liquidity crunches which can prevent the Aave protocol from operating smoothly.

AAVE Price Overview

Meanwhile, AAVE has declined by 5.30% in the last day after facing serious resistance at the $98.20 price zone. The DeFi token is currently valued at $92.30 after an overall negative performance in the past week resulting in an 11.53% price loss.

However, according to price prediction site Coincodex, the general sentiment around AAVE remains positive. The team at Coincodex backs AAVE to make a remarkable comeback hitting a price point of $303.87 in the next one month.