Key Notes

- XRPL recorded 70 million transactions in July with a every day common of 1.8 million, rating amongst prime blockchain networks.

- The 13-year-old community continues onboarding customers at startup pace with over 1 million new accounts created in 2025.

- Brazilian stablecoin BBRL issued $4.2 million price of tokens whereas RLUSD every day transfers doubled from 5,000 to 12,000.

The XRP Ledger, often known as XRPL, is likely one of the world’s main blockchain networks, created by Ripple and internet hosting the XRP token, ranked third by market capitalization as of August 1. Apart from the excessive market worth of its native token, the chain has additionally introduced stable metrics in several classes final month (July).

A not too long ago printed Dune report, on August 1, highlights a few of these metrics. They embody XRPL transaction rely, new pockets addresses, transaction quantity in decentralized exchanges (DEX), cross-chain operations, and stablecoin information. XRPL “retains proving why it’s some of the resilient [chains] in crypto,” stated the Dune account in a thread on X.

1/ It’s been 30 days since XRPL information went stay on Dune, and the chain retains proving why it’s some of the resilient in crypto.

Right here’s a fast replace on what’s modified in only a month 👇 https://t.co/9otxcLUpi1

— Dune (@Dune) August 1, 2025

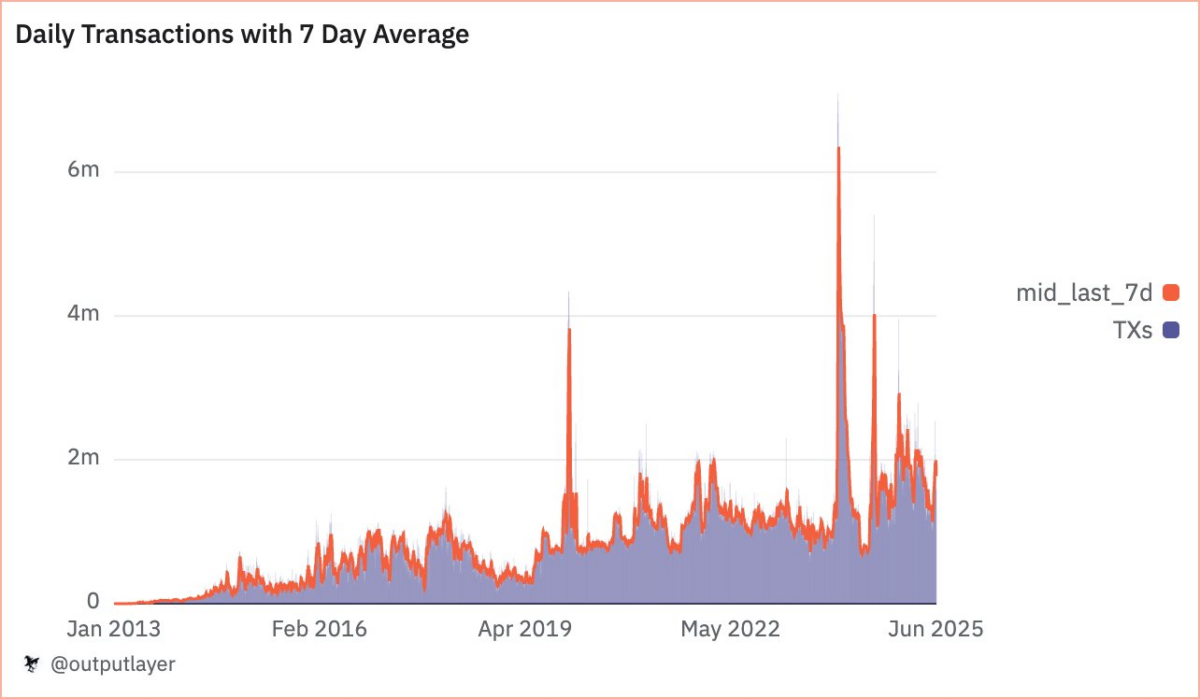

Notably, the blockchain registered over 70 million new transactions in July, totaling 3.83 billion transactions completely stamped within the ledger. July 2025 represents roughly 1.83% of the entire, and 13.5 million have been made within the final week alone. In line with Dune, this information ends in a every day common of 1.8 million transactions, placing XRPL’s community exercise among the many highest compared to different chains.

XRPL Day by day Transactions with 7-Day Common | Supply: Dune Dashboard by @outputlayer

What caught the analyst’s eye, nonetheless, was the truth that a 13-year-old chain is “nonetheless onboarding [new users] at startup pace.” Information from the dashboard reveals 3,000 new accounts created every day, with over 1 million in 2025.

Stablecoins and Cross-Chain Operations on XRPL

Total, the demand for stablecoins has been rising worldwide, giving this asset class growing significance for worldwide and home transactions. The US greenback holds the place as the preferred fiat foreign money backing these tokens, however different nations even have their very own pegged representatives.

Curiously, the BBRL—a stablecoin pegged to the Brazilian Actual (BRL), working on XRPL, and created by BrazaBank—had over $4.2 million price of latest tokens issued in July 2025. With this issuance charge, the XRP Ledger holds the second place amongst all chains for Brazil’s stablecoins, solely behind BRZ, which runs natively on the Ethereum Digital Machine (EVM).

Furthermore, RLUSD has greater than doubled its every day transfers from 5,000 to over 12,000 within the final 30 days. Ripple launched RLUSD in late 2024, and the USD stablecoin is backed by money and cash-equivalent reserves held at Commonplace Custody, a Ripple subsidiary regulated in New York.

The corporate has been working to expand the RLUSD market to Europe, as Coinspeaker reported on July 15, which might have contributed to the huge improve in its every day transactions.

XRP has additionally seen important will increase in its demand on different chains, registering over $165 million moved through Axelar to EVM blockchains. On Close to Intents,

XRP

$3.01

24h volatility:

2.1%

Market cap:

$178.60 B

Vol. 24h:

$9.35 B

represents 5.4% of the protocol’s whole worth locked (TVL), with practically $700,000 in liquidity obtainable for cross-chain swaps, based on one other Dune dashboard.

Because it stands, this information backs what the Dune report referred to as notable resilience for a blockchain that’s 13 years previous. XRPL is proving it could possibly compete with new applied sciences moreover the already notable efficiency of its native token, XRP.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Vini Barbosa has lined the crypto trade professionally since 2020, summing as much as over 10,000 hours of analysis, writing, and enhancing associated content material for media retailers and key trade gamers. Vini is an lively commentator and a heavy person of the expertise, really believing in its revolutionary potential. Matters of curiosity embody blockchain, open-source software program, decentralized finance, and real-world utility.