Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin merchants are making ready for a jam-packed and probably turbulent week. From looming tariffs to whale-sized BTC bid exercise, listed here are 5 main elements that market members have to carry on their radar.

#1 US Tariffs Poised To Escalate On April 2

The worldwide stage is bracing for what US President Donald Trump has dubbed “Liberation Day” on April 2. In accordance with The Kobeissi Letter (@KobeissiLetter), the administration’s plan for “reciprocal tariffs” guarantees to be a watershed second in ongoing worldwide commerce disputes.

“President Trump has been discussing this Wednesday, April 2nd, for weeks. It is a day that he has named ‘Liberation Day’ the place widespread new tariffs are coming. We consider April 2nd would be the greatest escalation of the commerce conflict so far,” The Kobeissi Letter writes through X.

These tariffs will layer on prime of a slew of current US duties that span metal, aluminum, Canadian items, Mexican items, and plenty of Chinese language imports. The Kobeissi Letter factors out that 25% levies on auto imports and on international locations buying Venezuelan oil will even take impact this week. With retaliatory measures from Canada, China, the EU, and Mexico within the pipeline, they warn of a “huge commerce conflict,” intensifying uncertainty for international markets.

Associated Studying

Past commerce specifics, the approaching days may see inflation strain intensify as a consequence of greater client prices on imported items. Citing an uptick within the Economic system Coverage Uncertainty Index, The Kobeissi Letter highlights: “Coverage uncertainty is presently above nearly any disaster in fashionable US historical past. We’re seeing ~80% HIGHER uncertainty ranges than 2008. In consequence, market swings are widening, and we anticipate an especially unstable week.”

Add in President Trump’s newest threats concerning Iran—the place “secondary tariffs” and potential levies on Russian oil are on the desk—and there are a number of worldwide flashpoints that will feed into market volatility.

