Ethereum worth nosedived after it settled beneath $3,000. ETH is down over 20% and it’s now making an attempt to get better from the $2,000 zone.

- Ethereum began a serious decline beneath the $2,800 and $2,650 ranges.

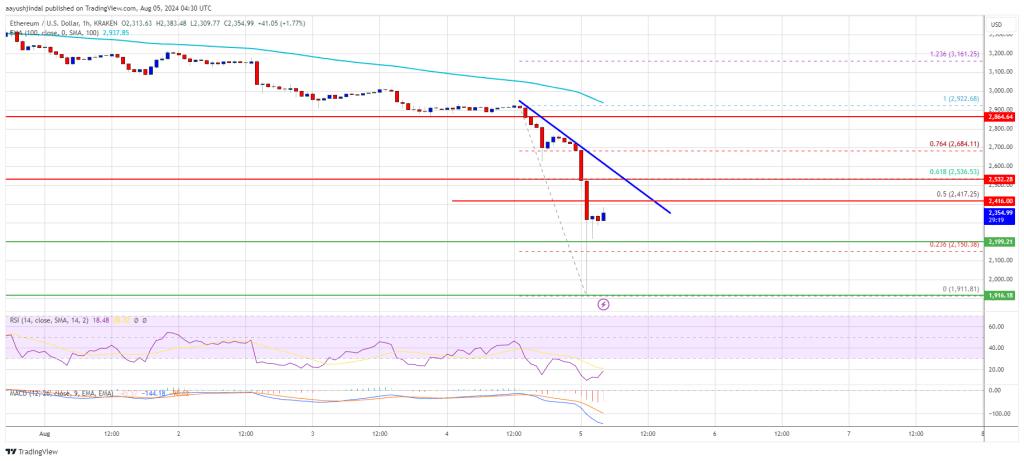

- The value is buying and selling beneath $2,500 and the 100-hourly Easy Shifting Common.

- There’s a key bearish pattern line forming with resistance at $2,500 on the hourly chart of ETH/USD (information feed by way of Kraken).

- The pair may begin a restoration wave if it clears the $2,500 resistance zone.

Ethereum Worth Takes Main Hit

Ethereum worth began a serious decline after it broke the $3,000 assist. ETH dragged Bitcoin decrease and traded beneath the $2,500 assist. It declined over 20% and there was a pointy decline beneath the $2,200 stage.

The value even dived beneath $2,000 and examined $1,920. A low is fashioned at $1,911 and the value is now consolidating losses. There was a minor restoration wave above the $2,200 stage. The value broke the 23.6% Fib retracement stage of the downward transfer from the $2,922 swing excessive to the $1,911 low.

Ethereum worth is now buying and selling beneath $2,500 and the 100-hourly Simple Moving Average. If there’s a regular restoration wave, the value may face resistance close to the $2,420 stage and the 50% Fib retracement stage of the downward transfer from the $2,922 swing excessive to the $1,911 low.

The primary main resistance is close to the $2,500 stage. There may be additionally a key bearish pattern line forming with resistance at $2,500 on the hourly chart of ETH/USD. The subsequent main hurdle is close to the $2,540 stage. An in depth above the $2,540 stage may ship Ether towards the $2,680 resistance.

The subsequent key resistance is close to $2,800. An upside break above the $2,800 resistance may ship the value increased towards the $3,000 resistance zone within the close to time period.

One other Decline In ETH?

If Ethereum fails to clear the $2,500 resistance, it may begin one other decline. Preliminary assist on the draw back is close to $2,200. The primary main assist sits close to the $2,120 zone.

A transparent transfer beneath the $2,120 assist may push the value towards $2,050. Any extra losses may ship the value towards the $2,000 assist stage within the close to time period. The subsequent key assist sits at $1,920.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is dropping momentum within the bearish zone.

Hourly RSI – The RSI for ETH/USD is now beneath the 50 zone.

Main Help Stage – $2,120

Main Resistance Stage – $2,500