#2 Bitcoin Whale Exercise

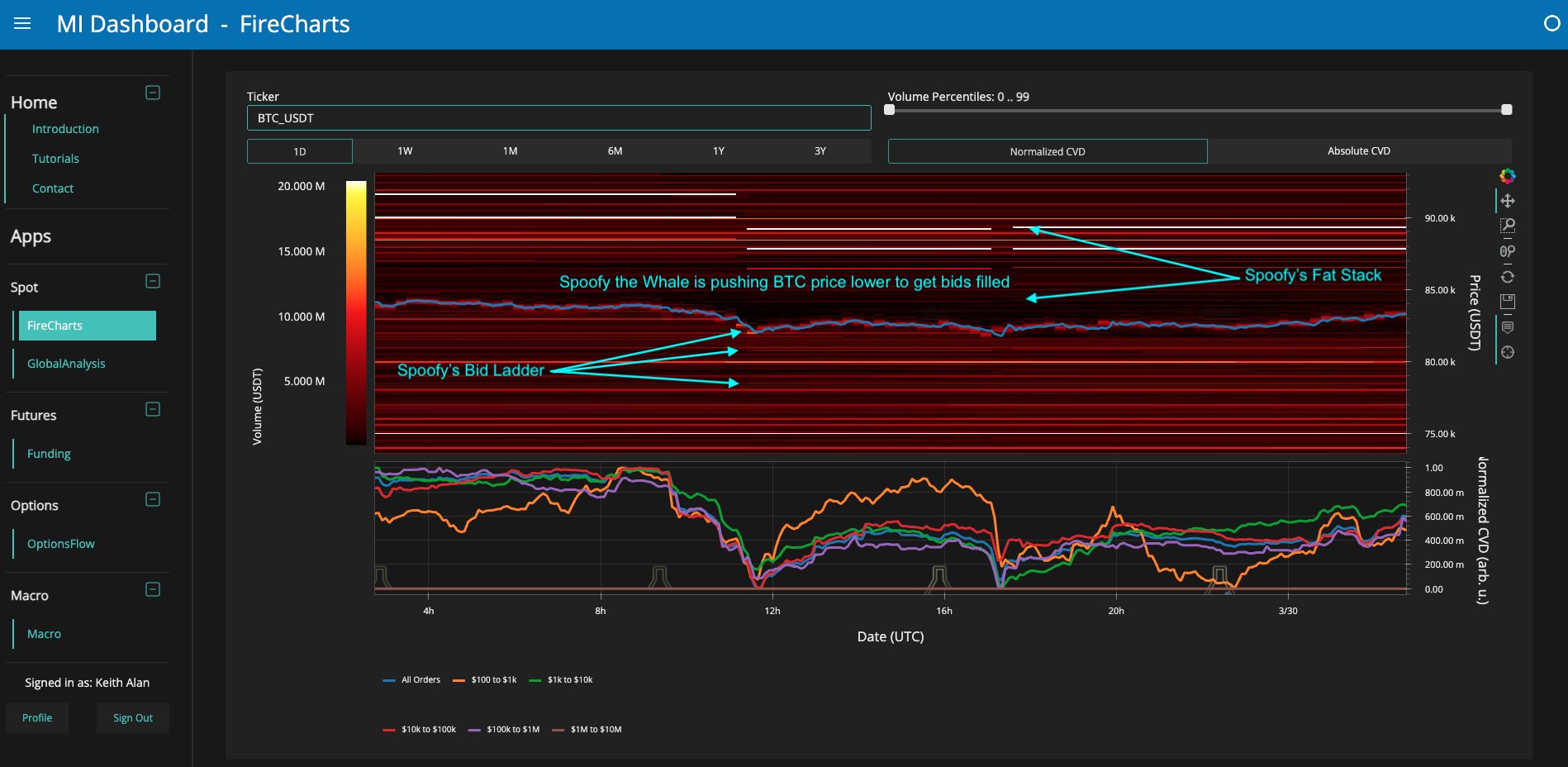

Within the Bitcoin area, large-scale liquidity maneuvers stay a focus. Keith Alan (@KAProductions), co-founder of Materials Indicators, drew consideration to a possible whale technique in motion—attributed to a determine he dubs “Spoofy the Whale.”

“My first clue that one thing was up got here with a sequence of micro actions that gave the impression to be a bit of totally different than his typical value adjustment of his huge blocks of ask liquidity. At a better look I seen a ladder of BTC bid liquidity completely aligned and transferring with the ask liquidity. Whereas I’ve no possible way of confirming that it’s the identical entity utilizing ask liquidity to herd value into their very own bids, it actually seems that Spoofy has been shopping for this dip and has bids laddered all the way down to $78k,” Alan wrote on Sunday.

He additionally famous the convergence of a number of information occasions—Sunday’s weekly shut, Monday’s month-to-month shut, and the anticipated tariff implementation midweek—that will catalyze additional value swings. Whereas acknowledging BTC may nonetheless go decrease, he underlined the whale’s obvious dedication to accumulating at present ranges: “Within the grand scheme of issues, none of this implies BTC value can’t go decrease, however it does imply that the whale that has been suppressing BTC value for the final 3 weeks is utilizing a DCA technique to purchase this dip…and so am I.”

#3 Bitcoin Bearish Flag Breakdown

Technical analyst Kevin (@Kev_Capital_TA) is warning merchants to maintain a detailed eye on pivotal help ranges following a bearish flag breakdown: “We have been monitoring this bearish flag sample all final week and as we will see we had a breakdown of that weak point. If BTC does lose the golden pocket right here at $81K and follows by way of with that measured transfer goal, then the $70K–$73K vary … can be the ‘Measured Transfer’ goal.”

Nonetheless, Kevin posits that, given widespread unfavourable sentiment round April 2 (“Armageddon Day” in some corners of the media), there’s a risk of a contrarian twist: “Will the Tariff implementation on April 2nd be a uncommon ‘promote the rumor purchase the information occasion’? … Everybody thinks the world is immediately going to finish.”

Associated Studying

He additionally added: “A bit of little bit of lengthy liquidity on the $78K-$80K stage however a number of juice within the $87K-$89K (Darkish Yellow) vary for market makers to transact in proper earlier than the CNBC proclaimed “Armageddon Day” on April 2nd. Makes me surprise.”

#4 Seasoned Gamers Accumulate

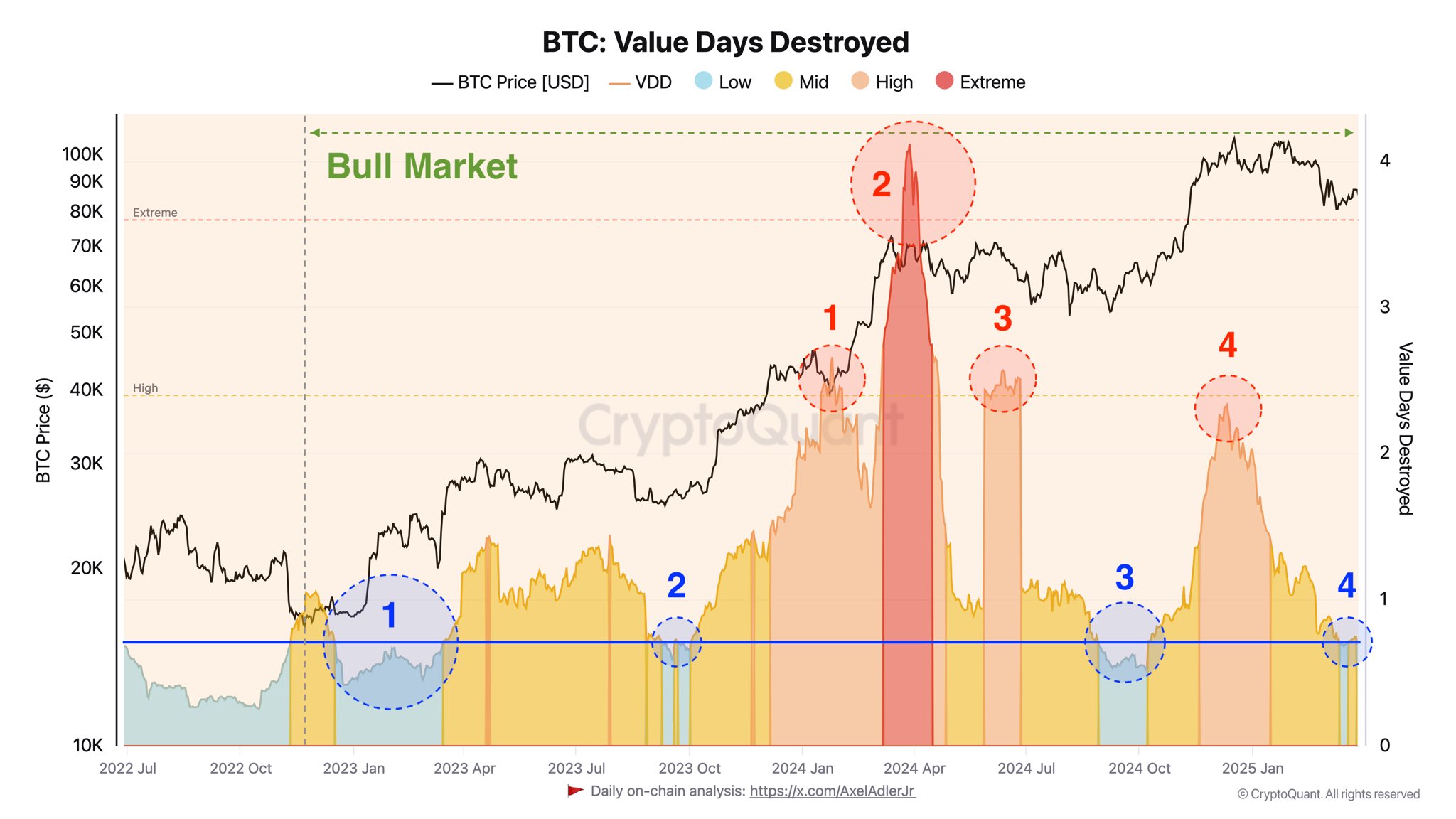

From an on-chain perspective, Axel Adler Jr, an analyst at CryptoQuant, observes that skilled market members are transferring into a brand new accumulation section. Drawing from the Worth Days Destroyed (VDD) indicator, Adler identifies a collection of 4 distinct accumulation durations since early 2023, marking the present cycle as ripe for potential long-term upside:

“The absence of great promoting within the present section demonstrates the arrogance of those skilled gamers that the present BTC value stage is just not favorable for profit-taking.” Adler underlines that historic knowledge exhibits low VDD durations usually precede value will increase, suggesting a bullish medium-term outlook—supplied macro elements, together with international financial coverage shifts, don’t derail market sentiment.

#5 CME Hole

Lastly, merchants want to look at the CME (Chicago Mercantile Alternate) hole formation, which has been a notable characteristic in Bitcoin’s value motion. Rekt Capital (@rektcapital) highlighted the current filling of a niche between $82,000 and $85,000: “BTC has stuffed the overall CME Hole space from $82k–$85k. Furthermore, Bitcoin will most likely develop a model new CME Hole over this weekend … Which may set BTC up for a transfer into a minimum of $84k subsequent week.”

CME gaps often act as magnets for value motion, and Rekt Capital’s evaluation suggests a doable retracement to fill newly fashioned gaps or a continuation transfer that takes BTC greater, relying on how broader market forces unfold this week.

At press time, BTC traded at $82,010.

Featured picture created with DALL.E, chart from TradingView.com